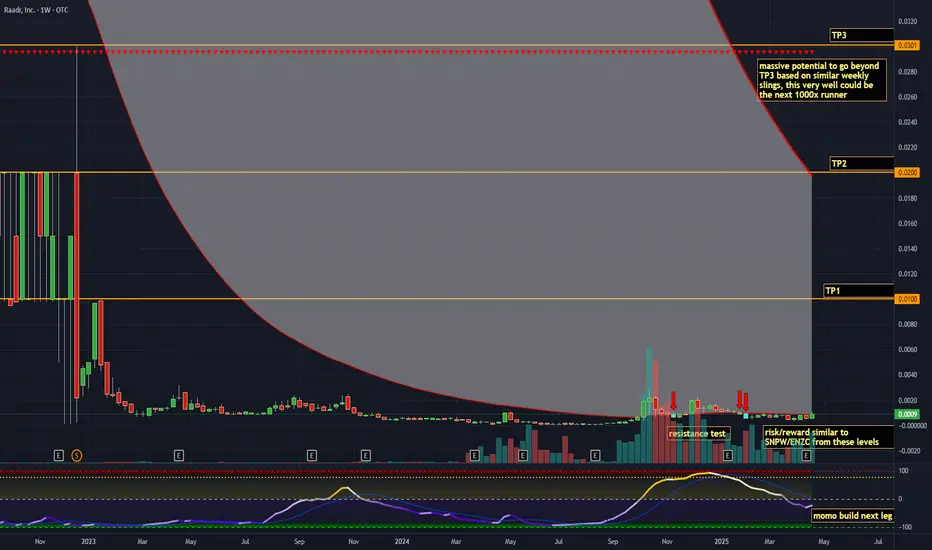

Weekend scan continues to find the best candidates into this 8 year cycle -  RDAR, wow is all I can say, this has massive potential once it breaks into sub territory with volume. The hype is in the AI buzz and the constant awareness for their product in the media.

RDAR, wow is all I can say, this has massive potential once it breaks into sub territory with volume. The hype is in the AI buzz and the constant awareness for their product in the media.

Raadr Inc. (OTC: RDAR), also known as Telvantis Inc., is a U.S.-based technology company specializing in AI-driven software solutions aimed at combating cyberbullying and online harassment. The company offers tools for real-time monitoring of social media and digital platforms, targeting parents, schools, and law enforcement agencies.

If we learned anything about share structures with bloated OS/AS, it won't mean a damn thing once this sling gets going to the upside - remember how HMBL/ENZC/SNPW, had massive floats and still ran from trips to dollars... I got that itchin' feelin' again, taking a starter Monday and will add on momentum into the sling.

Raadr Inc. (OTC: RDAR), also known as Telvantis Inc., is a U.S.-based technology company specializing in AI-driven software solutions aimed at combating cyberbullying and online harassment. The company offers tools for real-time monitoring of social media and digital platforms, targeting parents, schools, and law enforcement agencies.

If we learned anything about share structures with bloated OS/AS, it won't mean a damn thing once this sling gets going to the upside - remember how HMBL/ENZC/SNPW, had massive floats and still ran from trips to dollars... I got that itchin' feelin' again, taking a starter Monday and will add on momentum into the sling.

Trade active

Solid confirmation this week - look for the volume to surgeNote

🚨 TELVANTIS INC. (OTC: RDAR) – The Telecom Sleeper Waking UpThis isn’t a story stock. This is a fully audited, revenue-generating telecom platform that's just starting to unlock its valuation. Telvantis (formerly Raadr Inc.) is now the U.S. engine behind Mexedia S.p.A., a global telecom player based in Paris.

They’ve cleaned house, locked in the foundation, and laid out a growth roadmap — now it’s just execution.

🔧 CORPORATE RESET COMPLETE

✅ $250 million to $300 million in guided revenue for 2025

🔗 finance.yahoo.com/news/telvantis-announces-audited-financials-revenue-123000982.html

✅ PCAOB-audited financials signed, sealed, and filed

🔗 finance.yahoo.com/news/telvantis-announces-audited-financials-revenue-123000982.html

✅ Convertible debt slashed — from 540K to 400K

🔗 otcmarkets.com/stock/RDAR/news/story?e&id=2796252

✅ MOU signed with Fortytwo — opening the door to telecom infrastructure expansion

🔗 finance.yahoo.com/news/raadr-doing-business-telvantis-announces-120000249.html

✅ $1 million share buyback in place

🔗 finance.yahoo.com/news/telvantis-announces-1-million-share-113000984.html

✅ Industry veteran Maickel Abdou appointed to lead Voice Services

🔗 finance.yahoo.com/news/telecom-veteran-maickel-abdou-joins-110000883.html

📊 SHARE STRUCTURE (as of June 9, 2025)

• Outstanding shares: 6,771,260,661

• Float: 6,026,338,763

• Authorized shares: 15,925,000,000

• Market cap at 0.0012: ~8.1 million

🔗 otcmarkets.com/stock/RDAR/security

💸 LET’S TALK NUMBERS — THE REAL TARGETS

This isn’t a fantasy — it's straight valuation math.

Based on the company's own revenue guidance and standard EV/Revenue multiples used in the telecom and SaaS sector, here’s what Telvantis projects to:

Revenue Multiple Valuation Target PPS (based on 6.77B shares)

0.3x 75M 0.01

0.5x 125M 0.02

1.0x 250M 0.04

2.0x 500M 0.08

3.0x 750M 0.11

5.0x 1.25B 0.19

10.0x 2.5B 0.37

Let that sink in. Even at 0.3x, RDAR points to 1 cent, nearly 10x from current levels. A moderate 1x revenue multiple — which is common for verified telecom plays — gives you 4 cents. High-growth peers command 2x to 5x. That’s 8 to 19 cents. And if this becomes a legitimate CPaaS rocket under Mexedia’s infrastructure? 37 cents is on the table.

This isn’t a pump — it’s a blueprint.

Audited. Buyback active. Debt restructured. Revenue guided. Infrastructure in place.

The price hasn’t caught up — yet. When it does, you don’t want to be chasing.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.