Unable to take SG30SGD on Oanda demo account with the leverage at 20:1.

Besides that, the position is 34 lots per position I think. No idea how they could it. I could be wrong. I am using 100k demo account.

Maybe with that kind of leverage, i could only take trades on higher time frame with bigger SL.

Besides, I am only risking 1% per trade on Oanda demo account.

So, this is the limitation of Oanda demo account.

No broker is perfect.

They are after all business people who wants to earn your money.

If you keep trading on demo account with reasonably sized leverage, and you keep losing on it, what are the odds that you would want to trade with their real money account?

With the small leverage allowed, you get pissed off and start trading the real money account in order to trade with more leverage, and other reassons such as you being pissed that you are limited in the amount of trades you could take on their demo account, etc.

Just my personal observation and thoughts.

Traders don't trade rationally, and lose most of the time, and most traders lose money, and most traders hope their next trading strategy would work out.

So, what are the odds that traders who are desperate to make money while making bad trading decisions would make good decisions to continue trading with demo account instead of trading with multiple demo accounts?

I know cos I was once reckless like that.

0406SGT 26022025

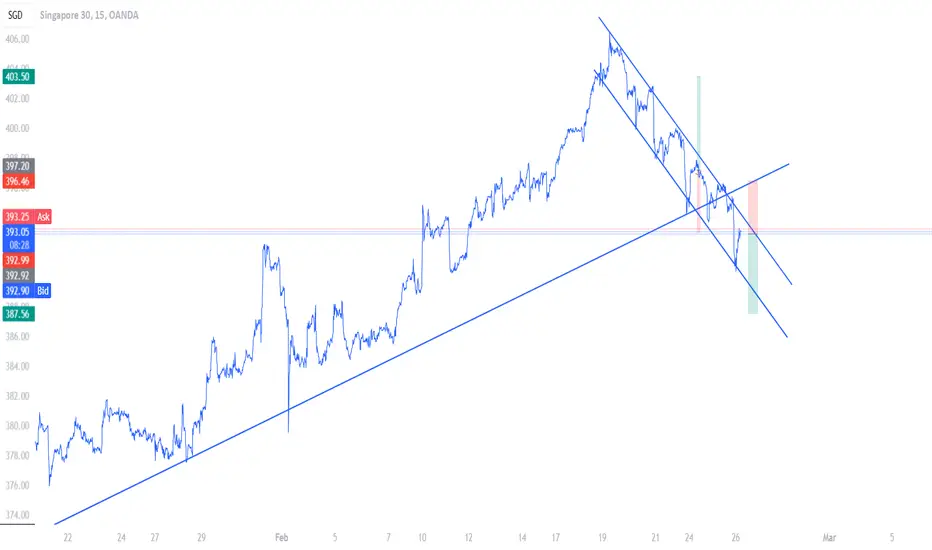

Add : Price broke out of the major uptrend trend line, so, I am selling.

Price has been making consistent lower low lower highs as seen in the current wave, so, I am selling with the trend.

Key phrase, With the trend.

0407SGT 26022025

Besides that, the position is 34 lots per position I think. No idea how they could it. I could be wrong. I am using 100k demo account.

Maybe with that kind of leverage, i could only take trades on higher time frame with bigger SL.

Besides, I am only risking 1% per trade on Oanda demo account.

So, this is the limitation of Oanda demo account.

No broker is perfect.

They are after all business people who wants to earn your money.

If you keep trading on demo account with reasonably sized leverage, and you keep losing on it, what are the odds that you would want to trade with their real money account?

With the small leverage allowed, you get pissed off and start trading the real money account in order to trade with more leverage, and other reassons such as you being pissed that you are limited in the amount of trades you could take on their demo account, etc.

Just my personal observation and thoughts.

Traders don't trade rationally, and lose most of the time, and most traders lose money, and most traders hope their next trading strategy would work out.

So, what are the odds that traders who are desperate to make money while making bad trading decisions would make good decisions to continue trading with demo account instead of trading with multiple demo accounts?

I know cos I was once reckless like that.

0406SGT 26022025

Add : Price broke out of the major uptrend trend line, so, I am selling.

Price has been making consistent lower low lower highs as seen in the current wave, so, I am selling with the trend.

Key phrase, With the trend.

0407SGT 26022025

Trade closed: stop reached

-1R loss.Oh yeah.

I am realising a trend, that price often touches the 1.5R SL level.

Often crossing beyond the 1R SL.

My opposite is true account on Oanda mt4 has 15 closed positions.

5 losses 10 wins.

1 win = +1R

1 loss = -1.5R

Total win = +10R

Total loss = -6R

Total PNL = +4R

True PNL = +3.3R~ ###

---

If I expand the 1R TP to 1.5R TP, and assuming that the win rate stays the same, then... >>>

Total win = +15R

Total loss = -6R

Total PNL = +9R ###

Not accounting for true PNL***

True PNL is my way of saying, total pnl minus slippage, spread, commission etc.

It's about 18%, 0.7R minus +4R profit.

So, assuming that my win rate is 9R, and I take out the 18% slippage, my true win rate would be about +7.38R true PNL.

1251SGT 28022025

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.