In every market cycle, some high-growth companies are misunderstood—until they aren’t. Palantir (PLTR) was one such stock, dismissed early for its lack of profitability and complex model, only to soar when its AI tools gained traction. Now, SentinelOne (NYSE: S) may be next in line.

🧠 What SentinelOne Does

SentinelOne is a top-tier cybersecurity firm offering an AI-powered endpoint protection platform called Singularity. Like Palantir, SentinelOne has faced criticism for:

Persistent losses

High stock-based compensation (SBC)

A misunderstood business model

Despite this, its technology is sticky, deeply embedded in client IT systems, and well-positioned to ride macro trends in AI and cybersecurity.

📈 Financials: Turning a Corner

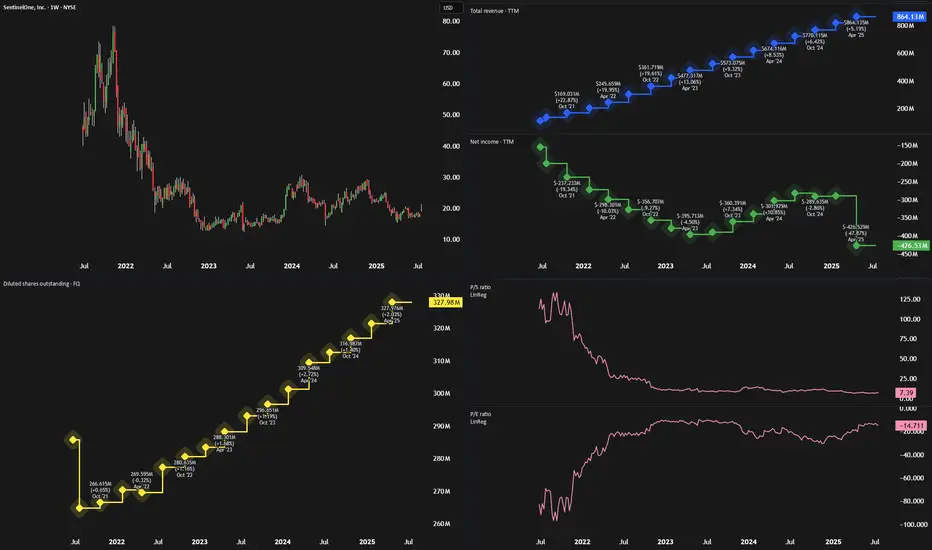

While the stock hasn’t moved much in two years, trading around $18, SentinelOne’s fundamentals are improving:

Revenue Growth: Double-digit YoY revenue growth (23%+ in each of the last 10 quarters)

Free Cash Flow: $214 million in the past 12 months (~25% FCF margin)

Gross Margins: High and improving

Operating Expenses: Slowing, creating operating leverage

Adjusted Earnings: Near breakeven, signaling profitability is in reach

These trends mirror Palantir’s path before its breakout, particularly the shift from high OpEx to better margins and rising free cash flow.

💰 Valuation: Still Underrated

SentinelOne is trading at only 6x sales and 27x free cash flow, despite:

Strong 20%+ expected revenue growth

Analyst EPS estimates of ~$0.50 by 2028

A market cap under $6 billion

It’s significantly cheaper than peers like CrowdStrike and Palo Alto Networks—despite having similar growth and margin profiles.

⚠️ Risks to Consider

Fierce Competition: Cybersecurity is a crowded field. SentinelOne will have to keep innovating to stay relevant.

Market Sentiment: As a high-growth name, it may be hit hard in downturns.

Limited TAM vs. PLTR: The cybersecurity market isn’t as vast as AI data platforms.

🚀 Final Take

With strong recurring revenue, improving profitability, and an attractive valuation, SentinelOne looks poised for a re-rating. While it may not match Palantir’s scale or splash, the setup is strikingly similar.

Rating: Strong Buy

🧠 What SentinelOne Does

SentinelOne is a top-tier cybersecurity firm offering an AI-powered endpoint protection platform called Singularity. Like Palantir, SentinelOne has faced criticism for:

Persistent losses

High stock-based compensation (SBC)

A misunderstood business model

Despite this, its technology is sticky, deeply embedded in client IT systems, and well-positioned to ride macro trends in AI and cybersecurity.

📈 Financials: Turning a Corner

While the stock hasn’t moved much in two years, trading around $18, SentinelOne’s fundamentals are improving:

Revenue Growth: Double-digit YoY revenue growth (23%+ in each of the last 10 quarters)

Free Cash Flow: $214 million in the past 12 months (~25% FCF margin)

Gross Margins: High and improving

Operating Expenses: Slowing, creating operating leverage

Adjusted Earnings: Near breakeven, signaling profitability is in reach

These trends mirror Palantir’s path before its breakout, particularly the shift from high OpEx to better margins and rising free cash flow.

💰 Valuation: Still Underrated

SentinelOne is trading at only 6x sales and 27x free cash flow, despite:

Strong 20%+ expected revenue growth

Analyst EPS estimates of ~$0.50 by 2028

A market cap under $6 billion

It’s significantly cheaper than peers like CrowdStrike and Palo Alto Networks—despite having similar growth and margin profiles.

⚠️ Risks to Consider

Fierce Competition: Cybersecurity is a crowded field. SentinelOne will have to keep innovating to stay relevant.

Market Sentiment: As a high-growth name, it may be hit hard in downturns.

Limited TAM vs. PLTR: The cybersecurity market isn’t as vast as AI data platforms.

🚀 Final Take

With strong recurring revenue, improving profitability, and an attractive valuation, SentinelOne looks poised for a re-rating. While it may not match Palantir’s scale or splash, the setup is strikingly similar.

Rating: Strong Buy

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.