Introduction

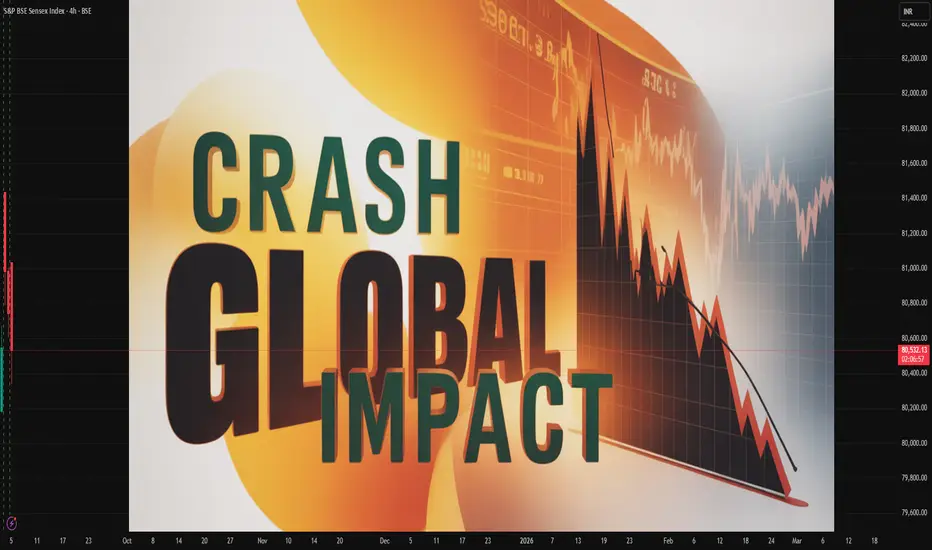

Stock markets are often described as the heartbeat of modern economies. They reflect investor confidence, corporate performance, and broader macroeconomic conditions. When markets rise steadily, optimism spreads across societies—businesses expand, jobs are created, and wealth grows. But when they crash, the opposite happens: wealth evaporates, panic sets in, and economies often spiral into recession or even depression.

A stock market crash is typically defined as a sudden, dramatic decline in stock prices across major indexes, often accompanied by panic selling and loss of investor confidence. Crashes are not mere financial events; they ripple through entire economies, affecting employment, government policies, trade, and even geopolitical stability.

This essay explores the history of major crashes, their causes, consequences, and the global impact they leave behind. It also discusses the lessons learned and whether crashes can be prevented—or if they are an unavoidable feature of capitalism.

Understanding Stock Market Crashes

A stock market crash differs from a normal market correction. A correction is usually a modest decline (around 10–20%), often seen as healthy after strong rallies. A crash, however, is sudden and severe, typically involving a drop of 20% or more in a very short time.

Key characteristics of a crash include:

Panic selling – Investors rush to liquidate holdings, driving prices down further.

Liquidity crisis – Buyers disappear, making it difficult to sell assets at fair value.

Systemic contagion – Losses spread to other sectors like banking, housing, and commodities.

Psychological impact – Fear and loss of trust in financial systems exacerbate the downturn.

Historical Stock Market Crashes

1. The Panic of 1907

Triggered by a failed attempt to corner the copper market, the 1907 crash caused bank runs across the U.S. The absence of a central bank made matters worse until J.P. Morgan personally intervened to provide liquidity. The crisis directly led to the creation of the U.S. Federal Reserve in 1913.

2. The Great Depression (1929–1939)

The crash of October 1929 is the most infamous. The Dow Jones lost almost 90% of its value from peak to trough. Banks failed, unemployment in the U.S. reached 25%, and global trade collapsed as protectionist tariffs rose. The Great Depression reshaped the global order and gave rise to both welfare capitalism and extreme political movements.

3. Black Monday (1987)

On October 19, 1987, global markets lost trillions in value, with the Dow plunging 22% in a single day—the largest one-day percentage drop in history. Interestingly, the economic fundamentals were relatively strong, but computerized program trading amplified panic. This crash led to better circuit-breaker mechanisms.

