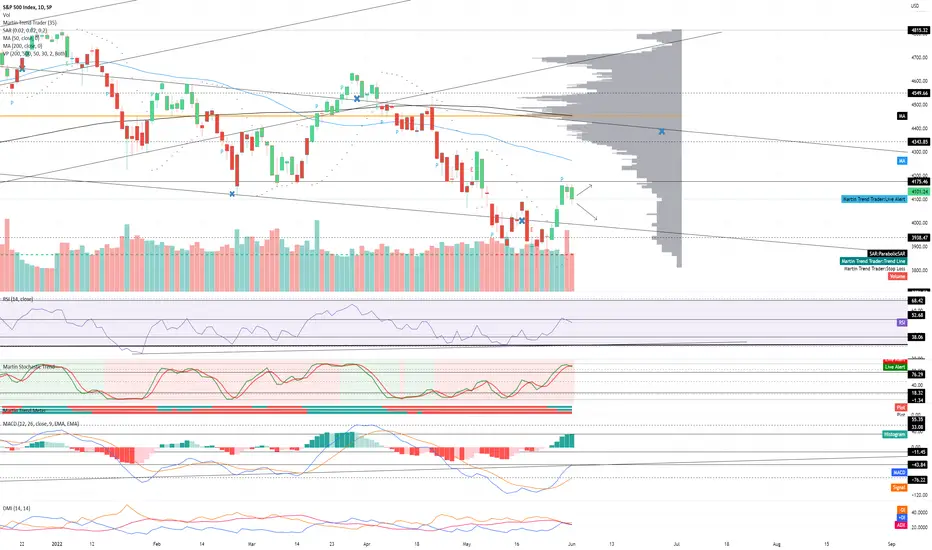

SPX/USD Daily neutral with a bearish bias. *Janet, Jerome and Joe all got together yesterday and it's fair to say they all agree they want more pain before more gain ("do anything it takes to bring down inflation"), and they want it mainly to be done through monetary policy (Fed). Fed also started rolling off TS and MBS today.* Recommended ratio: 40% SPX, 60% Cash. Price is currently trending down at $4100 after being rejected by $4175 resistance on the first test. Volume remains moderate and is on track to favor sellers for two consecutive sessions. Parabolic SAR flips bearish at $3869, this margin is neutral at the moment. RSI is currently trending down at 50.24 after getting rejected on a retest of 52.68 resistance. Stochastic is currently crossing over bearish at 91. MACD is currently testing the uptrend line from March 2020 at -44 after breaking out above -76.22 minor resistance. ADX is currently trending down at 23 as Price is attempting to continue rallying, this is mildly bullish at the moment. If Price is able to bounce here then it will likely retest $4175 resistance before attempting to test the upper trendline of the descending channel from November 2021 at ~$4400. However, if Price continues to break down here then it will likely retest the lower trendline of the descending channel at $4000 before potentially falling lower. Mental Stop Loss: (two consecutive closes above) $4175.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.