V2. US S&P Zones - PMI Manuf, USINTR, Inflation, DXY & QE

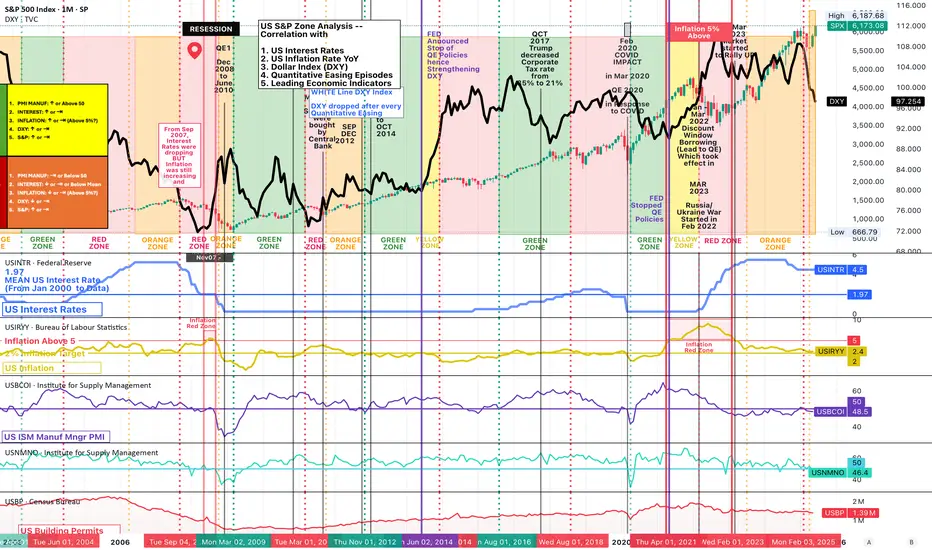

US S&P Zone Analysis -- Correlation with

1. Leading Economic Indicators (PMI Manufacturing Index, PMI Services Index, Building Permits)

2. US Interest Rates (MEAN 1.97 from Jan 2003)

3. US Inflation Rate YoY

4. Dollar Index (DXY)

5. Quantitative Easing Episodes

WHY CHANGE IN APPROACH?

As per Ammar Bhai, Red and other Zones for US and developed markets shall not follow only Interest Rates after 2000. Traditional single impact of Interest Rate is not Enough.

NOTE ABOUT INFLATION ABOVE 5%

It was also noticed that if inflation was about 5% that coincided with Red and Yellow zone and it must be avoided for stock trading.

NEW APPROACH

NEW GREEN ZONE

1. PMI Manuf Index is RISING or ABOVE 50

2. Interest Rates are FALLING or LEVELED or BELOW MEAN (Expansionary Policy in Effect)

3. Inflation is FALLING or AROUND TARGET

4. DXY is FALLING or SIDEWAYS

5. Stock Market RISING

NEW APPROACH for RED ZONE

1. PMI Manuf Index is FALLING or BELOW 50

2. Interest Rates are RISING or LEVELED or ABOVE MEAN (Contractionary Policy in Effect)

3. Inflation is RISING or SIDEWAYS. (Also Check if Inflation rate is above 5%)

4. DXY is RISING

5. Stock Market FALLING or SIDEWAYS

NEW YELLOW ZONE

1. PMI Manuf Index is RISING or ABOVE 50

2. Interest Rates are RISING or LEVELED

3. Inflation is RISING or SIDEWAYS (Also Check if Inflation rate is above 5%)

4. DXY is RISING or SIDEWAYS

5. Stock Market RISING or SIDEWAYS

NEW ORANGE ZONE

1. PMI Manuf Index is SIDEWAYS or BELOW 50

2. Interest Rates are FALLING or LEVELED or BELOW MEAN (Expansionary Policy in Effect)

3. Inflation is FALLING or SIDEWAYS (Also Check if Inflation rate is above 5%)

4. DXY is FALLING or SIDEWAYS

5. Stock Market RISING or SIDEWAYS

Historically whenever Interest Rates are dropping, US market goes down for some months:

US somehow try to control Inflation before bringing the interest rates down.

When Inflation is under control and Growth has not gone down much, then they decrease the interest rates

Because in past whenever Interest rates were decreased, growth also fell for some months and then improved.

Then FED does QE, which bring surplus cash in the market, Which drops Dollar rate, that helps the Stock Market grow.

US S&P Zone Analysis -- Correlation with

1. Leading Economic Indicators (PMI Manufacturing Index, PMI Services Index, Building Permits)

2. US Interest Rates (MEAN 1.97 from Jan 2003)

3. US Inflation Rate YoY

4. Dollar Index (DXY)

5. Quantitative Easing Episodes

WHY CHANGE IN APPROACH?

As per Ammar Bhai, Red and other Zones for US and developed markets shall not follow only Interest Rates after 2000. Traditional single impact of Interest Rate is not Enough.

NOTE ABOUT INFLATION ABOVE 5%

It was also noticed that if inflation was about 5% that coincided with Red and Yellow zone and it must be avoided for stock trading.

NEW APPROACH

NEW GREEN ZONE

1. PMI Manuf Index is RISING or ABOVE 50

2. Interest Rates are FALLING or LEVELED or BELOW MEAN (Expansionary Policy in Effect)

3. Inflation is FALLING or AROUND TARGET

4. DXY is FALLING or SIDEWAYS

5. Stock Market RISING

NEW APPROACH for RED ZONE

1. PMI Manuf Index is FALLING or BELOW 50

2. Interest Rates are RISING or LEVELED or ABOVE MEAN (Contractionary Policy in Effect)

3. Inflation is RISING or SIDEWAYS. (Also Check if Inflation rate is above 5%)

4. DXY is RISING

5. Stock Market FALLING or SIDEWAYS

NEW YELLOW ZONE

1. PMI Manuf Index is RISING or ABOVE 50

2. Interest Rates are RISING or LEVELED

3. Inflation is RISING or SIDEWAYS (Also Check if Inflation rate is above 5%)

4. DXY is RISING or SIDEWAYS

5. Stock Market RISING or SIDEWAYS

NEW ORANGE ZONE

1. PMI Manuf Index is SIDEWAYS or BELOW 50

2. Interest Rates are FALLING or LEVELED or BELOW MEAN (Expansionary Policy in Effect)

3. Inflation is FALLING or SIDEWAYS (Also Check if Inflation rate is above 5%)

4. DXY is FALLING or SIDEWAYS

5. Stock Market RISING or SIDEWAYS

Historically whenever Interest Rates are dropping, US market goes down for some months:

US somehow try to control Inflation before bringing the interest rates down.

When Inflation is under control and Growth has not gone down much, then they decrease the interest rates

Because in past whenever Interest rates were decreased, growth also fell for some months and then improved.

Then FED does QE, which bring surplus cash in the market, Which drops Dollar rate, that helps the Stock Market grow.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.