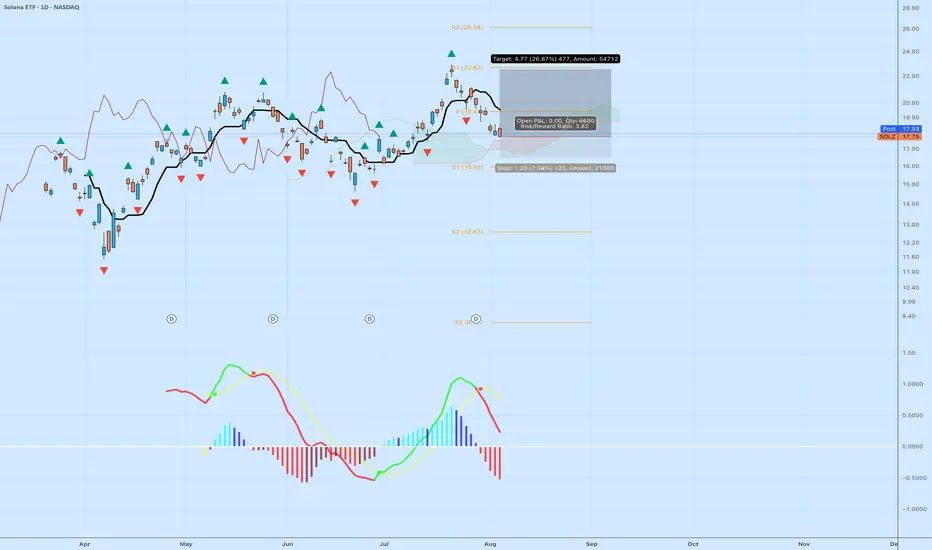

This chart shows a potential long opportunity forming on  SOLZ using Ichimoku principles.

SOLZ using Ichimoku principles.

The price has pulled back into the Ichimoku Cloud (Kumo), which often acts as dynamic support during an uptrend. The cloud is still bullish, with Senkou Span A above Span B, indicating the longer-term trend remains intact.

The Kijun-sen (Base Line) at around $18.50 is the next resistance. A daily close above that level would confirm a potential trend continuation. The Tenkan-sen (Conversion Line) is currently sloping downward but would turn up if price moves higher.

The Chikou Span (Lagging Line) is still above price candles, showing that overall momentum remains bullish.

MACD histogram is red but beginning to flatten, signaling bearish momentum may be slowing.

Trade setup:

Entry: $17.75 (current price in the cloud)

Stop: $16.50 (below Kumo base and S1 support)

Target: $22.67 (R1 and prior resistance)

Risk/Reward: 3.78

Setup remains valid as long as the price holds above the cloud. A breakdown below $16.50 would invalidate the trade. A close above the cloud and Kijun would trigger full bullish confirmation.

This is a textbook cloud bounce opportunity with strong trend-following potential.

The price has pulled back into the Ichimoku Cloud (Kumo), which often acts as dynamic support during an uptrend. The cloud is still bullish, with Senkou Span A above Span B, indicating the longer-term trend remains intact.

The Kijun-sen (Base Line) at around $18.50 is the next resistance. A daily close above that level would confirm a potential trend continuation. The Tenkan-sen (Conversion Line) is currently sloping downward but would turn up if price moves higher.

The Chikou Span (Lagging Line) is still above price candles, showing that overall momentum remains bullish.

MACD histogram is red but beginning to flatten, signaling bearish momentum may be slowing.

Trade setup:

Entry: $17.75 (current price in the cloud)

Stop: $16.50 (below Kumo base and S1 support)

Target: $22.67 (R1 and prior resistance)

Risk/Reward: 3.78

Setup remains valid as long as the price holds above the cloud. A breakdown below $16.50 would invalidate the trade. A close above the cloud and Kijun would trigger full bullish confirmation.

This is a textbook cloud bounce opportunity with strong trend-following potential.

Trade active

Trade closed: target reached

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.