First you probably want to watch this video:

📊 ETF News Meets the Charts: ETH, BTC, XRP, and Solana 🔥🚀

The SEC’s new in-kind ETF ruling is a macro-level reset. But as always — we bring it back to the charts 📉🧠

Here's the visual breakdown of what I'm watching and why:

🏛️ ETF Approval = Real BTC/ETH Usage Starts Now

✔️ ETF issuers can now create/redeem with actual Bitcoin & Ethereum

✔️ Real spot demand, better arbitrage, and tighter price tracking

✔️ TradFi goes crypto-native — this changes how ETFs settle

But the market? Shrugged.

That’s why we watch price structure — not headlines alone.

📈 What the Charts Are Telling Us:

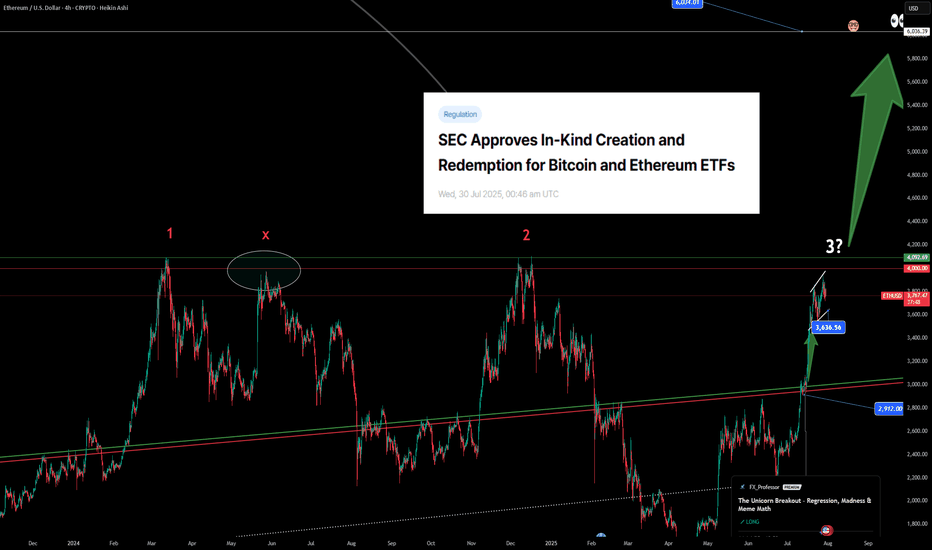

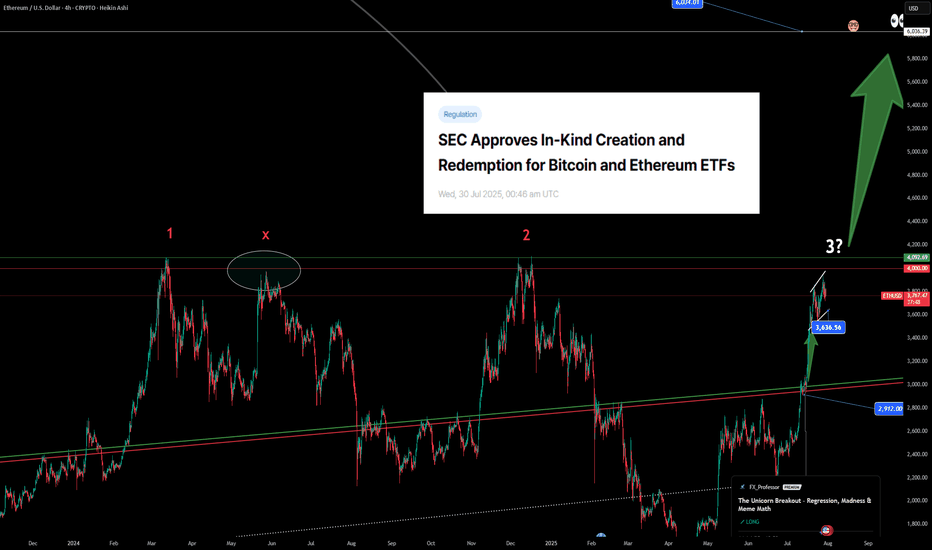

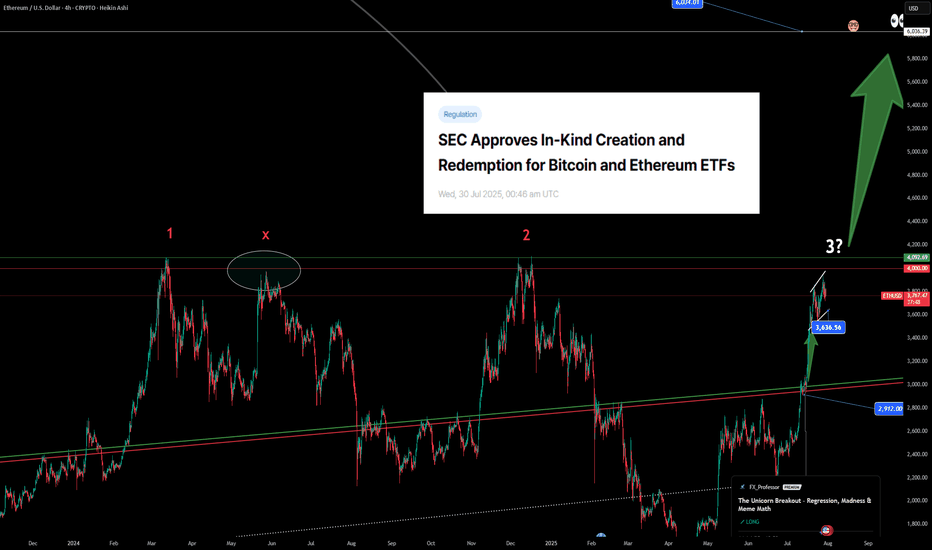

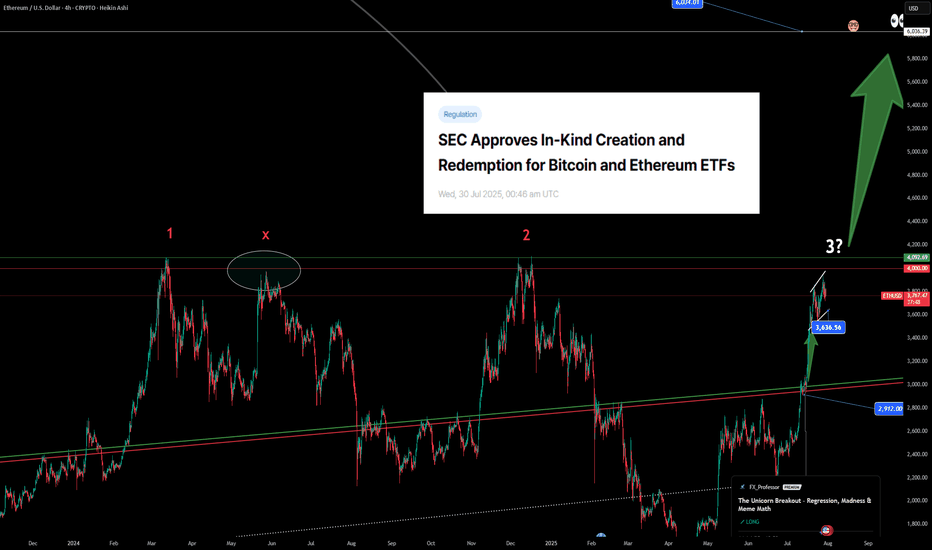

🔷 Top Left – Ethereum (ETHUSD)

Breakout triangle forming after the unicorn setup at $2,912.

Momentum building for the third breakout attempt at $4,092

🔥 Fuse lit. Target: $6,036

🔷 Top Right – SOLETH

Solana bleeding against Ethereum — just as forecasted months ago.

Rust tech, but memecoin dilution is hurting its institutional appeal. Solana will keep paying for their mistakes and damage done to Crypto!

🔷 Bottom Left – XRPBTC

Wedge breakdown playing out. XRP continues underperforming.

This chart was paired with a BTC dominance hedge — and dominance rose right after. XRP and dark pools is something I will cover..No, i don't like XRP, sorry.

🔷 Bottom Right – Bitcoin (BTCUSD)

Fib extension points to next possible macro leg:

🚀 0.618 = $131,736,

🟡 Final cycle target zone near $163K (or more? or 130k max?..we will find out)

🇨🇳 China: Rumor or Tumor?

Unconfirmed sources say China may be prepping a Bitcoin move. But let’s stay grounded:

🧠 It’s a rumor. Or a tumor.

