It’s not the Fed.

My perspective is Chairman Powell has been fairly clear in his updates to the markets. The markets simply don’t want to hear any of it.

It’s not bonds, or interest rates.

Those are trackable and I have posted on the 2yr and 10yr bond yields. Yields are creeping higher and have done so since the October lows.

It’s also not corporate earnings.

If NVDA couldn’t save the Nasdaq…then all hope is lost. Well…not all. Lol

Nope, it’s none of that.

It’s the potential for a government shutdown with an October 1st deadline. Is that going to be our catalyst? In truth, I don’t know. But according to CNBC, since the United States is in a Presidential election year, the stock market can’t go down. Have I mentioned CNBC is more detrimental to trading for profit than anything.

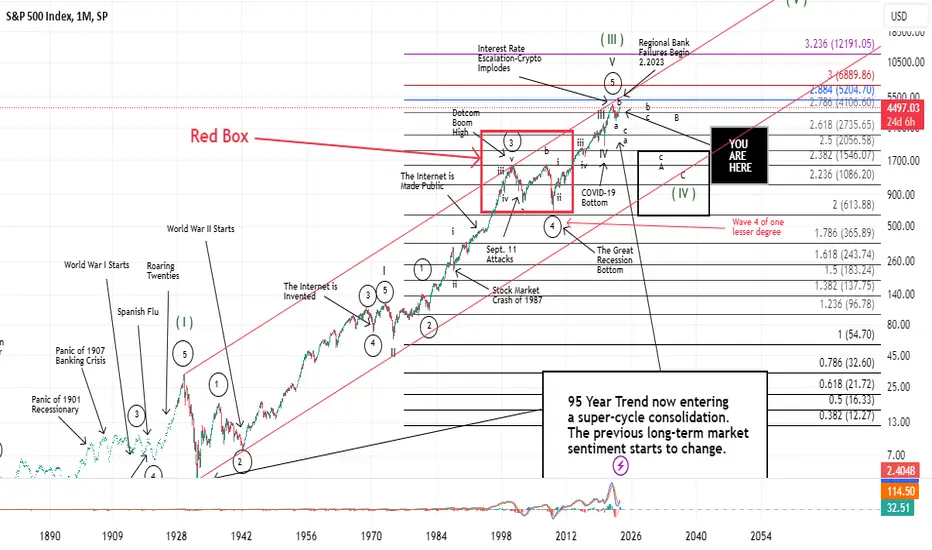

I have long contested that the US markets are in a multi-generation reversion to mean cycle. In EWT terms…a super-cycle wave IV. These excuses mentioned above, are all the old paradigms of a 100-year-old bull market which carved out our super-cycle advance in what I am forecasting as a super-cycle wave III top that occurred in January 2022. If my analysis is correct, (and it is by no means a slam dunk as to where we are right now in the indices)…the January 2022 highs will NOT be revisited for a long, long time.

In the short term, let's see if the US Congress proves Fitch's downgrade of US Debt was warranted.

Best to all,

Chris

My perspective is Chairman Powell has been fairly clear in his updates to the markets. The markets simply don’t want to hear any of it.

It’s not bonds, or interest rates.

Those are trackable and I have posted on the 2yr and 10yr bond yields. Yields are creeping higher and have done so since the October lows.

It’s also not corporate earnings.

If NVDA couldn’t save the Nasdaq…then all hope is lost. Well…not all. Lol

Nope, it’s none of that.

It’s the potential for a government shutdown with an October 1st deadline. Is that going to be our catalyst? In truth, I don’t know. But according to CNBC, since the United States is in a Presidential election year, the stock market can’t go down. Have I mentioned CNBC is more detrimental to trading for profit than anything.

I have long contested that the US markets are in a multi-generation reversion to mean cycle. In EWT terms…a super-cycle wave IV. These excuses mentioned above, are all the old paradigms of a 100-year-old bull market which carved out our super-cycle advance in what I am forecasting as a super-cycle wave III top that occurred in January 2022. If my analysis is correct, (and it is by no means a slam dunk as to where we are right now in the indices)…the January 2022 highs will NOT be revisited for a long, long time.

In the short term, let's see if the US Congress proves Fitch's downgrade of US Debt was warranted.

Best to all,

Chris

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.