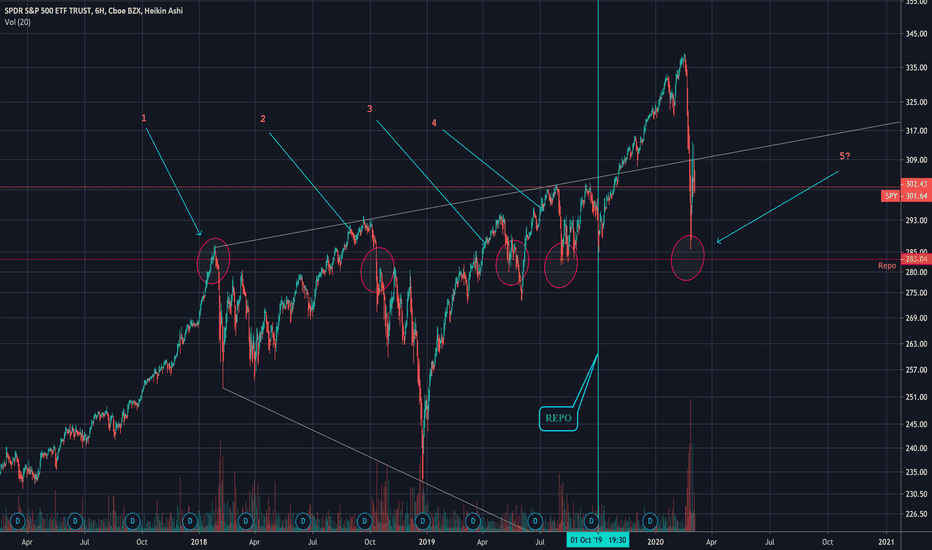

Analysis Method: Fibonacci & Wave Theory

Please see previous analyses for further information.

This is a continuation of the SP500 analysis that was started July, 2018.

SPY has completed a 5 Wave Super-Cycle (143 years) and is now in a correction phase.

An 'Irregular Correction' is when the B Wave exceeds the Terminal 5th Wave.

It is my opinion, the Private Federal Reserve is running out of monetary 'ammo'. The private bank can no longer raise interest rates and is now being forced to cut rates in an objectively 'good economy'.

All gains can directly be correlated to the Private Federal Reserve's monetary injections.

The Hedge: Cryptocurrency

Analysis Method: Wave Theory & Fibonacci

143 Year Super-Cycle:

Wave Theory Rule: 2/3 Impulse Waves will near equality

Irregular Correction are most often observed after a Wave Cycle with a Double Extension

Waves 3 & 5 both extended.

Will update.

FMW

Note

I believe we are seeing the end of the 'B Wave'.Note

Extending Wave 1 (Hourly)Note

$2829 is a key level...Note

If $2829 breaks look to $2768...Note

If 2829 holds, look for a correction sequence.Note

Based on the price-action, it looks like we will break 2829.Note

Flat Corrections usually terminate around 100% & 123.6% Level respectively...Note

Above: Daily ChartNote

Above: 3 Minute Wave CountNote

Above: Sub-Micro SequenceNote

Sub-Micro Retrace LevelsNote

Double Flat CorrectionNote

No real support here unless the Private Fed can pump...Note

New Wave Sequence should be forming now...Note

Could be another big down day...We will find out soon...

Note

Watch the futures...Note

Headline: STOCKS SURGE ON BETS CENTRAL BANKS TAKE ACTIONto fight a biological virus...

Note

Price-action is Trapped in the 'Ending Diagonal'Note

(Bloomberg) -- U.S. stocks surged as investors gained confidence that stewards of the world’s largest economies would act in concert to offset any impact from the spreading coronavirus.Note

The S&P 500 jumped more than 3%, the most in a year, after news that Group of Seven finance ministers and central bankers will hold a teleconference Tuesday to discuss how to respond to the outbreak. Tech shares led gains after seven straight days of declines for the benchmark index, with monetary policy makers from Japan to England joining the Federal Reserve in promising to take action to support their economies if needed.Note

In other words...'Lets Accelerate the Destruction of Value in our Currency'Note

While Interest Rates plummet...Note

Should be beginning a new wave sequence down...Note

We are about to drop...Note

Target: $303-$301Note

If $301 breaks look to $298...Note

We should be turning extremely hard....Note

Looking for a Minor Wave 3 to begin...Note

We got the turn I was looking for...Note

$3,031 is a Key Level.Note

If $3,031 breaks look to...Note

$3,012Note

Then $2098.50Note

*Correction $2928Note

5 Minute Count (Above)Note

Moving Averages:EMA 33 Green

EMA 50 Yellow

Note

EMA 300 RedNote

Estimate Micro-Wave 3 Target Area: $2980-$2928.50Timeframe: <7 Hours

Note

Fed Suicide Watch...Interest Rates going to Zero...

Note

Fed credibility gone...Note

Going to create new Hourly thread.Note

Should be picking up momentum to the downside...Note

Immediate Target: $2984.25 - $2923.75Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.