🚨💰🌱 Soybeans vs. US Dollar Commodities CFD Heist Plan (Swing/Day) 🕶️⚡

👋 Dear Ladies & Gentlemen… and my fellow Thief OG’s 🐱👤💵,

Tonight’s grand heist is in the Soybeans Vault 🌱💰 vs. the Mighty Dollar 💵.

We move Bullish 📈 – the loot is ripe, and the guards are weak!

🎯 The Master Heist Plan

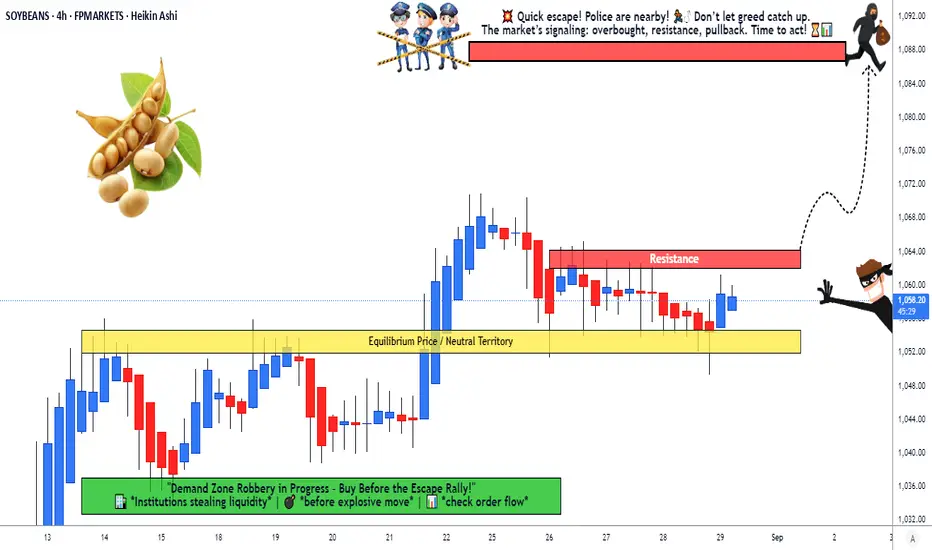

Entry (Breakout Trigger): ⚡ 1065.00

👉 Once the vault door cracks open at 1065, we sneak in with Thief Layer Entries 🕶️🔪:

1063.00

1060.00

1055.00

1052.00

(Keep layering your entries, thief-style… the deeper the pullback, the fatter the loot 💎💸).

Stop Loss (Thief Escape Plan): 🏃♂️💨

📍 The secret tunnel is at 1040.00.

But hey thieves, adjust your SL 🔑 based on your strategy & risk appetite.

Target (Police Barricade 🚔):

👉 1088.00 – That’s where the cops set up the roadblock, so escape with the bag before they catch you 🏆💰✈️.

🕶️ Thief Trading Wisdom

Multiple buy limit layered orders = professional thief entry strategy.

Always confirm the breakout before layering in.

Police (market makers) will try to trap you – stay one step ahead 🐱👤⚡.

🔥 Boost our Robbery Plan if you’re part of the crew 💣💵!

The more likes & views, the bigger the gang grows 🚀.

#ThiefTrading 🕶️ #SoybeansHeist 🌱💰 #CommodityLoot 💸 #SwingTradePlan ⚡ #DayTradeRobbery 🐱👤 #USDvsSoybeans 💵 #BreakoutStrategy 📈 #LayerEntry 🔑 #TradingViewHeist 🚔 #MarketLootPlan

👋 Dear Ladies & Gentlemen… and my fellow Thief OG’s 🐱👤💵,

Tonight’s grand heist is in the Soybeans Vault 🌱💰 vs. the Mighty Dollar 💵.

We move Bullish 📈 – the loot is ripe, and the guards are weak!

🎯 The Master Heist Plan

Entry (Breakout Trigger): ⚡ 1065.00

👉 Once the vault door cracks open at 1065, we sneak in with Thief Layer Entries 🕶️🔪:

1063.00

1060.00

1055.00

1052.00

(Keep layering your entries, thief-style… the deeper the pullback, the fatter the loot 💎💸).

Stop Loss (Thief Escape Plan): 🏃♂️💨

📍 The secret tunnel is at 1040.00.

But hey thieves, adjust your SL 🔑 based on your strategy & risk appetite.

Target (Police Barricade 🚔):

👉 1088.00 – That’s where the cops set up the roadblock, so escape with the bag before they catch you 🏆💰✈️.

🕶️ Thief Trading Wisdom

Multiple buy limit layered orders = professional thief entry strategy.

Always confirm the breakout before layering in.

Police (market makers) will try to trap you – stay one step ahead 🐱👤⚡.

🔥 Boost our Robbery Plan if you’re part of the crew 💣💵!

The more likes & views, the bigger the gang grows 🚀.

#ThiefTrading 🕶️ #SoybeansHeist 🌱💰 #CommodityLoot 💸 #SwingTradePlan ⚡ #DayTradeRobbery 🐱👤 #USDvsSoybeans 💵 #BreakoutStrategy 📈 #LayerEntry 🔑 #TradingViewHeist 🚔 #MarketLootPlan

Note

🎯 Real-Time Soybeans Data (02 Sept 2025)Current Price: $1,026.01 per bushel (USD) [🔻0.86% daily]

Monthly Performance: +5.88%

Yearly Performance: +2.96%

52-Week Range: $955.00 - $1,105.25

📊 Investor Sentiment Outlook

Retail Traders

Sentiment: Neutral to Cautiously Bearish

Key Drivers:

Focus on technical breakdowns and seasonal weakness.

Awaiting China demand signals and USDA updates.

Institutional Traders

Sentiment: Balanced (Waiting for Catalysts)

Managed money funds are neutral after exiting short positions in August.

Monitoring US harvest progress and Brazil’s upcoming harvest.

😨😊 Fear & Greed Index

Current Reading: 64/100 (Greed) [📈 Stock market momentum-driven]

Implication: Optimism in broader markets, but commodities like soybeans may face volatility due to macro risks.

🌍📉 Fundamental & Macro Score Points

Supply Factors

US Harvest: Bumper crop expected, limiting price gains.

Global Stocks: Record-high ending stocks (122.5M tons), led by Brazil’s production boost.

US Acreage: Reduced to 80.9M acres (down 2.5M from June estimate).

Demand Factors

China Import Uncertainty: No recent US purchases; relying on Brazil/Argentina.

Biofuel Policy: EPA biofuel exemptions may reduce soy-based fuel demand.

Export Sales: Down 50% YoY.

Macro Risks

US-China Trade Talks: Potential tariff reductions could boost sentiment.

Global Trade Tensions: Cooling tensions may support agricultural exports.

🐂🐻 Overall Market Outlook Score

Bullish (Long) Case:

Tightening US ending stocks (290M bushels, lowest in 3 years).

Potential trade deal catalyst if China resumes buying.

Bearish (Short) Case:

Ample global supply + Brazil’s record crop (175M tons).

Weak export demand and seasonal pressure.

✅ Net Outlook: Neutral to Slightly Bearish (Short-term caution until demand improves).

📌 Key Takeaways

Prices are pressured by oversupply but supported by low US stocks.

China’s demand is the make-or-break factor.

Watch for USDA reports and trade talk developments.

Institutional money is on sidelines—waiting for clarity.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.