Published: June 3, 2025

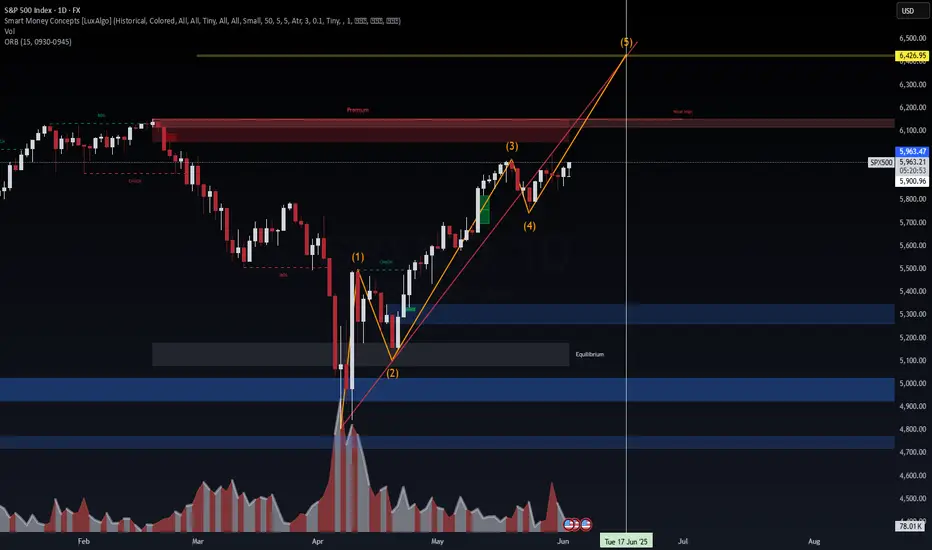

🔍 Chart Breakdown (Daily | LuxAlgo + EW + SMC)

Structure Summary:

🔶 Wave Count: Completing Wave (5), with price nearing exhaustion

🔴 Weak High Zone: ~6,100–6,200 = liquidity magnet

🟥 Premium Zone: Between current price and 6,426

🟦 Equilibrium Zone: ~4,950–5,150

🟩 Discount Zone: ~4,150 = long re-entry or cycle bottom if correction occurs

📅 Key Timing Line: June 17, 2025 = potential reversal date (time-based confluence)

Volume Analysis:

🔊 Volume spikes at Wave 2 and Wave 4 suggest reactive participation

📉 Lower volume into recent highs suggests distribution, not accumulation

🔁 Multi-Timeframe Outlook

Timeframe Direction Probability Rationale

Intraday (15M) Bearish 60% Weak high rejection, premium zone swept, liquidity-based reversal

Swing (2–3 weeks) Bullish → Bearish 70% to 6,420 → then reversal Wave 5 completion into supply zone, followed by corrective ABC

Macro (Q3–Q4 2025) Bearish 80% Likely mean reversion toward equilibrium (5,000) or discount (4,200)

📊 Key Price Zones to Watch

Level Label Strategy

6,426 🎯 Wave 5 Target Look for exhaustion, divergence, or liquidity sweep

6,150–6,200 🟥 Weak High / Premium Possible fake-out zone or reversal trigger

5,900 🔵 Short-term support Likely retest zone on first rejection

5,150–4,950 ⚖️ Equilibrium Mid-cycle mean reversion target

4,150 🟩 Discount/Strong Low Long reload zone if correction deepens

⚠️ Risk Considerations

Macro Data Watchlist: June 12 CPI + June 17 FOMC = macro catalysts for Wave 5 peak

Invalidation: If price holds above 6,450 after June 17, EW count must be adjusted

Alternative Count: Parabolic Wave 5 extensions can overshoot — be cautious shorting early

🔍 Chart Breakdown (Daily | LuxAlgo + EW + SMC)

Structure Summary:

🔶 Wave Count: Completing Wave (5), with price nearing exhaustion

🔴 Weak High Zone: ~6,100–6,200 = liquidity magnet

🟥 Premium Zone: Between current price and 6,426

🟦 Equilibrium Zone: ~4,950–5,150

🟩 Discount Zone: ~4,150 = long re-entry or cycle bottom if correction occurs

📅 Key Timing Line: June 17, 2025 = potential reversal date (time-based confluence)

Volume Analysis:

🔊 Volume spikes at Wave 2 and Wave 4 suggest reactive participation

📉 Lower volume into recent highs suggests distribution, not accumulation

🔁 Multi-Timeframe Outlook

Timeframe Direction Probability Rationale

Intraday (15M) Bearish 60% Weak high rejection, premium zone swept, liquidity-based reversal

Swing (2–3 weeks) Bullish → Bearish 70% to 6,420 → then reversal Wave 5 completion into supply zone, followed by corrective ABC

Macro (Q3–Q4 2025) Bearish 80% Likely mean reversion toward equilibrium (5,000) or discount (4,200)

📊 Key Price Zones to Watch

Level Label Strategy

6,426 🎯 Wave 5 Target Look for exhaustion, divergence, or liquidity sweep

6,150–6,200 🟥 Weak High / Premium Possible fake-out zone or reversal trigger

5,900 🔵 Short-term support Likely retest zone on first rejection

5,150–4,950 ⚖️ Equilibrium Mid-cycle mean reversion target

4,150 🟩 Discount/Strong Low Long reload zone if correction deepens

⚠️ Risk Considerations

Macro Data Watchlist: June 12 CPI + June 17 FOMC = macro catalysts for Wave 5 peak

Invalidation: If price holds above 6,450 after June 17, EW count must be adjusted

Alternative Count: Parabolic Wave 5 extensions can overshoot — be cautious shorting early

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.