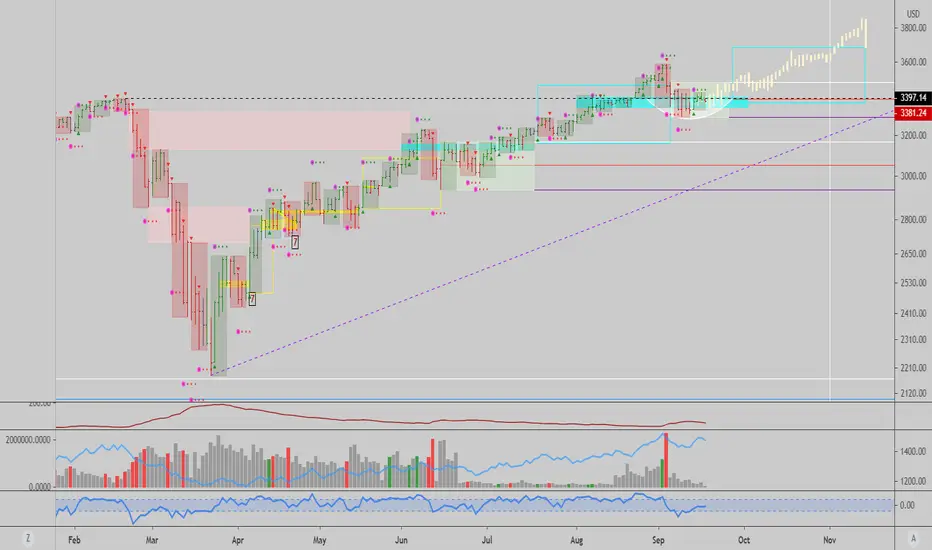

A new weekly signal can trigger by the week starting Sep 28th, and we have many short term charts in certain tech stocks showing bearish signals, while a lot of other stocks -energy, travel, hotels, to name a few- have bullish signals, so a sideways index here would not be too crazy.

Once we confirm a new bullish signal we could project a rally over 3684, at least, provided we get bullish confirmation next.

I'm holding both bullish and bearish positions in individual stocks, as well as some insurance using derivatives as well, but should we get a bullish swing once again, the bullish signals will far outweigh any potential loss I might have to deal with from bearish setups. That's the beauty of stock picking, many times you can find good trades that might not correlate the index at all times, or even afford the luxury of trading both long and short positions in different stocks.

Stimulus talks need to progress for the rally to continue, so I will be keeping an eye on those developments going forward.

Best of luck!

Ivan Labrie.

Note

Bouncing, this area should be support before we get the next trending move. (see the light green shaded area).

If we get a strong break of this zone, then support is breaking and we are in fact seeing the start of a big decline. This is why it is wise to trade both long and short ideas, and perhaps use VIXY options as low cost insurance.

Note

twitter.com/Spus/status/1307031483882840066?s=20Keep in mind this, aligns with my idea of sideways for one more week before rallying. Today's options expiration caused massive gyrations in different directions in different stocks. Indices were dragged down due to tech sliding but bounced into the close after testing the lower boundary of the support area. If we hold and grind higher sideways, we will fulfill his forecast over time.

Trade closed manually

It looks like support broke, currencies are in the move as well, and 🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.