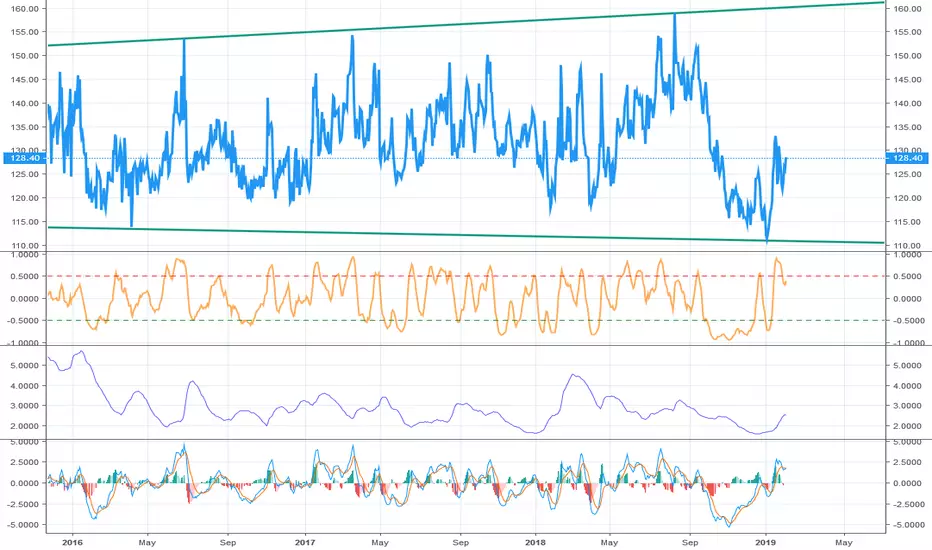

skew (demand for otm puts in spx) has been slumbering, lingering in the background, but growing. from hitting its all time high prior to december meltdown. we're beginning to see the slumbering giant grow meaning the downside weight of spx puts is growing (can see in OI chain). from a vix point of view we may be in contango (futures curve) but we've learned the tail can overpower the dog. with skew growing and VVIX nearing a reflexive low. wide strangle (either benefit from delta change or volatility expansion) may be an optimal vix strategy. ignore the oscillators this is primarily a leading indicator that updates once daily

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.