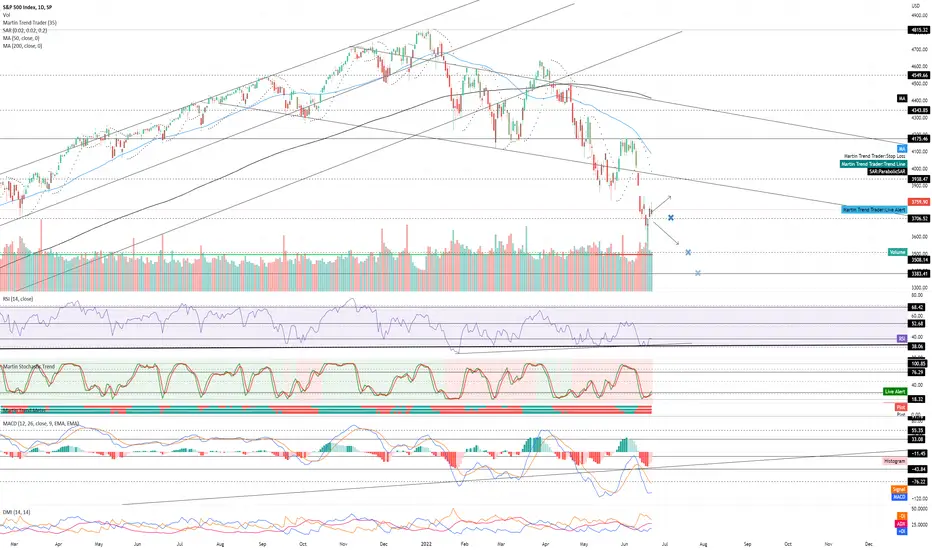

SPX Daily neutral with a bullish bias. Recommended ratio: 51% SPX, 49% Cash. *Fed Chair Jerome Powell testified before the Senate Banking Committee today and to no one's surprise reiterated the Fed's 'reaction function' (comprised of quantitative tightening and a higher federal funds rate (FFR)) working like it's supposed to. He mentioned that the market reacted appropriately by pricing in future rate hikes and repeated that the Fed will continue to move expeditiously (go beyond neutral) to bring Core PCE inflation down from ~5% to their target of 2%; according to Powell beyond neutral is beyond 2.5% FFR, the current FFR target rate is 1.5%-1.75%. With direct endorsement from Powell, the crypto and equity markets are correct in thinking FFR will be at or above 3.5% EOY (75bp July to 2.5%, 50-75bp September to 3%-3.25%, 25-50bp October to 3.25%-3.75%, 25-50bp to 3.5%-4.00%); obviously certain events can expedite or delay this but it seems like markets are beginning to price in the reality of a recession. It is important to remember that by the time the economy recognizes that it is in a recession, financial markets will already be pricing in the road to recovery. In other words, the economy is usually last to feel a recession. That said, it's still to premature to call a bottom (Jim Cramer hasn't told us to sell everything yet) but we could perhaps be in store for a short term rally. PMI report will be released tomorrow at 945am (EST) and Core PCE Inflation report will be released 06/30 at 830am (EST).* Price is currently trending sideways at $3759 after closing above $3706.52 minor support for a second consecutive session. Volume remained Moderate and has favored buyers for three consecutive sessions now. Parabolic SAR flips bullish at $3983, this margin is mildly bullish. RSI is currently trending sideways at 38.06 resistance as it attempts to flip it to support. Stochastic remained bullish for a second consecutive session and is currently testing 18.32 resistance. MACD remains bearish and is currently trending sideways at -105 as it continues to form a trough; it would need to break above -81 in order to cross over bullish. ADX is currently trending sideways at 27 as Price continues to decide whether to bounce here at $3706.52 minor support or go down lower, this is neutral at the moment. If Price is able to continue up from here then it will likely retest the lower trendline of the descending channel from August 2021 at ~$3900 as resistance. However, if Price breaks down below $3706.52 minor support, it will likely retest $3508.14 minor support for the first time since November 2020. Mental Stop Loss: (one close below) $3706.52.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.