There’s a 40% chance we get bad news instead — so keep your expectations realistic.

Still, if true, it could mean:

BTC in reserves

Regulated mining zones

Digital Yuan–BTC integration

🧯 Nothing official yet. But timing near the BRICS summit makes it worth watching.

🧠 Key Altcoin Narratives:

🔹 Ethereum L2s (ARB, OP, BASE) – ETF gas pressure = L2 scalability play

🔹 DeFi (UNI, AAVE, LDO) – TradFi flows into real DeFi utility

🔹 Staking Derivatives (LDO, RPL) – Institutions love yield

🔹 Oracles (LINK) – Real-time price data needed for ETF tracking

🔹 BTC Bridges (ThorChain, tBTC) – Infrastructure plays if BTC moves on ETH rails

🚫 What I’m Not Touching:

❌ Memecoins

❌ GameFi

❌ Ghost Layer 1s

📽️ Full breakdown is in my latest video — check it out from the video ideas tab for full context.

Stay sharp. Stack smart. Structure > noise.

One 💙 Love,

The FXPROFESSOR

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

📊 ETF News Meets the Charts: ETH, BTC, XRP, and Solana 🔥🚀

The SEC’s new in-kind ETF ruling is a macro-level reset. But as always — we bring it back to the charts 📉🧠

Here's the visual breakdown of what I'm watching and why:

🏛️ ETF Approval = Real BTC/ETH Usage Starts Now

✔️ ETF issuers can now create/redeem with actual Bitcoin & Ethereum

✔️ Real spot demand, better arbitrage, and tighter price tracking

✔️ TradFi goes crypto-native — this changes how ETFs settle

But the market? Shrugged.

That’s why we watch price structure — not headlines alone.

📈 What the Charts Are Telling Us:

🔷 Top Left – Ethereum (ETHUSD)

Breakout triangle forming after the unicorn setup at $2,912.

Momentum building for the third breakout attempt at $4,092

🔥 Fuse lit. Target: $6,036

🔷 Top Right – SOLETH

Solana bleeding against Ethereum — just as forecasted months ago.

Rust tech, but memecoin dilution is hurting its institutional appeal. Solana will keep paying for their mistakes and damage done to Crypto!

🔷 Bottom Left – XRPBTC

Wedge breakdown playing out. XRP continues underperforming.

This chart was paired with a BTC dominance hedge — and dominance rose right after. XRP and dark pools is something I will cover..No, i don't like XRP, sorry.

🔷 Bottom Right – Bitcoin (BTCUSD)

Fib extension points to next possible macro leg:

🚀 0.618 = $131,736,

🟡 Final cycle target zone near $163K (or more? or 130k max?..we will find out)

🇨🇳 China: Rumor or Tumor?

Unconfirmed sources say China may be prepping a Bitcoin move. But let’s stay grounded:

🧠 It’s a rumor. Or a tumor.

There’s a 40% chance we get bad news instead — so keep your expectations realistic.

Still, if true, it could mean:

BTC in reserves

Regulated mining zones

Digital Yuan–BTC integration

🧯 Nothing official yet. But timing near the BRICS summit makes it worth watching.

🧠 Key Altcoin Narratives:

🔹 Ethereum L2s (ARB, OP, BASE) – ETF gas pressure = L2 scalability play

🔹 DeFi (UNI, AAVE, LDO) – TradFi flows into real DeFi utility

🔹 Staking Derivatives (LDO, RPL) – Institutions love yield

🔹 Oracles (LINK) – Real-time price data needed for ETF tracking

🔹 BTC Bridges (ThorChain, tBTC) – Infrastructure plays if BTC moves on ETH rails

🚫 What I’m Not Touching:

❌ Memecoins

❌ GameFi

❌ Ghost Layer 1s

📽️ Full breakdown is in my latest video — check it out from the video ideas tab for full context.

Stay sharp. Stack smart. Structure > noise.

One 💙 Love,

The FXPROFESSOR

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

🐾 TOP DOGS TEAM is LIVE! 🚀 Join the $6M KCGI 2025 battle — Signals, Charts & Coaching included.

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🐾 TOP DOGS TEAM is LIVE! 🚀 Join the $6M KCGI 2025 battle — Signals, Charts & Coaching included.

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.