4. Dot-Com Bubble (2000–2002)

Fueled by excessive speculation in internet startups, tech stocks soared in the late 1990s. When profitability didn’t match expectations, the bubble burst, erasing $5 trillion in market value. Many companies went bankrupt, but survivors like Amazon and Google emerged stronger.

5. Global Financial Crisis (2008–2009)

Triggered by the collapse of the U.S. housing bubble and subprime mortgages, this crash nearly collapsed the global banking system. Lehman Brothers’ bankruptcy sent shockwaves worldwide. Governments had to bail out banks, and trillions were injected into economies. The aftershocks shaped global monetary policy for over a decade.

6. COVID-19 Pandemic Crash (2020)

In March 2020, as the pandemic spread globally, markets experienced one of the fastest declines in history. Supply chains froze, oil prices collapsed, and entire economies went into lockdown. Central banks intervened with massive liquidity injections, and markets rebounded faster than expected, though inequality widened.

Causes of Stock Market Crashes

Speculative Bubbles – Excessive optimism leads investors to drive prices far beyond intrinsic values (e.g., tulip mania, dot-com bubble).

Leverage & Debt – Borrowed money magnifies gains but also magnifies losses when markets turn.

Banking Failures – Weak banking systems spread panic when liquidity dries up.

Geopolitical Events – Wars, oil shocks, or political instability can trigger sudden sell-offs.

Technological Factors – Automated trading systems can accelerate crashes.

Psychological Herding – Fear and greed amplify movements, leading to irrational decisions.

Economic & Social Consequences

A market crash is not just numbers falling on screens; it creates real-world damage:

Wealth Destruction – Households lose savings, pensions shrink, and corporate valuations collapse.

Unemployment – Businesses cut back, leading to layoffs and wage stagnation.

Banking Stress – Non-performing loans rise, banks tighten credit, stifling growth.

Government Debt – States often borrow heavily to stabilize economies, leading to long-term fiscal challenges.

Social Unrest – Rising inequality, poverty, and frustration often trigger protests and political upheaval.

Shift in Global Power – Crashes can weaken one region while strengthening another (e.g., U.S. decline in 1930s, rise of Europe and later Asia).

Global Ripple Effects

Stock markets are interconnected; a crash in one major market spills over into others.

Trade Decline: Reduced demand lowers imports/exports, hurting global supply chains.

Currency Volatility: Investors flee to safe havens like gold, U.S. treasuries, or the Swiss franc.

Capital Flight: Emerging markets often see massive outflows during global downturns.

Policy Shifts: Central banks coordinate interventions, lowering rates and providing stimulus.

Geopolitical Shifts: Crashes often weaken alliances, spark nationalism, or accelerate the rise of new powers.

Case Study: 2008 Crisis Global Impact

U.S.: Housing collapse, unemployment peaking at 10%, massive bailouts.

Europe: Sovereign debt crises in Greece, Spain, and Italy.

Asia: Export-driven economies like China saw slowed growth, but also emerged as stronger alternatives to Western dependence.

Developing Nations: Suffered from falling commodity prices, reduced remittances, and currency instability.

This showed how deeply integrated the global economy had become.

Lessons Learned

Stronger Regulation – The 2008 crash showed the need for tighter oversight of derivatives and shadow banking.

Central Bank Coordination – Global central banks now act in unison to stabilize liquidity.

Risk Management – Investors are more cautious about leverage and speculative excess.

Diversification – Global portfolios help mitigate region-specific risks.

Psychological Awareness – Understanding behavioral finance helps explain panic-driven moves.

Are Crashes Preventable?

History suggests crashes are not entirely preventable because markets are built on human behavior, which swings between fear and greed. However, their severity can be managed:

Circuit breakers and trading halts prevent extreme panic.

Transparent regulation reduces systemic risk.

Global cooperation cushions shocks.

Investor education lowers herd mentality.

The Future of Stock Market Crashes

Looking ahead, new risks emerge:

Algorithmic & AI Trading – Speed of trading could magnify volatility.

Cryptocurrency Integration – Digital assets could create new bubbles.

Climate Change – Extreme weather could disrupt industries, creating market shocks.

