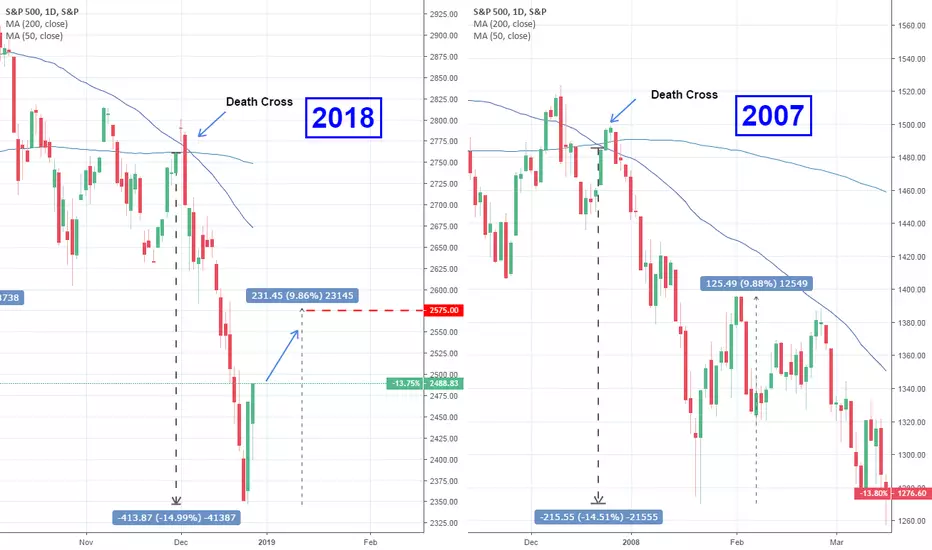

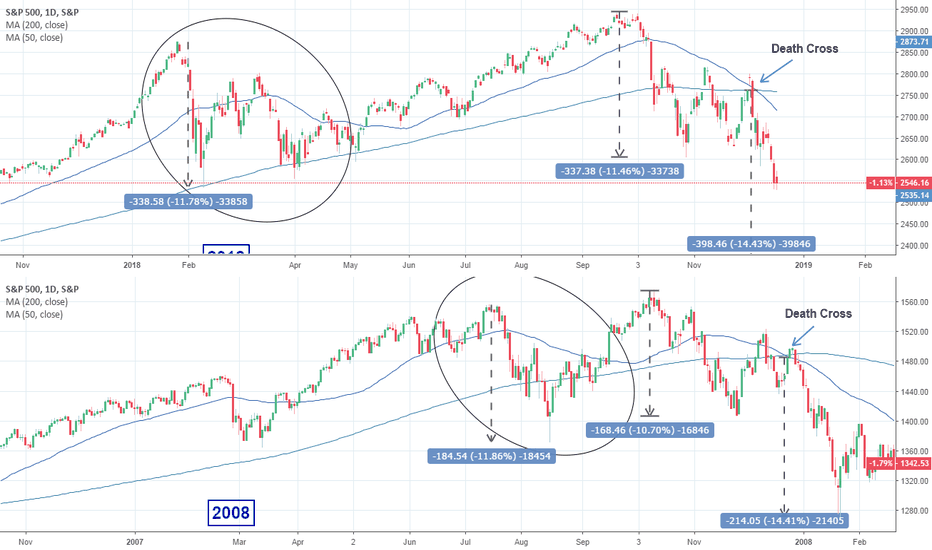

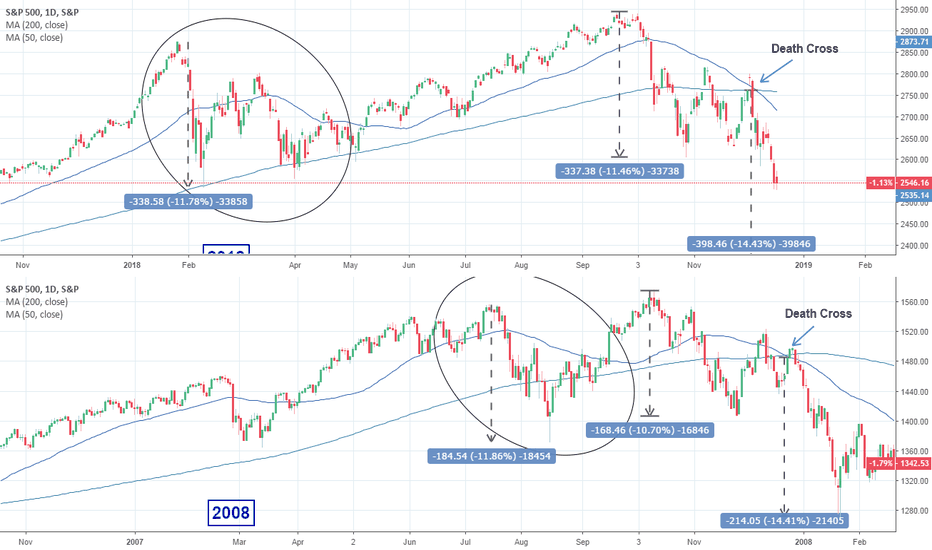

Since the last update and comparison made on the similarities of S&P's candle sequences between the 2007 and 2018 Death Cross patterns, the index followed exactly the 2007 pattern, as it completed a nearly -15% decline and then rebounded. Based on the 2007 pattern this rebound shouldn't exceed +10% and our estimates put it around 2,575. This can be described as a "Dead Cat Bounce" and in 2007 it was what led economy into the 2008 recession. The new lows on the index should be expected in about 2 months.

** If you like our free content follow our profile (tradingview.com/u/InvestingScope) to get more daily ideas. **

Comments and likes are greatly appreciated.

** If you like our free content follow our profile (tradingview.com/u/InvestingScope) to get more daily ideas. **

Comments and likes are greatly appreciated.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.