Silver market was undermined with a notorious Flash Crash occurred last summer.

The chart structure was spoiled but at the end of the day if we have enough patience

to wait until dust settles we could see the clear picture again.

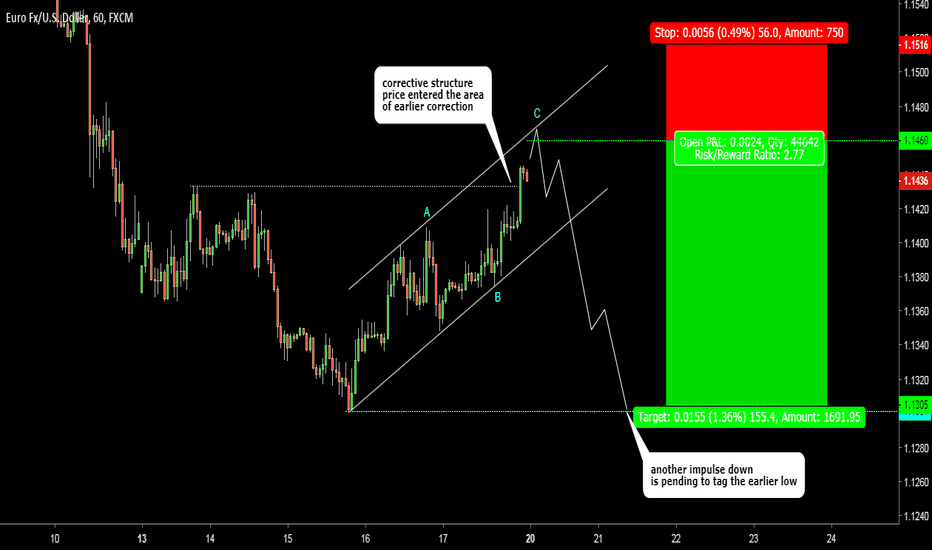

I spotted for you both the blue downtrend and the yellow triangle pattern in the wave X on the chart.

It looks like we can gain from the last drop down to the previous low at the 13.65 or even lower to the downside

of the downtrend to the area of 12 handle.

The RSI indicator can't raise its head above the waterline beyond the 50 level and it favors the short.

The invalidation level is set at the finish of the wave "e" of X at the 17.70 level.

The minimum risk/reward then is equal to 2 and is healthily asymmetric.

The chart structure was spoiled but at the end of the day if we have enough patience

to wait until dust settles we could see the clear picture again.

I spotted for you both the blue downtrend and the yellow triangle pattern in the wave X on the chart.

It looks like we can gain from the last drop down to the previous low at the 13.65 or even lower to the downside

of the downtrend to the area of 12 handle.

The RSI indicator can't raise its head above the waterline beyond the 50 level and it favors the short.

The invalidation level is set at the finish of the wave "e" of X at the 17.70 level.

The minimum risk/reward then is equal to 2 and is healthily asymmetric.

Note

move stop to break-even and enjoy the safe ride.watch 14.40 area where the Flash-Crash drop was quickly absorbed and book profit there if aggressive buying appears.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.