Geopolitical Tensions – Trade wars, cyber conflicts, and resource scarcity may fuel future crises.

While markets will continue to experience crashes, societies are better equipped to handle them—though not immune.

Conclusion

Stock market crashes are dramatic reminders of the fragility of financial systems. They destroy wealth, disrupt lives, and alter the trajectory of nations. From the Great Depression to COVID-19, each crash has reshaped global finance, politics, and society.

Yet, paradoxically, crashes also pave the way for renewal. They expose weaknesses, force reforms, and create opportunities for resilient businesses to thrive. In this sense, crashes are not just destructive—they are part of capitalism’s self-correcting cycle.

For investors, policymakers, and citizens, the lesson is clear: crashes cannot be avoided, but their impact can be mitigated through preparation, diversification, and prudent regulation. The challenge is not to eliminate volatility but to ensure societies are resilient enough to withstand it.

Stock markets are often described as the heartbeat of modern economies. They reflect investor confidence, corporate performance, and broader macroeconomic conditions. When markets rise steadily, optimism spreads across societies—businesses expand, jobs are created, and wealth grows. But when they crash, the opposite happens: wealth evaporates, panic sets in, and economies often spiral into recession or even depression.

A stock market crash is typically defined as a sudden, dramatic decline in stock prices across major indexes, often accompanied by panic selling and loss of investor confidence. Crashes are not mere financial events; they ripple through entire economies, affecting employment, government policies, trade, and even geopolitical stability.

This essay explores the history of major crashes, their causes, consequences, and the global impact they leave behind. It also discusses the lessons learned and whether crashes can be prevented—or if they are an unavoidable feature of capitalism.

Understanding Stock Market Crashes

A stock market crash differs from a normal market correction. A correction is usually a modest decline (around 10–20%), often seen as healthy after strong rallies. A crash, however, is sudden and severe, typically involving a drop of 20% or more in a very short time.

Key characteristics of a crash include:

Panic selling – Investors rush to liquidate holdings, driving prices down further.

Liquidity crisis – Buyers disappear, making it difficult to sell assets at fair value.

Systemic contagion – Losses spread to other sectors like banking, housing, and commodities.

Psychological impact – Fear and loss of trust in financial systems exacerbate the downturn.

Historical Stock Market Crashes

1. The Panic of 1907

Triggered by a failed attempt to corner the copper market, the 1907 crash caused bank runs across the U.S. The absence of a central bank made matters worse until J.P. Morgan personally intervened to provide liquidity. The crisis directly led to the creation of the U.S. Federal Reserve in 1913.

2. The Great Depression (1929–1939)

The crash of October 1929 is the most infamous. The Dow Jones lost almost 90% of its value from peak to trough. Banks failed, unemployment in the U.S. reached 25%, and global trade collapsed as protectionist tariffs rose. The Great Depression reshaped the global order and gave rise to both welfare capitalism and extreme political movements.

3. Black Monday (1987)

On October 19, 1987, global markets lost trillions in value, with the Dow plunging 22% in a single day—the largest one-day percentage drop in history. Interestingly, the economic fundamentals were relatively strong, but computerized program trading amplified panic. This crash led to better circuit-breaker mechanisms.

4. Dot-Com Bubble (2000–2002)

Fueled by excessive speculation in internet startups, tech stocks soared in the late 1990s. When profitability didn’t match expectations, the bubble burst, erasing $5 trillion in market value. Many companies went bankrupt, but survivors like Amazon and Google emerged stronger.

5. Global Financial Crisis (2008–2009)

Triggered by the collapse of the U.S. housing bubble and subprime mortgages, this crash nearly collapsed the global banking system. Lehman Brothers’ bankruptcy sent shockwaves worldwide. Governments had to bail out banks, and trillions were injected into economies. The aftershocks shaped global monetary policy for over a decade.

6. COVID-19 Pandemic Crash (2020)

In March 2020, as the pandemic spread globally, markets experienced one of the fastest declines in history. Supply chains froze, oil prices collapsed, and entire economies went into lockdown. Central banks intervened with massive liquidity injections, and markets rebounded faster than expected, though inequality widened.

