Consumer Services (Hotel & Tourism Sector) : SPCSECSP : CSE

Fundamentals

* Q4 2025 results indicate weakening momentum in the sector in respect of topline growth.

* Combined YoY revenue growth for Q4 2025 of four biggest hotel operators listed in CSE AHUN, KHL, PALM & AHPL is just 1%

* Major 5 STAR city hotels (AHPL, TAJ, SERV) combined revenue had recorded a negative growth of more than 5% (dropped by > 5%) during Q4 2025 comparative to previous year

* CBSL data indicates USD Earnings per Arrival had dropped by 3.03% during April 2025 against 2024. This indicates deteriorating quality of arrivals.

* No visible global promotional campaign during last 6-8 months

* Country is entering the tourism off-season

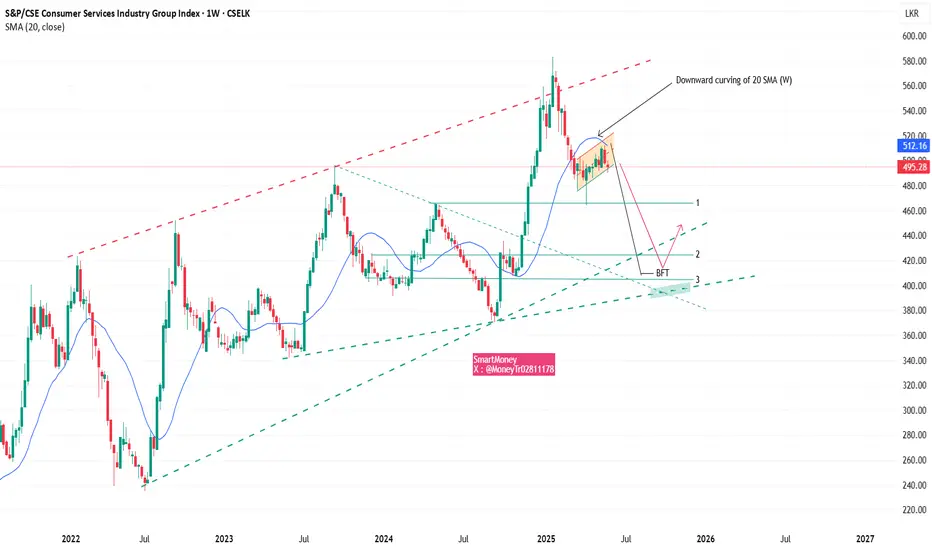

Technical Analysis (Chart Patterns)

* After dropping aggressively (17%) from recent top, SPCSECSP index is consolidating between 484-514 area creating a bear flag formation while CSE is in a bull run.

* If breaks down technical target would be 400-420 level (another 15-17% drop)

* Weekly 20 SMA is curling down

* Levels marked as 1,2,3 are support areas where investors can assess the developments for re-positioning. (levels 2/3 are strong support areas)

Strategy

Staying away from the sector and monitoring the progress/developments might be prudent while allocating capital for sectors with momentum/better growth

* If technical pattern discussed above, breaks down estimated time it will take to reach major support area coincides with the start of next tourism season (Sep/Oct), where investors can assess the situation for re-positioning.

Disclaimer

* NOT financial advice

* Investors should take their investment decisions based their own analysis

* Q4 2025 results indicate weakening momentum in the sector in respect of topline growth.

* Combined YoY revenue growth for Q4 2025 of four biggest hotel operators listed in CSE AHUN, KHL, PALM & AHPL is just 1%

* Major 5 STAR city hotels (AHPL, TAJ, SERV) combined revenue had recorded a negative growth of more than 5% (dropped by > 5%) during Q4 2025 comparative to previous year

* CBSL data indicates USD Earnings per Arrival had dropped by 3.03% during April 2025 against 2024. This indicates deteriorating quality of arrivals.

* No visible global promotional campaign during last 6-8 months

* Country is entering the tourism off-season

Technical Analysis (Chart Patterns)

* After dropping aggressively (17%) from recent top, SPCSECSP index is consolidating between 484-514 area creating a bear flag formation while CSE is in a bull run.

* If breaks down technical target would be 400-420 level (another 15-17% drop)

* Weekly 20 SMA is curling down

* Levels marked as 1,2,3 are support areas where investors can assess the developments for re-positioning. (levels 2/3 are strong support areas)

Strategy

Staying away from the sector and monitoring the progress/developments might be prudent while allocating capital for sectors with momentum/better growth

* If technical pattern discussed above, breaks down estimated time it will take to reach major support area coincides with the start of next tourism season (Sep/Oct), where investors can assess the situation for re-positioning.

Disclaimer

* NOT financial advice

* Investors should take their investment decisions based their own analysis

Trade active

Breaking down confirmedDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.