The AI infrastructure boom is reshaping the global economy, and two companies—Super Micro Computer (SMCI) and NVIDIA (NVDA)—stand at the forefront of this transformation. Recent geopolitical and business developments, particularly President Donald Trump’s Middle East trip in May 2025 and Japan’s endorsement of SMCI for its sovereign AI installation, have significantly bolstered the growth prospects of both companies. In this article, I’ll analyze the impact of these deals, project new revenue streams for SMCI and NVDA, and make a compelling case for why their stocks are undervalued, supported by current price-to-earnings (P/E) ratios. This is a comprehensive exploration of why SMCI and NVDA are poised for explosive growth and why their stocks are a bargain for long-term investors.

Context: Trump’s Middle East Trip and AI Infrastructure Deals

In May 2025, President Trump embarked on a high-profile tour of the Gulf States—Saudi Arabia, Qatar, and the UAE—to strengthen U.S. technological and economic ties. The trip resulted in landmark AI infrastructure deals, positioning NVDA and SMCI as key beneficiaries as these nations pivot from oil-based economies to technology hubs. Key highlights include:

Saudi Arabia: Saudi Arabia committed $600 billion to invest in the U.S., with a significant portion allocated to AI infrastructure. NVDA secured a deal to supply “several hundred thousand” of its advanced Blackwell AI chips to Saudi Arabia’s Humain project, while SMCI signed a $20 billion multi-year partnership with DataVolt to deliver ultra-dense GPU platforms and liquid-cooled rack systems for hyperscale AI campuses in Saudi Arabia and the U.S.

Qatar and UAE: While specific deals for NVDA and SMCI in Qatar and the UAE were less detailed, the broader context suggests technology partnerships, with Qatar Airways ordering Boeing planes, indicating a wide-ranging economic collaboration likely including tech infrastructure.

Tech Conferences and Sentiment: The trip coincided with events like the Saudi-US Investment Forum, where NVDA’s CEO Jensen Huang and SMCI’s CEO Charles Liang were prominent figures, reinforcing their leadership in AI. Market sentiment, reflected in posts on X, shows strong enthusiasm, with NVDA and SMCI stocks surging post-announcements.

Additionally, Japan’s decision to select SMCI for its sovereign AI installation is a massive endorsement. As one of the most technologically advanced nations after the U.S., Japan’s preference for SMCI’s liquid-cooled, AI-optimized servers over competitors like Dell or HP underscores SMCI’s technological edge, particularly in energy-efficient data center solutions.

These developments position SMCI and NVDA as critical players in a global AI infrastructure surge, with the Middle East and Japan emerging as pivotal markets.

Revenue Projections and Growth Infused by the Deals

To quantify the impact, let’s compute new revenue projections for SMCI and NVDA, focusing on the incremental growth from these deals. I’ll assume that a significant portion of NVDA’s high-performance chips (e.g., Blackwell GPUs) will be integrated into SMCI’s servers, given their long-standing partnership and SMCI’s dominance in liquid-cooled AI server solutions.

Super Micro Computer (SMCI)

Current Revenue Baseline:

SMCI reported $14.94 billion in revenue for fiscal year 2024 (ended June 30, 2024) and guided for $21.8 billion to $22.6 billion in fiscal year 2025.

For fiscal Q3 2025 (March 2025), SMCI guided revenue of $5 billion to $6 billion, and for Q4 2025 (June 2025), $5.6 billion to $6.4 billion.

SMCI’s long-term goal is $40 billion in revenue by fiscal year 2026 (ending June 30, 2026).

Impact of Saudi Deal:

The $20 billion DataVolt deal is multi-year, likely spanning 2025–2028, with an estimated annual revenue contribution of $4 billion to $6.7 billion (assuming 3–5 years).

This deal alone represents nearly 100% of SMCI’s 2025 consensus revenue, significantly boosting its growth trajectory.

SMCI expects to earn $200 million in annual EBIT from this deal, implying strong profitability despite margin pressures from competition.

