Education

The new simple anatomy of my trades

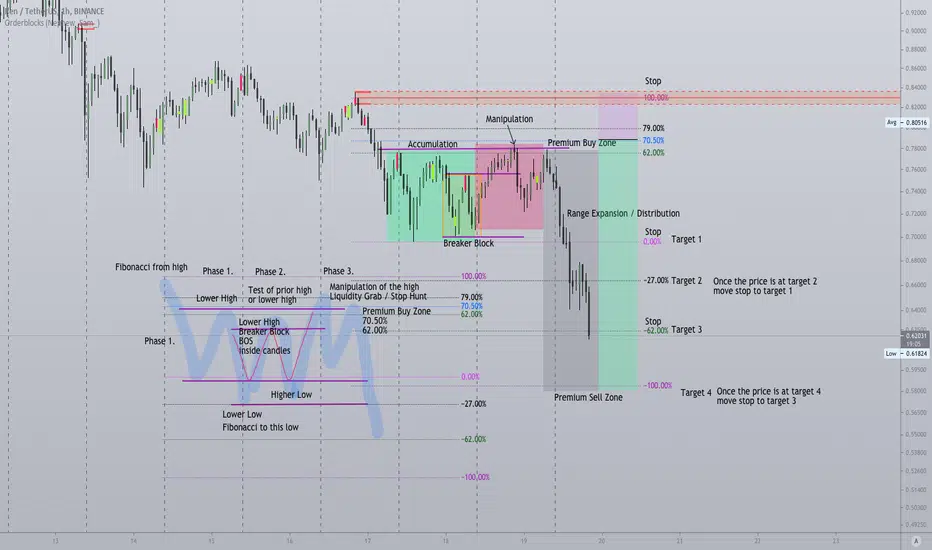

Hello traders, here is a diagram of my analysis or strategy that may help some traders moving forward. I have combined various pieces of information from talented traders and it has helped me to see the market more clearly. It consists of an accumulation followed by a manipulation which leads to a range expansion. I seek the inside W which is the breaker block just before manipulation. If prices show weakness in momentum, in the direction of the manipulation, and the price is turning at the Premium zone after the manipulation phase, all these elements must exist to confirm a trade, I place an order just after the 62.00% Fibonacci. I then trail it down until my stop is taken out or the 100% is completed. I place my stop at the opposite 100% High and move it down depending on which target has been reached. The opposite is true for longs. I hope this helps. Good luck!

Note

Due to the fractal nature of cycles, the pattern repeats across all time frames - here is one on the four-hour chart, spread across days/weeks. The simple rule of 3 elements: accumulation, manipulation, and the inside breaker block with a short pullback between the 70.50 and the 62.00. Unless all three are visible, we don't trade. Note

I have simplified the process on a new education example.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.