Causes of Stock Market Crashes

Speculative Bubbles – Excessive optimism leads investors to drive prices far beyond intrinsic values (e.g., tulip mania, dot-com bubble).

Leverage & Debt – Borrowed money magnifies gains but also magnifies losses when markets turn.

Banking Failures – Weak banking systems spread panic when liquidity dries up.

Geopolitical Events – Wars, oil shocks, or political instability can trigger sudden sell-offs.

Technological Factors – Automated trading systems can accelerate crashes.

Psychological Herding – Fear and greed amplify movements, leading to irrational decisions.

Economic & Social Consequences

A market crash is not just numbers falling on screens; it creates real-world damage:

Wealth Destruction – Households lose savings, pensions shrink, and corporate valuations collapse.

Unemployment – Businesses cut back, leading to layoffs and wage stagnation.

Banking Stress – Non-performing loans rise, banks tighten credit, stifling growth.

Government Debt – States often borrow heavily to stabilize economies, leading to long-term fiscal challenges.

Social Unrest – Rising inequality, poverty, and frustration often trigger protests and political upheaval.

Shift in Global Power – Crashes can weaken one region while strengthening another (e.g., U.S. decline in 1930s, rise of Europe and later Asia).

Global Ripple Effects

Stock markets are interconnected; a crash in one major market spills over into others.

Trade Decline: Reduced demand lowers imports/exports, hurting global supply chains.

Currency Volatility: Investors flee to safe havens like gold, U.S. treasuries, or the Swiss franc.

Capital Flight: Emerging markets often see massive outflows during global downturns.

Policy Shifts: Central banks coordinate interventions, lowering rates and providing stimulus.

Geopolitical Shifts: Crashes often weaken alliances, spark nationalism, or accelerate the rise of new powers.

Case Study: 2008 Crisis Global Impact

U.S.: Housing collapse, unemployment peaking at 10%, massive bailouts.

Europe: Sovereign debt crises in Greece, Spain, and Italy.

Asia: Export-driven economies like China saw slowed growth, but also emerged as stronger alternatives to Western dependence.

Developing Nations: Suffered from falling commodity prices, reduced remittances, and currency instability.

This showed how deeply integrated the global economy had become.

Lessons Learned

Stronger Regulation – The 2008 crash showed the need for tighter oversight of derivatives and shadow banking.

Central Bank Coordination – Global central banks now act in unison to stabilize liquidity.

Risk Management – Investors are more cautious about leverage and speculative excess.

Diversification – Global portfolios help mitigate region-specific risks.

Psychological Awareness – Understanding behavioral finance helps explain panic-driven moves.

Are Crashes Preventable?

History suggests crashes are not entirely preventable because markets are built on human behavior, which swings between fear and greed. However, their severity can be managed:

Circuit breakers and trading halts prevent extreme panic.

Transparent regulation reduces systemic risk.

Global cooperation cushions shocks.

Investor education lowers herd mentality.

The Future of Stock Market Crashes

Looking ahead, new risks emerge:

Algorithmic & AI Trading – Speed of trading could magnify volatility.

Cryptocurrency Integration – Digital assets could create new bubbles.

Climate Change – Extreme weather could disrupt industries, creating market shocks.

Geopolitical Tensions – Trade wars, cyber conflicts, and resource scarcity may fuel future crises.

While markets will continue to experience crashes, societies are better equipped to handle them—though not immune.

Conclusion

Stock market crashes are dramatic reminders of the fragility of financial systems. They destroy wealth, disrupt lives, and alter the trajectory of nations. From the Great Depression to COVID-19, each crash has reshaped global finance, politics, and society.

Yet, paradoxically, crashes also pave the way for renewal. They expose weaknesses, force reforms, and create opportunities for resilient businesses to thrive. In this sense, crashes are not just destructive—they are part of capitalism’s self-correcting cycle.

For investors, policymakers, and citizens, the lesson is clear: crashes cannot be avoided, but their impact can be mitigated through preparation, diversification, and prudent regulation. The challenge is not to eliminate volatility but to ensure societies are resilient enough to withstand it.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.