Impact of Japan’s Sovereign Installation:

While specific financial details are unavailable, Japan’s choice of SMCI for its sovereign AI infrastructure suggests a multi-billion-dollar contract, given the scale of national AI projects. Japan’s AI investments are part of a broader push to compete with the U.S. and China, with budgets in the tens of billions. Let’s conservatively estimate $2 billion in revenue over 2025–2027, or $500 million to $1 billion annually.

Other Growth Drivers:

SMCI’s partnerships with NVDA and Fujitsu, along with its leadership in liquid-cooled servers (80% market share), position it to capture a growing share of the $133.3 billion global server market in 2025, potentially increasing its market share from 12.7% in 2024 to 22%.

SMCI’s Q2 2025 revenue was $5.65 billion, with AI-optimized infrastructure accounting for 70% of sales, indicating robust demand.

New Revenue Projection for FY 2025:

Baseline FY 2025 guidance: $21.8 billion to $22.6 billion.

Saudi deal contribution (2025 portion): $2 billion (conservatively assuming partial deployment in 2025).

Japan deal contribution: $500 million.

Organic growth from existing markets: Assume $1 billion from increased market share and demand.

Total FY 2025 Revenue: $25.3 billion to $26.1 billion (a 69%–75% increase over FY 2024’s $14.94 billion).

Growth Infused by Trump’s Trip:

The Saudi deal adds $2 billion to 2025 revenue, representing an 8%–9% uplift over the original guidance.

Japan’s endorsement enhances SMCI’s credibility, likely driving additional contracts globally, contributing $500 million (2% uplift).

Combined, these deals infuse 10%–11% additional growth for FY 2025, with further upside in 2026 as SMCI targets $40 billion.

NVIDIA (NVDA)

Current Revenue Baseline:

NVDA guided for $24 billion in revenue for Q1 FY 2025 (ended April 2025), a 300% year-over-year increase.

For FY 2025 (ending January 2025), analysts estimated $103 billion in revenue, driven by data center GPUs like Hopper Craig and Blackwell.

NVDA’s data center segment, which includes AI GPUs, grew 16% quarter-over-quarter in January 2025, with Blackwell GPUs constituting 31% of revenue.

Impact of Saudi Deal:

NVDA’s deal to supply “several hundred thousand” Blackwell GPUs to Saudi Arabia’s Humain project is massive. Assuming 300,000 GPUs at an average price of $30,000 each (based on Blackwell pricing estimates), this deal could generate $9 billion in revenue.

Spread over 2025–2027, this implies $2 billion to $3 billion annually, with $2 billion likely in FY 2026 (ending January 2026).

Other Middle East Deals:

Qatar and UAE deals are less quantified, but given NVDA’s global demand, assume an additional $1 billion in 2026 from these regions.

Other Growth Drivers:

NVDA’s backlog for Blackwell GPUs is oversubscribed, with hyperscalers and sovereign entities driving demand.

SMCI, NVDA’s third-largest customer, integrates NVDA GPUs into 70% of its servers, amplifying NVDA’s revenue as SMCI grows.

Japan’s AI push likely includes NVDA GPUs, given SMCI’s reliance on them. Estimate $500 million in additional revenue for 2026.

New Revenue Projection for FY 2026:

Baseline FY 2026 revenue (analyst consensus): $125 billion (assuming 20% growth over FY 2025’s $103 billion).

Saudi deal contribution: $2 billion.

Qatar/UAE contribution: $1 billion.

Japan contribution (via SMCI): $500 million.

Total FY 2026 Revenue: $128.5 billion (a 25% increase over FY 2025).

Growth Infused by Trump’s Trip:

The Saudi deal adds $2 billion, or 1.6% uplift to FY 2026 revenue.

Qatar/UAE and Japan add $1.5 billion, or 1.2% uplift.

Combined, these deals infuse 2.8% additional growth for FY 2026, with potential for more if Middle East investments accelerate.

Case for SMCI and NVDA Stocks Being Undervalued

Both SMCI and NVDA are trading at valuations that significantly undervalue their growth potential, particularly given the transformative impact of the Middle East deals and Japan’s endorsement. Below, I outline why their stocks are cheap, supported by P/E ratio calculations and qualitative factors.

