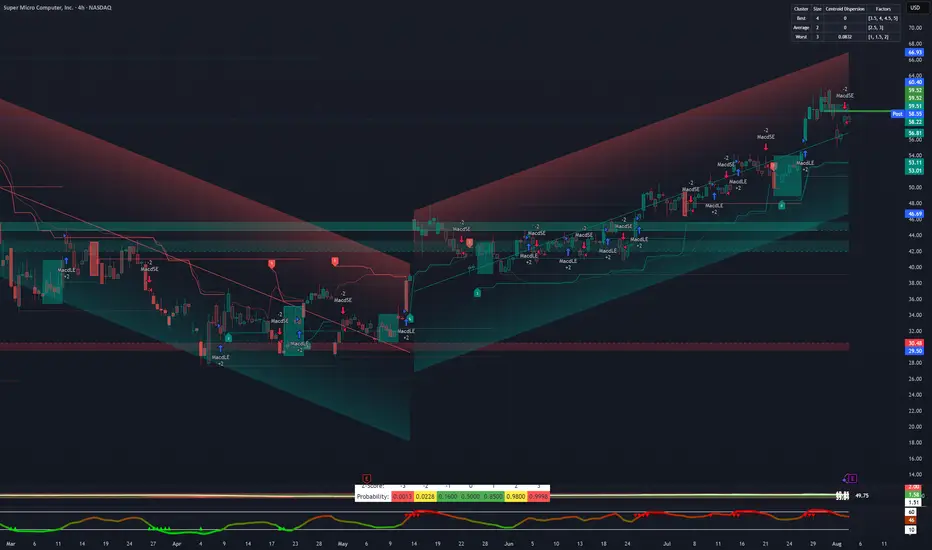

Things here are about overcoming the new 4-hour resistance from the accumulated volume of $60.40. I think that will happen only after good results tomorrow. Logical, because it clearly did not happen today. And the decline logically came after the SP500 correction, which I wrote about here at the beginning of last week, about which some friends here asked me why I was sure it would happen. It was clear that it would happen and it did, but it started strangely a little before the results of Apple and Amazon, but I will not comment on that here. Ultimately, the price movement is perfect, like in a textbook. We have a breakthrough of the daily resistance of $52.41, which is now a solid support, and then a retest that strengthened this support. The RSI has decreased. In case of bad results, God forbid not tragic ones, we will return there. In case of good results, however, we will reach $72. I have open positions and I think I'll take a risk and, although I don't have any after-market trading for this stock, I'll play for $72+. This is the reality. I don't think I'll give more detailed information on the 5, 15 and 30m levels right now because tomorrow is a special day. I only hope that we don't have a big movement and only a slight drop in the SP500, which I think will be $6358. Good luck!

Trade active

There is something else that I think is important. The decline and the break of the daily support in February starts a few days before the report, on February 19-20, whereas now we don't have that.Trade closed: stop reached

Unfortunately, the earnings report was not good, I also lost a significant amount, and the daily support was broken. Fortunately, however, at this point the most solid support from the accumulated volume, namely the weekly one, is holding. With small differences with expectations and analysts' opinions, it is very likely that we will not see $30 again, but will go up from here as is currently noticeable. However, one must trade cautiously and indeed, in the end, this company is for day trading, something I did too, but I fell into this trap.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.