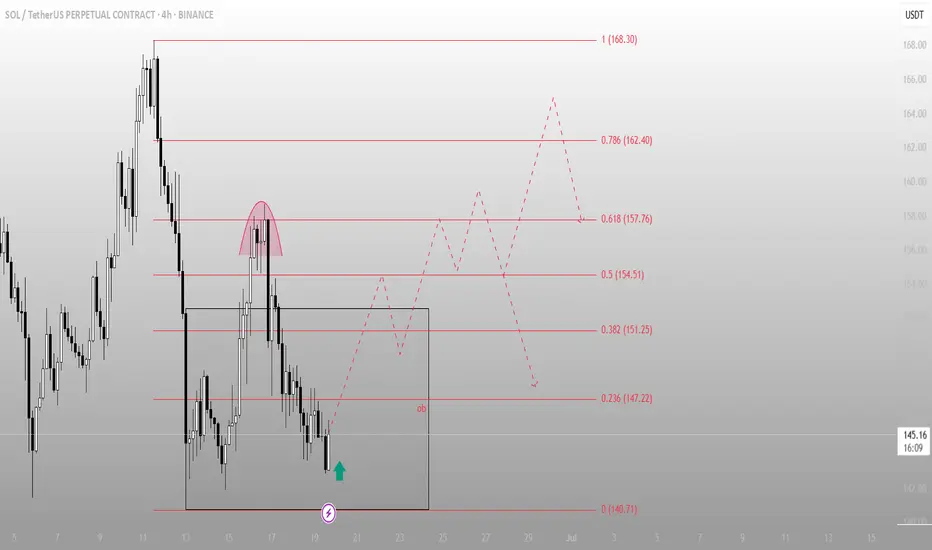

We’ve got a clean rounded top → breakdown → demand sweep setup.

Current price action suggests a potential reversal is brewing.

🔍 What’s happening on this chart?

Rounded top marks a local distribution — aggressive short entries

Price broke lower, swept the demand zone (gray box), and now shows rejection wick + bullish reaction

Fibonacci levels mapped out the structure

0.5 = 154.51

0.618 = 157.76 = key resistance liquidity zone

🎯 Trade idea:

Entry: inside demand zone (OB marked on chart)

Target 1: 151.25

Target 2: 157.76 (0.618)

Full fill: 162.40 – 168.30 (complete inefficiency sweep)

🧠 Mindset:

This setup is classic spring + reclaim. If price consolidates and flips 147.2, upside becomes favorable.

If you like clean trade setups with logic and clear invalidation, check the account bio for more updates and live breakdowns.

Current price action suggests a potential reversal is brewing.

🔍 What’s happening on this chart?

Rounded top marks a local distribution — aggressive short entries

Price broke lower, swept the demand zone (gray box), and now shows rejection wick + bullish reaction

Fibonacci levels mapped out the structure

0.5 = 154.51

0.618 = 157.76 = key resistance liquidity zone

🎯 Trade idea:

Entry: inside demand zone (OB marked on chart)

Target 1: 151.25

Target 2: 157.76 (0.618)

Full fill: 162.40 – 168.30 (complete inefficiency sweep)

🧠 Mindset:

This setup is classic spring + reclaim. If price consolidates and flips 147.2, upside becomes favorable.

If you like clean trade setups with logic and clear invalidation, check the account bio for more updates and live breakdowns.

Smart Money signals. Hourly trades. More Signals here

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Smart Money signals. Hourly trades. More Signals here

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.