Super Micro Computer (SMCI)

Current Valuation and P/E Ratio:

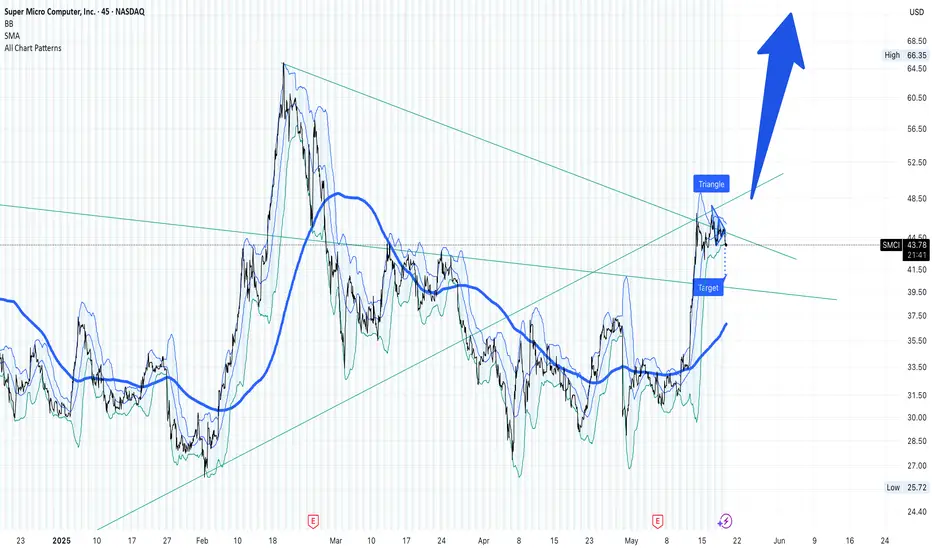

As of May 16, 2025, SMCI’s stock price is approximately $46.14.

For FY 2025, SMCI’s guidance for earnings per share (EPS) is not explicitly stated, but preliminary Q2 2025 results suggest $0.29–$0.31 EPS.

Assume FY 2025 EPS of $1.20 (based on Q2 and Q3 guidance and historical growth). With a stock price of $46.14, the forward P/E ratio is:

Analysts project 2028 EPS at $5.11 (based on SMCI trading at 9x 2028 forecasts).

Why SMCI is Undervalued:

Explosive Revenue Growth: SMCI’s revenue grew 74.5% annually over the past three years, and the Saudi deal and Japan’s endorsement could push FY 2025 revenue to $25.3–$26.1 billion, a 69%–75% increase. The $40 billion target for FY 2026 implies 77% growth over 2025. This growth rate far exceeds the S&P 500’s average, yet SMCI’s forward P/E of 38.45 (and 9.03 for 2028) is modest for a hyper-growth tech stock.

Undervalued Relative to Peers: SMCI’s P/E of 38.45 is significantly lower than NVDA’s and other AI infrastructure players like Broadcom (AVGO, P/E ~70). Given SMCI’s 70% AI-driven sales and leadership in liquid cooling, it deserves a premium valuation.

Japan’s Endorsement: Japan’s choice of SMCI for its sovereign AI installation validates its technological superiority. As a leading tech nation, Japan’s decision could lead to further contracts in Asia and Europe, driving upside beyond current forecasts.

Saudi Deal’s Transformative Impact: The $20 billion DataVolt deal is nearly SMCI’s entire 2025 revenue, providing multi-year visibility and supporting upward estimate revisions. Analysts like Raymond James see SMCI as a “near-pure-play on AI,” with a $41 price target (11% upside from $46.14).

Margin Expansion Potential: Despite recent gross margin declines (11.9% in Q2 2025 vs. 16.7% in Q1 2024), SMCI’s operating margin expanded from 3% to 8.5% since 2020. Optimized pricing and scale from new deals could restore margins, boosting EPS and justifying a higher P/E.

Accounting Overhang Clearing: SMCI faced scrutiny from a 2024 Hindenburg Research report alleging accounting irregularities, but it filed delayed SEC reports by February 25, 2025, avoiding delisting. With a new auditor (BDO) and cleared regulatory hurdles, investor confidence is rebounding.

Price Target: Analysts suggest SMCI could trade at 30x 2028 earnings ($5.11), implying a price of $153.30—a 232% upside from $46.14. A conservative 20x P/E yields $102.20 (121% upside).

