Market Cap: ₹7,794 Cr

Sector: Metals & Mining – Manganese & Iron Ore

Sandur Manganese & Iron Ores Ltd (SMIORE) is a vertically integrated mining company engaged in manganese and iron ore production. With operations rooted in Karnataka and a legacy since 1954, the company continues to benefit from commodity demand and disciplined capital management.

🔍 Fundamental Snapshot

In FY24, Sandur reported revenue of ₹1,252 Cr and net profit of ₹239 Cr, resulting in a solid net margin of 19.06%. EPS stands at ₹29.00, while return ratios remain healthy – ROE at 11.03% and ROCE at 14.97%.

The company maintains a conservative financial structure with a debt-to-equity ratio of 0.54 and a strong current ratio of 4.34. It also rewards shareholders with a dividend yield of 1.31%.

Though not a high-growth play, Sandur’s consistent cash flows, low debt, and operational leverage in a cyclical sector make it a solid bet for long-term value seekers.

📈 Technical Analysis – Early Reversal from 200 EMA

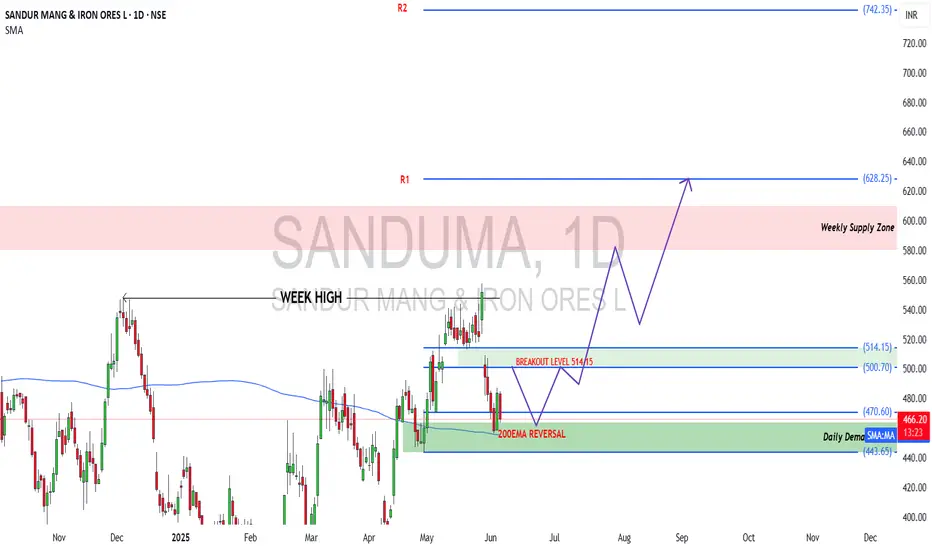

The stock recently reversed sharply from the 200 EMA and daily demand zone between ₹443.65 and ₹455, suggesting strong support and accumulation interest. The current close of ₹483.50 marks a reclaim of the key moving average and signals potential trend change.

🔧 Key Technical Levels:

A move above ₹514.15 will confirm a breakout and may trigger momentum towards the ₹628–₹742 zone.

✅ Summary

Traders and long-term investors can watch for momentum confirmation or dips toward support for strategic entry.

Disclaimer: lnkd.in/gJJDnvn2

Sector: Metals & Mining – Manganese & Iron Ore

Sandur Manganese & Iron Ores Ltd (SMIORE) is a vertically integrated mining company engaged in manganese and iron ore production. With operations rooted in Karnataka and a legacy since 1954, the company continues to benefit from commodity demand and disciplined capital management.

🔍 Fundamental Snapshot

In FY24, Sandur reported revenue of ₹1,252 Cr and net profit of ₹239 Cr, resulting in a solid net margin of 19.06%. EPS stands at ₹29.00, while return ratios remain healthy – ROE at 11.03% and ROCE at 14.97%.

The company maintains a conservative financial structure with a debt-to-equity ratio of 0.54 and a strong current ratio of 4.34. It also rewards shareholders with a dividend yield of 1.31%.

Though not a high-growth play, Sandur’s consistent cash flows, low debt, and operational leverage in a cyclical sector make it a solid bet for long-term value seekers.

📈 Technical Analysis – Early Reversal from 200 EMA

The stock recently reversed sharply from the 200 EMA and daily demand zone between ₹443.65 and ₹455, suggesting strong support and accumulation interest. The current close of ₹483.50 marks a reclaim of the key moving average and signals potential trend change.

🔧 Key Technical Levels:

- Reversal Zone (Support): ₹443.65 – ₹455

- Breakout Level: ₹514.15

- Resistance 1 (R1): ₹628.25 – Weekly Supply Zone

- Resistance 2 (R2): ₹742.35 – Long-term Target

- Near-Term Structure: Price may retest ₹514 before trending upward in a higher-high, higher-low sequence.

A move above ₹514.15 will confirm a breakout and may trigger momentum towards the ₹628–₹742 zone.

✅ Summary

- Sandur Manganese offers a compelling techno-fundamental setup:

- Debt-light and cash-flow rich

- Strong reversal from technical support

- Breakout above ₹514 could open up ₹628 and ₹742 as next targets

- Ideal zone to track for re-entry: ₹455–₹470 range

Traders and long-term investors can watch for momentum confirmation or dips toward support for strategic entry.

Disclaimer: lnkd.in/gJJDnvn2

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.