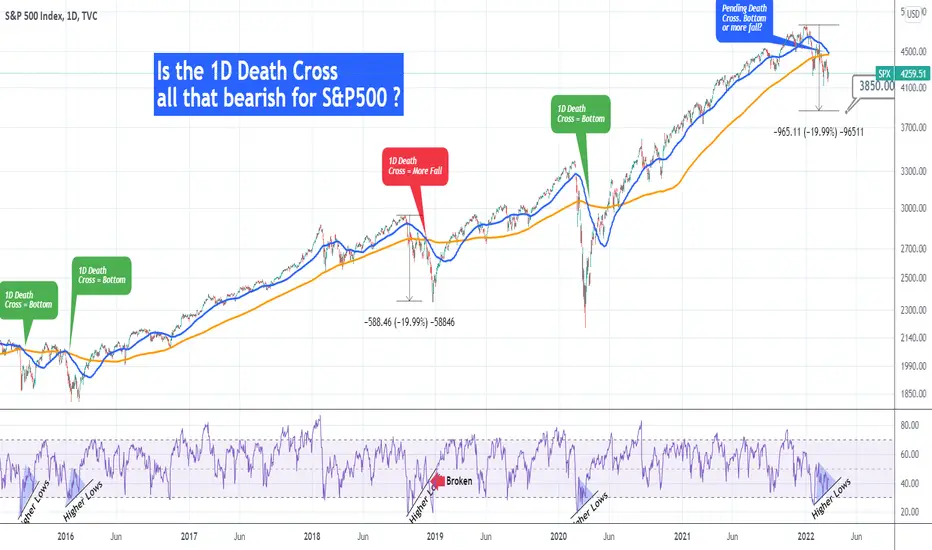

The S&P500 index is ahead of a Death Cross on the 1D time-frame that can't be avoided. This is technically a very bearish formation, which is formed after a series of selling and suggests that more is coming. Reality though may be different some times, especially in the stock markets, so let's see how this signal has traded historically.

As you see on this 1D chart, since 2015, there have been four Death Cross formations. Three took place on or after the index has formed a bottom and only once (December 03 2018), did the price broke (much) lower to form the bottom. What is common in all occurrences and may help at identifying if the current Death Cross has formed a bottom or will break lower, is the RSI indicator. When the RSI respects its Higher Lows (bullish divergence with the price that is currently on Lower Lows), then the bottom is in. On December 14 2018, that trend-line broke and that was when SPX collapsed to a new Low. Interestingly enough, during that correction, the price dipped to -20%, a repeat of that would place the current bottom around 3850.

We can even go further back with the chart below, after the 2008 subprime mortgage crash, to see that the 1D Death Crosses of July 2010 and August 2011, also marked the bottom (slight lower low in 2011 but is negligible), instead of a fall to a new Low.

So to sum it up, the 1D RSI is so far holding its Higher Lows trend-line. That is an early indication that the bottom will be in when the Death Cross forms, probably by early next week. Are you buying already or waiting to see if the RSI Higher Lows break first? Let me know in the comments section below!

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

As you see on this 1D chart, since 2015, there have been four Death Cross formations. Three took place on or after the index has formed a bottom and only once (December 03 2018), did the price broke (much) lower to form the bottom. What is common in all occurrences and may help at identifying if the current Death Cross has formed a bottom or will break lower, is the RSI indicator. When the RSI respects its Higher Lows (bullish divergence with the price that is currently on Lower Lows), then the bottom is in. On December 14 2018, that trend-line broke and that was when SPX collapsed to a new Low. Interestingly enough, during that correction, the price dipped to -20%, a repeat of that would place the current bottom around 3850.

We can even go further back with the chart below, after the 2008 subprime mortgage crash, to see that the 1D Death Crosses of July 2010 and August 2011, also marked the bottom (slight lower low in 2011 but is negligible), instead of a fall to a new Low.

So to sum it up, the 1D RSI is so far holding its Higher Lows trend-line. That is an early indication that the bottom will be in when the Death Cross forms, probably by early next week. Are you buying already or waiting to see if the RSI Higher Lows break first? Let me know in the comments section below!

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.