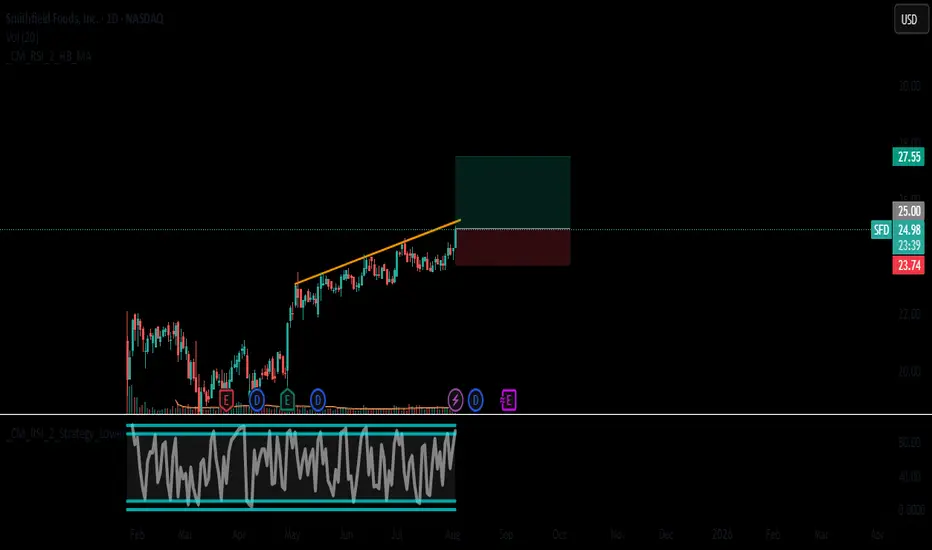

🚀 Trade Idea: SFD (Smithfield Foods, Inc.) - Reversal Play with Measured Upside

📈 Trading Setup

Entry: $25.00 (Break of descending trendline)

Stop Loss: $23.74 (Below recent swing low)

Take Profit: $27.55 (+10.2% upside)

Risk/Reward Ratio: 1:2.1

🔍 Why SFD Now?

✅ Fundamental Drivers

Protein Demand Recovery: Post-pandemic foodservice rebound

Margin Improvement: Corn/soybean feed costs moderating (Key input)

Valuation:

P/E 10.99 vs industry avg 15.3

P/S 0.66 (40% discount to peers)

Dividend: 2.3% yield (Defensive characteristic)

📊 Technical Triggers

Pattern: Falling wedge breakout (Daily chart)

Key Levels:

Resistance Break: $25.00 (200-day MA confluence)

Next Resistance: $27.55 (61.8% Fib retracement)

Momentum:

RSI: 58 and rising (No overbought condition)

MACD: Bullish crossover above signal line

🎯 Trade Management

Entry Confirmation:

Wait for >2% daily close above $25

Volume should exceed 20-day avg

Position Sizing:

Risk ≤2% of capital ($1.26 risk per share)

Profit Strategy:

50% at $26.40 (Test of YTD high)

50% at $27.55 (Full measured move)

Stop Adjustment:

Trail to $24.50 after $26 break

⚠️ Key Risk Factors

Commodity Prices: Pork futures volatility

Consumer Demand: Recessionary spending shifts

Competition: Plant-based protein substitution

📌 Institutional Context

Short Interest: 8.2% float (Could fuel squeeze)

Insider Activity: Net buying last quarter

Analyst Ratings: 4 Hold, 2 Buy (Avg PT $26.50)

Best For:

Swing traders (2-6 week hold)

Dividend investors adding positions

#SFD #ConsumerStaples #Protein #TechnicalBreakout

Always verify current market conditions before trading. This is not investment advice.

Chart Note: Recent breakout accompanied by highest volume in 3 months suggests institutional accumulation. The $25 level has been tested 4x in 2023 - a clean break could trigger algorithmic buying.

📈 Trading Setup

Entry: $25.00 (Break of descending trendline)

Stop Loss: $23.74 (Below recent swing low)

Take Profit: $27.55 (+10.2% upside)

Risk/Reward Ratio: 1:2.1

🔍 Why SFD Now?

✅ Fundamental Drivers

Protein Demand Recovery: Post-pandemic foodservice rebound

Margin Improvement: Corn/soybean feed costs moderating (Key input)

Valuation:

P/E 10.99 vs industry avg 15.3

P/S 0.66 (40% discount to peers)

Dividend: 2.3% yield (Defensive characteristic)

📊 Technical Triggers

Pattern: Falling wedge breakout (Daily chart)

Key Levels:

Resistance Break: $25.00 (200-day MA confluence)

Next Resistance: $27.55 (61.8% Fib retracement)

Momentum:

RSI: 58 and rising (No overbought condition)

MACD: Bullish crossover above signal line

🎯 Trade Management

Entry Confirmation:

Wait for >2% daily close above $25

Volume should exceed 20-day avg

Position Sizing:

Risk ≤2% of capital ($1.26 risk per share)

Profit Strategy:

50% at $26.40 (Test of YTD high)

50% at $27.55 (Full measured move)

Stop Adjustment:

Trail to $24.50 after $26 break

⚠️ Key Risk Factors

Commodity Prices: Pork futures volatility

Consumer Demand: Recessionary spending shifts

Competition: Plant-based protein substitution

📌 Institutional Context

Short Interest: 8.2% float (Could fuel squeeze)

Insider Activity: Net buying last quarter

Analyst Ratings: 4 Hold, 2 Buy (Avg PT $26.50)

Best For:

Swing traders (2-6 week hold)

Dividend investors adding positions

#SFD #ConsumerStaples #Protein #TechnicalBreakout

Always verify current market conditions before trading. This is not investment advice.

Chart Note: Recent breakout accompanied by highest volume in 3 months suggests institutional accumulation. The $25 level has been tested 4x in 2023 - a clean break could trigger algorithmic buying.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.