NVIDIA (NVDA)

Current Valuation and P/E Ratio:

As of May 16, 2025, NVDA’s stock price is approximately $105 (post-2024 price adjustments).

For FY 2025, NVDA’s adjusted EPS is estimated at $2.70 (based on $5.50 Q1 EPS forecast and analyst consensus).

For FY 2026, assume EPS of $3.24 (20% growth). The forward P/E is:

Why NVDA is Undervalued:

Unmatched AI Dominance: NVDA controls 80%–90% of the AI GPU market, with Blackwell GPUs driving 31% of Q1 2025 data center revenue. Demand is backordered, and deals like Saudi Arabia’s ensure sustained growth.

Middle East Catalyst: The Saudi deal ($9 billion over 2025–2027) and potential Qatar/UAE contracts add 2.8% to FY 2026 revenue, with upside if more nations invest. NVDA’s ability to court global leaders (e.g., China, Japan, D.C.) mitigates trade risks.

SMCI Synergy: As SMCI’s third-largest customer, NVDA benefits from SMCI’s growth, with 70% of SMCI’s servers using NVDA GPUs. SMCI’s $20 billion Saudi deal and Japan contract indirectly boost NVDA’s chip sales.

Margin Strength: NVDA’s operating margin expanded from 35% in 2020 to 54% in FY 2024, far surpassing SMCI’s 8.5%. This profitability supports reinvestment and resilience against tariffs.

Undervalued Growth: NVDA’s P/E of 38.89 (FY 2025) and 32.41 (FY 2026) is reasonable for a company with 300% Q1 2025 revenue growth and a $128.5 billion FY 2026 projection. Tech peers like Tesla (P/E ~100) trade at much higher multiples.

Geopolitical Shelter: Trump’s temporary exemption of GPUs from tariffs protects NVDA’s supply chain, unlike other tech firms facing 5%–25% cost increases.

Price Target: If NVDA trades at 50x FY 2026 EPS ($3.24), the price target is $162—a 54% upside from $105. A conservative 40x P/E yields $129.60 (23% upside).

Risks and Counterpoints

While the bullish case is strong, investors should consider potential risks:

SMCI:

NVDA:

Despite these risks, both companies’ fundamentals and deal-driven growth outweigh concerns, with SMCI’s valuation particularly attractive.

Conclusion

SMCI and NVDA are at the epicenter of the AI infrastructure revolution, with Trump’s Middle East trip and Japan’s endorsement catalyzing their growth. SMCI’s $20 billion Saudi deal and Japan contract could push FY 2025 revenue to $25.3–$26.1 billion (10%–11% uplift), while NVDA’s Saudi and regional deals add 2.8% to its $128.5 billion FY 2026 projection. Their forward P/E ratios—38.45 for SMCI (9.03 for 2028) and 38.89 for NVDA (32.41 for 2026)—are low relative to their hyper-growth profiles, making them compelling buys. SMCI’s leadership in liquid cooling and NVDA’s GPU dominance, amplified by global AI demand, suggest 121%–232% upside for SMCI and 23%–54% for NVDA. For investors seeking exposure to the AI megatrend, SMCI and NVDA offer unmatched value and growth potential. Now is the time to invest in these undervalued giants shaping the future of technology.

Context: Trump’s Middle East Trip and AI Infrastructure Deals

In May 2025, President Trump embarked on a high-profile tour of the Gulf States—Saudi Arabia, Qatar, and the UAE—to strengthen U.S. technological and economic ties. The trip resulted in landmark AI infrastructure deals, positioning NVDA and SMCI as key beneficiaries as these nations pivot from oil-based economies to technology hubs. Key highlights include:

Saudi Arabia: Saudi Arabia committed $600 billion to invest in the U.S., with a significant portion allocated to AI infrastructure. NVDA secured a deal to supply “several hundred thousand” of its advanced Blackwell AI chips to Saudi Arabia’s Humain project, while SMCI signed a $20 billion multi-year partnership with DataVolt to deliver ultra-dense GPU platforms and liquid-cooled rack systems for hyperscale AI campuses in Saudi Arabia and the U.S.

