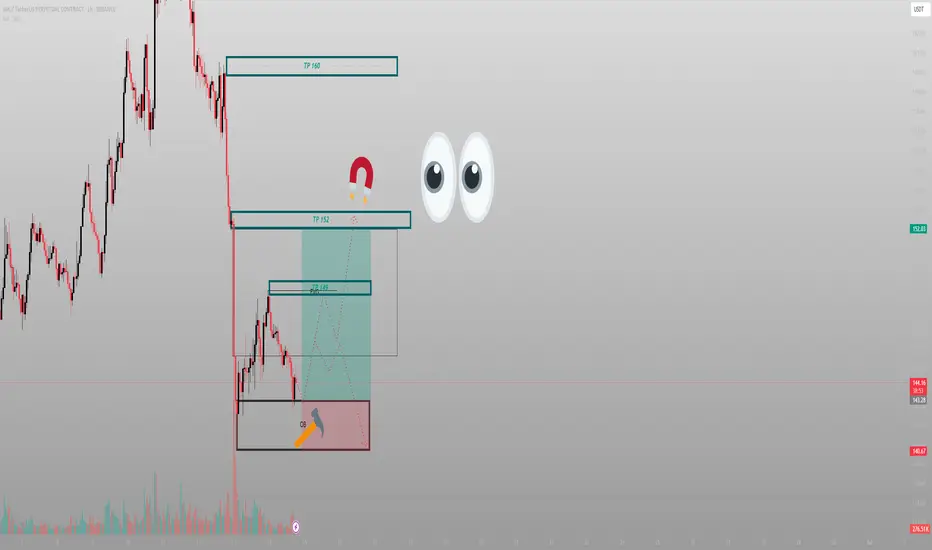

This isn’t chaos. It’s sequence. SOL sold off into a well-defined 1H OB, paired with a high-volume low. Price didn’t break. It anchored.

The setup:

After an aggressive dump, price settled into an Order Block between 140–143. This isn’t weakness. It’s rebalancing. Right above? A perfect FVG at 149 and inefficiency zones that align with liquidity draws at 152 and 160.

Volume is telling — it spiked into the OB, not on exit. That’s how Smart Money positions.

Expectation:

Accumulation near the OB → quick reversal → reclaim 145

From there, watch price reprice through:

TP1: 149 (FVG reclaim)

TP2: 152 (full inefficiency fill)

TP3: 160 (external liquidity sweep)

Any deeper dip below 140 becomes a deviation — not a breakdown — unless structure is violated with follow-through.

Execution:

Entry: 141–143 zone

SL: Below 139.8

TP1: 149

TP2: 152

Final: 160

This is engineered — not emotional.

Final thought:

“You don’t need to predict the bottom. You just need to know where price is built to return.”

The setup:

After an aggressive dump, price settled into an Order Block between 140–143. This isn’t weakness. It’s rebalancing. Right above? A perfect FVG at 149 and inefficiency zones that align with liquidity draws at 152 and 160.

Volume is telling — it spiked into the OB, not on exit. That’s how Smart Money positions.

Expectation:

Accumulation near the OB → quick reversal → reclaim 145

From there, watch price reprice through:

TP1: 149 (FVG reclaim)

TP2: 152 (full inefficiency fill)

TP3: 160 (external liquidity sweep)

Any deeper dip below 140 becomes a deviation — not a breakdown — unless structure is violated with follow-through.

Execution:

Entry: 141–143 zone

SL: Below 139.8

TP1: 149

TP2: 152

Final: 160

This is engineered — not emotional.

Final thought:

“You don’t need to predict the bottom. You just need to know where price is built to return.”

Trade closed: target reached

Smart Money signals. Hourly trades.

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Smart Money signals. Hourly trades.

📍Telegram: t.me/smartflowblog

📍Telegram: t.me/smartflowblog

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.