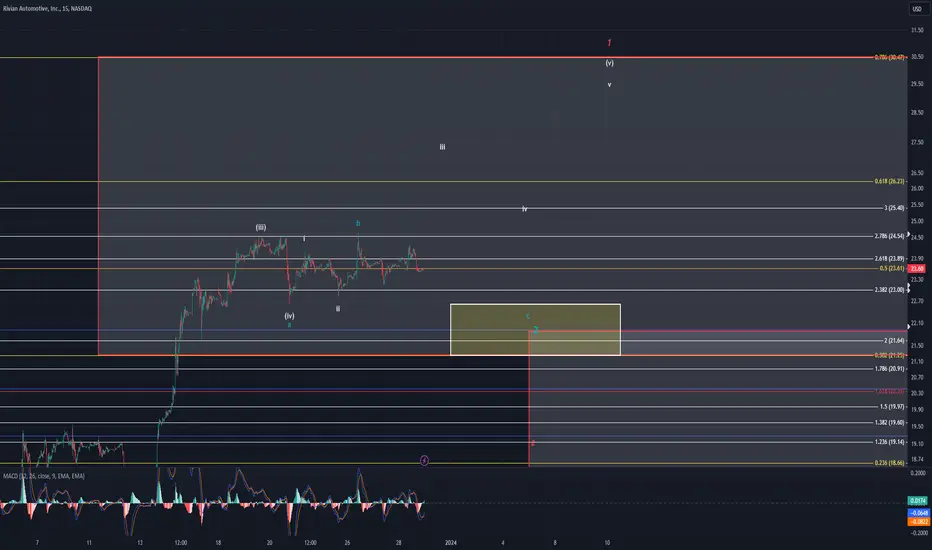

Price has started to become a little complex and confusing since the 20th of last week. When one boils it down though, we have been making higher lows in price and MACD. This bodes well for us to continue higher. Yes, price fell decently hard today after it hit $24.29 but it didn't make a new low and neither did MACD. In fact, MACD was raising during the entire post market even though price stayed stagnant. Using history to help guide me, that is usually a sign we will be headed up soon. The argument against that, is MACD started raising to reset for another drop. Of course, that is definitely possible but not my primary thought.

I won't go to deep into details as I feel I have been very thorough with my Rivian updates.

Primary - Start to raise tomorrow for wave iii of (v) - should ideally be a strong move

ALT - Fall for wave c indicating MACD was indeed just resetting to prepare for a drop. This would ideally end no lower than $21

2nd ALT - wave (i) is already over and we are headed lower...which should end around the 0.382 @ $21.25 with a possibility to drop to the 0.236 @ $18.66

Tomorrow should bring clarity to the count and give us a better picture of what is coming next. At this time, I still have my 250 shares. Should price move up towards the 0.786 @ $30.47, I stand to make almost $2000. If it falls to worst case scenario according to my count, I could be down $1250 if I let it ride but would make it right back on the next push higher. This is probably one of the lowest risk/reward trades I will enter. This is why I am trading such a small amount compared to my account size. Even still, I stand to make more then I stand to lose. Should price move against me, I will most likely make it right back due to counting this as a bullish trend. This doesn't mean go out and put your house on this trade. As I mentioned, I'm in a very small position. This protects my assets while exposing me to potential profit. Stops protect me even further. Are y'all getting a sense of what type of trader I am yet? Patience. Patience. Patience.

I won't go to deep into details as I feel I have been very thorough with my Rivian updates.

Primary - Start to raise tomorrow for wave iii of (v) - should ideally be a strong move

ALT - Fall for wave c indicating MACD was indeed just resetting to prepare for a drop. This would ideally end no lower than $21

2nd ALT - wave (i) is already over and we are headed lower...which should end around the 0.382 @ $21.25 with a possibility to drop to the 0.236 @ $18.66

Tomorrow should bring clarity to the count and give us a better picture of what is coming next. At this time, I still have my 250 shares. Should price move up towards the 0.786 @ $30.47, I stand to make almost $2000. If it falls to worst case scenario according to my count, I could be down $1250 if I let it ride but would make it right back on the next push higher. This is probably one of the lowest risk/reward trades I will enter. This is why I am trading such a small amount compared to my account size. Even still, I stand to make more then I stand to lose. Should price move against me, I will most likely make it right back due to counting this as a bullish trend. This doesn't mean go out and put your house on this trade. As I mentioned, I'm in a very small position. This protects my assets while exposing me to potential profit. Stops protect me even further. Are y'all getting a sense of what type of trader I am yet? Patience. Patience. Patience.

Go to ewtdaily.com for DETAILED DAILY UPDATES on 27 unique tickers and a daily zoom call with members to discuss latest analysis and get a 7-day FREE trial

Bonam Fortunam,

--Tyler

Bonam Fortunam,

--Tyler

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Go to ewtdaily.com for DETAILED DAILY UPDATES on 27 unique tickers and a daily zoom call with members to discuss latest analysis and get a 7-day FREE trial

Bonam Fortunam,

--Tyler

Bonam Fortunam,

--Tyler

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.