Qatar and UAE: While specific deals for NVDA and SMCI in Qatar and the UAE were less detailed, the broader context suggests technology partnerships, with Qatar Airways ordering Boeing planes, indicating a wide-ranging economic collaboration likely including tech infrastructure.

Tech Conferences and Sentiment: The trip coincided with events like the Saudi-US Investment Forum, where NVDA’s CEO Jensen Huang and SMCI’s CEO Charles Liang were prominent figures, reinforcing their leadership in AI. Market sentiment, reflected in posts on X, shows strong enthusiasm, with NVDA and SMCI stocks surging post-announcements.

Additionally, Japan’s decision to select SMCI for its sovereign AI installation is a massive endorsement. As one of the most technologically advanced nations after the U.S., Japan’s preference for SMCI’s liquid-cooled, AI-optimized servers over competitors like Dell or HP underscores SMCI’s technological edge, particularly in energy-efficient data center solutions.

These developments position SMCI and NVDA as critical players in a global AI infrastructure surge, with the Middle East and Japan emerging as pivotal markets.

Revenue Projections and Growth Infused by the Deals

To quantify the impact, let’s compute new revenue projections for SMCI and NVDA, focusing on the incremental growth from these deals. I’ll assume that a significant portion of NVDA’s high-performance chips (e.g., Blackwell GPUs) will be integrated into SMCI’s servers, given their long-standing partnership and SMCI’s dominance in liquid-cooled AI server solutions.

Super Micro Computer (SMCI)

Current Revenue Baseline:

SMCI reported $14.94 billion in revenue for fiscal year 2024 (ended June 30, 2024) and guided for $21.8 billion to $22.6 billion in fiscal year 2025.

For fiscal Q3 2025 (March 2025), SMCI guided revenue of $5 billion to $6 billion, and for Q4 2025 (June 2025), $5.6 billion to $6.4 billion.

SMCI’s long-term goal is $40 billion in revenue by fiscal year 2026 (ending June 30, 2026).

Impact of Saudi Deal:

The $20 billion DataVolt deal is multi-year, likely spanning 2025–2028, with an estimated annual revenue contribution of $4 billion to $6.7 billion (assuming 3–5 years).

This deal alone represents nearly 100% of SMCI’s 2025 consensus revenue, significantly boosting its growth trajectory.

SMCI expects to earn $200 million in annual EBIT from this deal, implying strong profitability despite margin pressures from competition.

Impact of Japan’s Sovereign Installation:

While specific financial details are unavailable, Japan’s choice of SMCI for its sovereign AI infrastructure suggests a multi-billion-dollar contract, given the scale of national AI projects. Japan’s AI investments are part of a broader push to compete with the U.S. and China, with budgets in the tens of billions. Let’s conservatively estimate $2 billion in revenue over 2025–2027, or $500 million to $1 billion annually.

Other Growth Drivers:

SMCI’s partnerships with NVDA and Fujitsu, along with its leadership in liquid-cooled servers (80% market share), position it to capture a growing share of the $133.3 billion global server market in 2025, potentially increasing its market share from 12.7% in 2024 to 22%.

SMCI’s Q2 2025 revenue was $5.65 billion, with AI-optimized infrastructure accounting for 70% of sales, indicating robust demand.

New Revenue Projection for FY 2025:

Baseline FY 2025 guidance: $21.8 billion to $22.6 billion.

Saudi deal contribution (2025 portion): $2 billion (conservatively assuming partial deployment in 2025).

Japan deal contribution: $500 million.

Organic growth from existing markets: Assume $1 billion from increased market share and demand.

Total FY 2025 Revenue: $25.3 billion to $26.1 billion (a 69%–75% increase over FY 2024’s $14.94 billion).

Growth Infused by Trump’s Trip:

The Saudi deal adds $2 billion to 2025 revenue, representing an 8%–9% uplift over the original guidance.

Japan’s endorsement enhances SMCI’s credibility, likely driving additional contracts globally, contributing $500 million (2% uplift).

Combined, these deals infuse 10%–11% additional growth for FY 2025, with further upside in 2026 as SMCI targets $40 billion.

