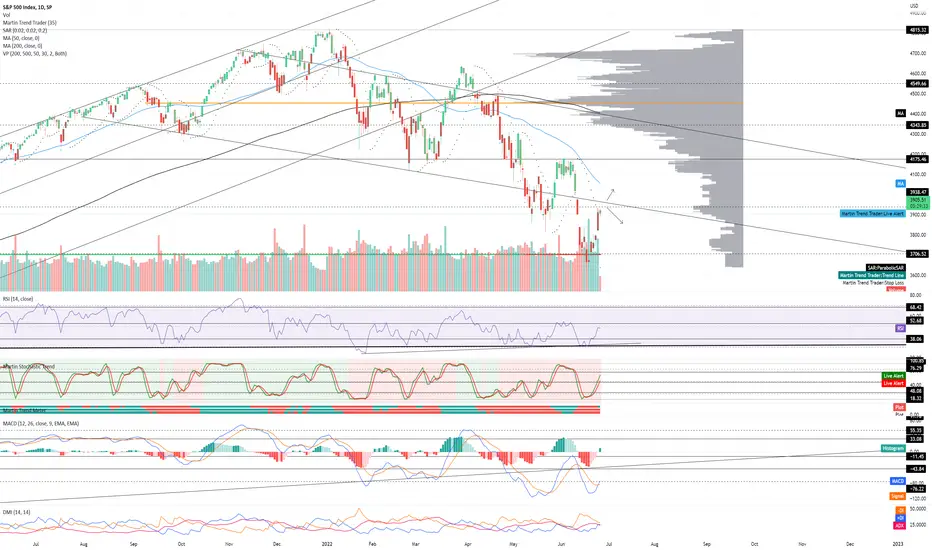

SPX Daily TA neutral with a bullish bias. Recommended ratio: 55% SPX, 45% Cash. *Equities, crypto, USD, gold all are getting off to a rough start this session while treasuries and energy started the week off with a boost. Global inflation numbers are continuing to print higher, Russia defaulted on their foreign debt for the first time since 1918 because many developed countries are not accepting the Russian Ruble, NATO is increasing military high-ready support forces for Ukraine to 300k, and 3AC has defaulted on a $670m loan from Voyager Digital. Key dates this week: 3rd Q1 GDP estimate due 830am (EST) on 06/29 and Core PCE Price Index report due at 12:30 (EST) on 06/30.* Price is currently testing $3938 minor resistance which coincides with the lower trendline of the descending channel from August 2021. Volume is currently Moderate (low) and on track to break a five day streak of buyers dominance if it can close today's session in the red. Parabolic SAR flips bearish at $3637, this margin is mildly bearish. RSI is currently trending sideways at 48 as Price is encountering a critical resistance at this level; the next RSI resistance is at 52.68. Stochastic remains bullish and is currently trending up at 68 (after blowing past 48.08 resistance) as it approaches a test of 76.29 resistance. MACD remains bullish for a second consecutive session and is currently testing -76.22 resistance, if it breaks above this level then the next resistance is at -43.84. ADX is currently trending down at 24 as Price continues pushing up, this is mildly bullish. If Price is able to break above $3938 minor resistance and reclaim support at the lower trendline of the descending channel from August 2021 (~$3960), then it will likely retest $4175 resistance. However, if Price is rejected here at this critical resistance, it will likely retest $3706.52 minor support before potentially heading lower. Mental Stop Loss: (one close below) $3800.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.