🏖️ #SANDUSDT Weekly Analysis — Final Base Test Before Potential Recovery?

🗓 Published: May 10, 2025

📊 Timeframe: 1W | Exchange: Binance

Author: HamadaMark

🔍 Market Structure Overview

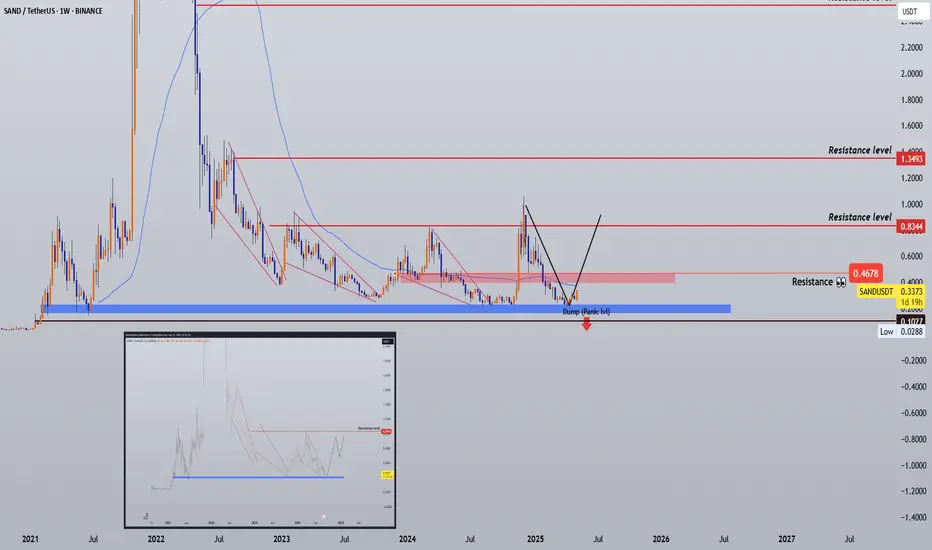

SAND has returned to its historical accumulation zone near $0.28–$0.33 after completing multiple falling wedge breakdowns throughout 2023–2025.

Price is now attempting a bounce from a major demand floor, forming what could become a mid-cycle double bottom.

📌 Macro Setup Observations:

✅ Retest of strong horizontal demand zone (2021 launch base)

✅ Clear panic wick below structure, followed by bounce

✅ Similar formation to 2022 → 2023 reversal setup

✅ Weekly candle reclaiming 200MA zone

🟦 Critical Support Zone (Demand Base):

Main Support: $0.28–$0.33

Panic Level / Invalid Zone: Close below $0.27–$0.25 = breakdown risk

🔻 If this zone fails, structure targets as low as $0.10–$0.07 become possible

🎯 Upside Resistance Targets (if Bounce Confirmed):

TP1: $0.4678 – Previous wedge support → now resistance

TP2: $0.8344 – Multi-month range top

TP3: $1.3493 – Mid-cycle top (2022 level reclaim)

⚖️ Risk/reward becomes attractive above $0.35 reclaim with macro upside of 100–300%

🧠 Strategy Insight

• DCA is favorable in the blue box zone with tight SL

• Stronger confirmation = reclaim of red box ($0.47)

• Breakout traders should wait for weekly close above $0.47 + retest

💡 Volume + structure confirm this area remains a “make or break” pivot zone

🗣 What’s Next?

If $0.28–$0.33 holds and we reclaim the $0.47–$0.50 resistance box, SAND could attempt a multi-leg recovery into Q3–Q4.

If we lose $0.27, exit and reassess at deeper levels.

📢 SAND is at its most critical level in years — this isn’t the time to fade structure. If it holds, the upside opens fast.

we ask Allah reconcile and repay

🗓 Published: May 10, 2025

📊 Timeframe: 1W | Exchange: Binance

Author: HamadaMark

🔍 Market Structure Overview

SAND has returned to its historical accumulation zone near $0.28–$0.33 after completing multiple falling wedge breakdowns throughout 2023–2025.

Price is now attempting a bounce from a major demand floor, forming what could become a mid-cycle double bottom.

📌 Macro Setup Observations:

✅ Retest of strong horizontal demand zone (2021 launch base)

✅ Clear panic wick below structure, followed by bounce

✅ Similar formation to 2022 → 2023 reversal setup

✅ Weekly candle reclaiming 200MA zone

🟦 Critical Support Zone (Demand Base):

Main Support: $0.28–$0.33

Panic Level / Invalid Zone: Close below $0.27–$0.25 = breakdown risk

🔻 If this zone fails, structure targets as low as $0.10–$0.07 become possible

🎯 Upside Resistance Targets (if Bounce Confirmed):

TP1: $0.4678 – Previous wedge support → now resistance

TP2: $0.8344 – Multi-month range top

TP3: $1.3493 – Mid-cycle top (2022 level reclaim)

⚖️ Risk/reward becomes attractive above $0.35 reclaim with macro upside of 100–300%

🧠 Strategy Insight

• DCA is favorable in the blue box zone with tight SL

• Stronger confirmation = reclaim of red box ($0.47)

• Breakout traders should wait for weekly close above $0.47 + retest

💡 Volume + structure confirm this area remains a “make or break” pivot zone

🗣 What’s Next?

If $0.28–$0.33 holds and we reclaim the $0.47–$0.50 resistance box, SAND could attempt a multi-leg recovery into Q3–Q4.

If we lose $0.27, exit and reassess at deeper levels.

📢 SAND is at its most critical level in years — this isn’t the time to fade structure. If it holds, the upside opens fast.

we ask Allah reconcile and repay

👋 Be a trader, not a gambler, by following risk/capital management!!

🎉Get Your Discount Today! (Limited offer)

t.me/PCS_Signals_Results/8448

We ask Allah reconcile and repay ❤️🙏

🎉Get Your Discount Today! (Limited offer)

t.me/PCS_Signals_Results/8448

We ask Allah reconcile and repay ❤️🙏

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👋 Be a trader, not a gambler, by following risk/capital management!!

🎉Get Your Discount Today! (Limited offer)

t.me/PCS_Signals_Results/8448

We ask Allah reconcile and repay ❤️🙏

🎉Get Your Discount Today! (Limited offer)

t.me/PCS_Signals_Results/8448

We ask Allah reconcile and repay ❤️🙏

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.