NVIDIA (NVDA)

Current Revenue Baseline:

NVDA guided for $24 billion in revenue for Q1 FY 2025 (ended April 2025), a 300% year-over-year increase.

For FY 2025 (ending January 2025), analysts estimated $103 billion in revenue, driven by data center GPUs like Hopper Craig and Blackwell.

NVDA’s data center segment, which includes AI GPUs, grew 16% quarter-over-quarter in January 2025, with Blackwell GPUs constituting 31% of revenue.

Impact of Saudi Deal:

NVDA’s deal to supply “several hundred thousand” Blackwell GPUs to Saudi Arabia’s Humain project is massive. Assuming 300,000 GPUs at an average price of $30,000 each (based on Blackwell pricing estimates), this deal could generate $9 billion in revenue.

Spread over 2025–2027, this implies $2 billion to $3 billion annually, with $2 billion likely in FY 2026 (ending January 2026).

Other Middle East Deals:

Qatar and UAE deals are less quantified, but given NVDA’s global demand, assume an additional $1 billion in 2026 from these regions.

Other Growth Drivers:

NVDA’s backlog for Blackwell GPUs is oversubscribed, with hyperscalers and sovereign entities driving demand.

SMCI, NVDA’s third-largest customer, integrates NVDA GPUs into 70% of its servers, amplifying NVDA’s revenue as SMCI grows.

Japan’s AI push likely includes NVDA GPUs, given SMCI’s reliance on them. Estimate $500 million in additional revenue for 2026.

New Revenue Projection for FY 2026:

Baseline FY 2026 revenue (analyst consensus): $125 billion (assuming 20% growth over FY 2025’s $103 billion).

Saudi deal contribution: $2 billion.

Qatar/UAE contribution: $1 billion.

Japan contribution (via SMCI): $500 million.

Total FY 2026 Revenue: $128.5 billion (a 25% increase over FY 2025).

Growth Infused by Trump’s Trip:

The Saudi deal adds $2 billion, or 1.6% uplift to FY 2026 revenue.

Qatar/UAE and Japan add $1.5 billion, or 1.2% uplift.

Combined, these deals infuse 2.8% additional growth for FY 2026, with potential for more if Middle East investments accelerate.

Case for SMCI and NVDA Stocks Being Undervalued

Both SMCI and NVDA are trading at valuations that significantly undervalue their growth potential, particularly given the transformative impact of the Middle East deals and Japan’s endorsement. Below, I outline why their stocks are cheap, supported by P/E ratio calculations and qualitative factors.

Super Micro Computer (SMCI)

Current Valuation and P/E Ratio:

As of May 16, 2025, SMCI’s stock price is approximately $46.14.

For FY 2025, SMCI’s guidance for earnings per share (EPS) is not explicitly stated, but preliminary Q2 2025 results suggest $0.29–$0.31 EPS.

Assume FY 2025 EPS of $1.20 (based on Q2 and Q3 guidance and historical growth). With a stock price of $46.14, the forward P/E ratio is:

Analysts project 2028 EPS at $5.11 (based on SMCI trading at 9x 2028 forecasts).

Why SMCI is Undervalued:

Explosive Revenue Growth: SMCI’s revenue grew 74.5% annually over the past three years, and the Saudi deal and Japan’s endorsement could push FY 2025 revenue to $25.3–$26.1 billion, a 69%–75% increase. The $40 billion target for FY 2026 implies 77% growth over 2025. This growth rate far exceeds the S&P 500’s average, yet SMCI’s forward P/E of 38.45 (and 9.03 for 2028) is modest for a hyper-growth tech stock.

Undervalued Relative to Peers: SMCI’s P/E of 38.45 is significantly lower than NVDA’s and other AI infrastructure players like Broadcom (AVGO, P/E ~70). Given SMCI’s 70% AI-driven sales and leadership in liquid cooling, it deserves a premium valuation.

Japan’s Endorsement: Japan’s choice of SMCI for its sovereign AI installation validates its technological superiority. As a leading tech nation, Japan’s decision could lead to further contracts in Asia and Europe, driving upside beyond current forecasts.

Saudi Deal’s Transformative Impact: The $20 billion DataVolt deal is nearly SMCI’s entire 2025 revenue, providing multi-year visibility and supporting upward estimate revisions. Analysts like Raymond James see SMCI as a “near-pure-play on AI,” with a $41 price target (11% upside from $46.14).

