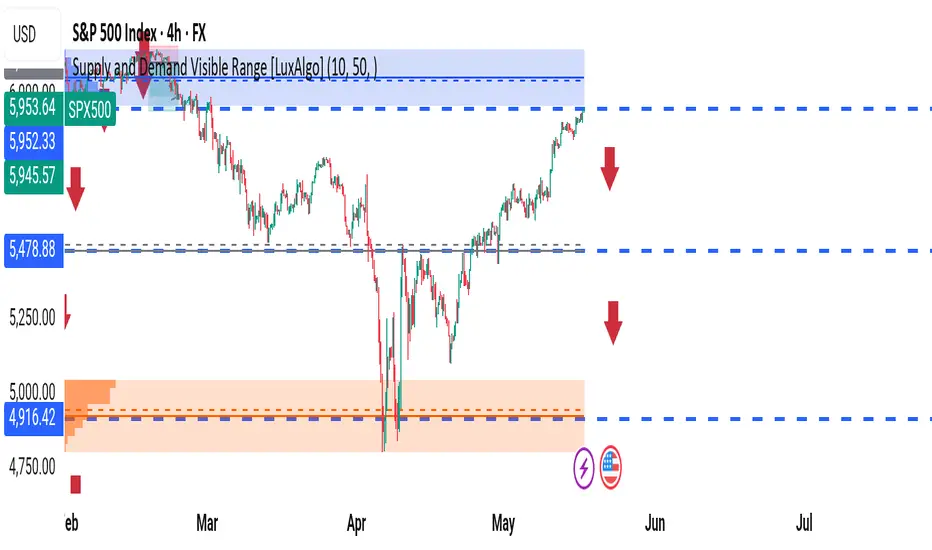

The S&P 500 (SPX500) just tapped a significant supply zone between 5945–5952, a key level where previous selling pressure led to strong bearish moves. Price is currently showing signs of exhaustion at the top of this zone on the 4H timeframe, and we may be witnessing a potential reversal setup.

Key Levels:

Supply Zone (Resistance): 5945 – 5952

Mid-Support: 5478

Demand Zone (Strong Support): 4916 – 4920

Possible Scenarios:

1. Rejection from the supply zone could trigger a pullback to 5478, and if that breaks, the next bearish target would be the demand zone at 4916.

2. If the bulls break and close above 5952 with strong momentum, we might see new highs, but volume confirmation is needed.

Watch for:

Bearish candlestick patterns in the supply zone

Reversal confirmation with RSI or MACD divergence

Volume drop on the breakout attempt

Red Arrows Mark: High-probability downside targets in case of reversal.

With key economic events marked on the chart (highlighted on May 22), volatility is expected. A fakeout or whipsaw move could be in play—stay cautious!

Are you bullish or bearish on SPX500? Drop your thoughts below and don’t forget to like and follow for more institutional-level analysis!

#SPX500 #S&P500 #LuxAlgo #SupplyDemand #TradingView #Forex #Stocks #PriceAction #SmartMoney #TechnicalAnalysis #SP500Analysis

Key Levels:

Supply Zone (Resistance): 5945 – 5952

Mid-Support: 5478

Demand Zone (Strong Support): 4916 – 4920

Possible Scenarios:

1. Rejection from the supply zone could trigger a pullback to 5478, and if that breaks, the next bearish target would be the demand zone at 4916.

2. If the bulls break and close above 5952 with strong momentum, we might see new highs, but volume confirmation is needed.

Watch for:

Bearish candlestick patterns in the supply zone

Reversal confirmation with RSI or MACD divergence

Volume drop on the breakout attempt

Red Arrows Mark: High-probability downside targets in case of reversal.

With key economic events marked on the chart (highlighted on May 22), volatility is expected. A fakeout or whipsaw move could be in play—stay cautious!

Are you bullish or bearish on SPX500? Drop your thoughts below and don’t forget to like and follow for more institutional-level analysis!

#SPX500 #S&P500 #LuxAlgo #SupplyDemand #TradingView #Forex #Stocks #PriceAction #SmartMoney #TechnicalAnalysis #SP500Analysis

✅JOIN FREE SIGNALS t.me/frankfxforextrade

✅FOR VIP DM: t.me/frankfx22

✅ AUTOMATED BOT: bot.frankfxx.com/

✅ICMARKETS frankfxx.com/icmarkets

✅ EXNESS frankfxx.com/exness

✅ XM frankfxx.com/xm

✅FOR VIP DM: t.me/frankfx22

✅ AUTOMATED BOT: bot.frankfxx.com/

✅ICMARKETS frankfxx.com/icmarkets

✅ EXNESS frankfxx.com/exness

✅ XM frankfxx.com/xm

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅JOIN FREE SIGNALS t.me/frankfxforextrade

✅FOR VIP DM: t.me/frankfx22

✅ AUTOMATED BOT: bot.frankfxx.com/

✅ICMARKETS frankfxx.com/icmarkets

✅ EXNESS frankfxx.com/exness

✅ XM frankfxx.com/xm

✅FOR VIP DM: t.me/frankfx22

✅ AUTOMATED BOT: bot.frankfxx.com/

✅ICMARKETS frankfxx.com/icmarkets

✅ EXNESS frankfxx.com/exness

✅ XM frankfxx.com/xm

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.