Margin Expansion Potential: Despite recent gross margin declines (11.9% in Q2 2025 vs. 16.7% in Q1 2024), SMCI’s operating margin expanded from 3% to 8.5% since 2020. Optimized pricing and scale from new deals could restore margins, boosting EPS and justifying a higher P/E.

Accounting Overhang Clearing: SMCI faced scrutiny from a 2024 Hindenburg Research report alleging accounting irregularities, but it filed delayed SEC reports by February 25, 2025, avoiding delisting. With a new auditor (BDO) and cleared regulatory hurdles, investor confidence is rebounding.

Price Target: Analysts suggest SMCI could trade at 30x 2028 earnings ($5.11), implying a price of $153.30—a 232% upside from $46.14. A conservative 20x P/E yields $102.20 (121% upside).

NVIDIA (NVDA)

Current Valuation and P/E Ratio:

As of May 16, 2025, NVDA’s stock price is approximately $105 (post-2024 price adjustments).

For FY 2025, NVDA’s adjusted EPS is estimated at $2.70 (based on $5.50 Q1 EPS forecast and analyst consensus).

For FY 2026, assume EPS of $3.24 (20% growth). The forward P/E is:

Why NVDA is Undervalued:

Unmatched AI Dominance: NVDA controls 80%–90% of the AI GPU market, with Blackwell GPUs driving 31% of Q1 2025 data center revenue. Demand is backordered, and deals like Saudi Arabia’s ensure sustained growth.

Middle East Catalyst: The Saudi deal ($9 billion over 2025–2027) and potential Qatar/UAE contracts add 2.8% to FY 2026 revenue, with upside if more nations invest. NVDA’s ability to court global leaders (e.g., China, Japan, D.C.) mitigates trade risks.

SMCI Synergy: As SMCI’s third-largest customer, NVDA benefits from SMCI’s growth, with 70% of SMCI’s servers using NVDA GPUs. SMCI’s $20 billion Saudi deal and Japan contract indirectly boost NVDA’s chip sales.

Margin Strength: NVDA’s operating margin expanded from 35% in 2020 to 54% in FY 2024, far surpassing SMCI’s 8.5%. This profitability supports reinvestment and resilience against tariffs.

Undervalued Growth: NVDA’s P/E of 38.89 (FY 2025) and 32.41 (FY 2026) is reasonable for a company with 300% Q1 2025 revenue growth and a $128.5 billion FY 2026 projection. Tech peers like Tesla (P/E ~100) trade at much higher multiples.

Geopolitical Shelter: Trump’s temporary exemption of GPUs from tariffs protects NVDA’s supply chain, unlike other tech firms facing 5%–25% cost increases.

Price Target: If NVDA trades at 50x FY 2026 EPS ($3.24), the price target is $162—a 54% upside from $105. A conservative 40x P/E yields $129.60 (23% upside).

Risks and Counterpoints

While the bullish case is strong, investors should consider potential risks:

SMCI:

NVDA:

Despite these risks, both companies’ fundamentals and deal-driven growth outweigh concerns, with SMCI’s valuation particularly attractive.

Conclusion

SMCI and NVDA are at the epicenter of the AI infrastructure revolution, with Trump’s Middle East trip and Japan’s endorsement catalyzing their growth. SMCI’s $20 billion Saudi deal and Japan contract could push FY 2025 revenue to $25.3–$26.1 billion (10%–11% uplift), while NVDA’s Saudi and regional deals add 2.8% to its $128.5 billion FY 2026 projection. Their forward P/E ratios—38.45 for SMCI (9.03 for 2028) and 38.89 for NVDA (32.41 for 2026)—are low relative to their hyper-growth profiles, making them compelling buys. SMCI’s leadership in liquid cooling and NVDA’s GPU dominance, amplified by global AI demand, suggest 121%–232% upside for SMCI and 23%–54% for NVDA. For investors seeking exposure to the AI megatrend, SMCI and NVDA offer unmatched value and growth potential. Now is the time to invest in these undervalued giants shaping the future of technology.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.