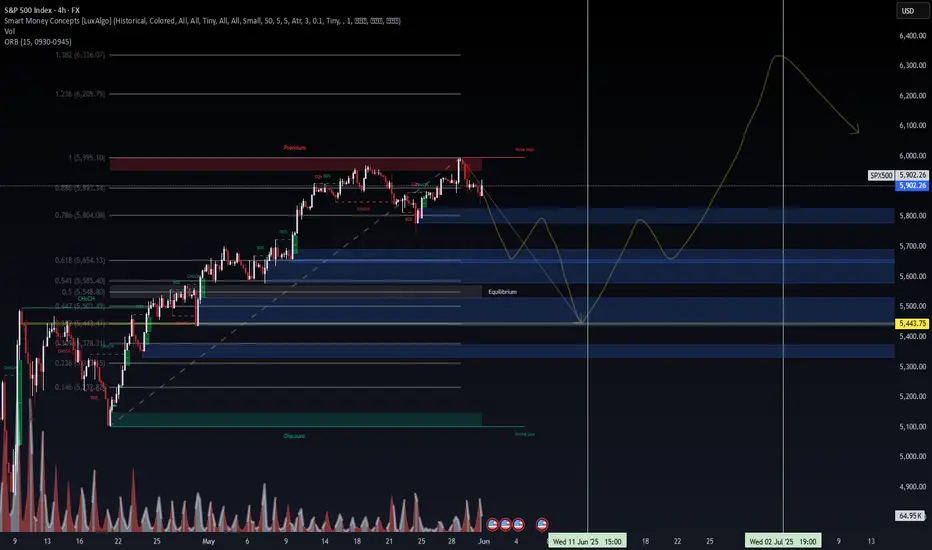

📅 Chart Timestamp: May 31, 2025 – 4H Timeframe

📈 Current Price: 5,902.26

📊 Volume (Recent Candle): 64.95K

🧠 Technical Breakdown

🔺 Premium Zone Rejection

Price has sharply rejected the 5,995–6,050 area — a key premium supply zone aligned with the Fibonacci 1.0–1.236 extension.

This rejection occurred after a weak internal high was formed, showing signs of exhaustion and liquidity grab behavior.

📉 Market Structure

Multiple Break of Structure (BOS) and Change of Character (CHoCH) confirm a short-term bearish market structure.

Price has begun forming lower highs and is now in a distribution phase.

📏 Key Fibonacci & Smart Money Levels

0.786 Fib Retracement (5,804) → Recently tested; acted as a short-term support but broken.

Equilibrium Zone (5,443.75) → Critical price magnet. Price is projected to gravitate toward this zone as part of a liquidity sweep and reaccumulation.

Discount Zone (below 5,300) → Stronger support if equilibrium fails. Could serve as a long-term buying opportunity.

🌀 Expected Price Path (Yellow Projection)

Short-term downside continuation into 5,560–5,440.

Likely to form a double-bottom or mitigation structure at equilibrium.

Reversal potential targeting 6,200–6,300 (1.236–1.382 extension) before next macro correction.

📈 Probability Framework

Scenario Description Probability Rationale

📉 Pullback to Equilibrium Price revisits 5,443.75 75% Confluence of Smart Money FVGs + Fib levels + BOS indicates liquidity resting below

🔁 Reaccumulation at EQ Reversal from 5,440–5,500 65% Price often reacts to equilibrium in a bullish uptrend continuation

📈 Rally to 6,200+ Price takes out weak highs and extends 50% Depends on macro sentiment improving + liquidity expansion

🧨 Break below EQ into Discount Price collapses toward 5,300 30% Only if macro deterioration accelerates (Fed surprise, global contagion)

🧠 Macro Risk & Fundamental Context (as of May 31, 2025)

🏦 Federal Reserve

Market is pricing in no rate cut in June, but increased odds (65–70%) of a cut in July.

Sticky inflation + slowing job growth creates an uncertain macro narrative.

💵 Liquidity & Risk Sentiment

Bond market volatility (MOVE Index) remains elevated → signaling stress in interest rate pricing.

VIX is stable near 12–14 range → complacency risk if volatility spikes.

Global liquidity has tightened in EMs due to dollar strength, though US equities remain buoyed by AI & tech.

📉 Earnings + Breadth

Earnings season was mixed; top-heavy performance (few stocks driving index).

Weak market breadth suggests a correction is healthy or overdue.

⚠️ Risk Factors to Monitor

Surprise Fed policy pivot (hawkish).

Geopolitical escalations (Middle East, Taiwan).

Sudden rise in VIX or credit spreads.

Bearish divergence between index and market breadth indicators.

📈 Current Price: 5,902.26

📊 Volume (Recent Candle): 64.95K

🧠 Technical Breakdown

🔺 Premium Zone Rejection

Price has sharply rejected the 5,995–6,050 area — a key premium supply zone aligned with the Fibonacci 1.0–1.236 extension.

This rejection occurred after a weak internal high was formed, showing signs of exhaustion and liquidity grab behavior.

📉 Market Structure

Multiple Break of Structure (BOS) and Change of Character (CHoCH) confirm a short-term bearish market structure.

Price has begun forming lower highs and is now in a distribution phase.

📏 Key Fibonacci & Smart Money Levels

0.786 Fib Retracement (5,804) → Recently tested; acted as a short-term support but broken.

Equilibrium Zone (5,443.75) → Critical price magnet. Price is projected to gravitate toward this zone as part of a liquidity sweep and reaccumulation.

Discount Zone (below 5,300) → Stronger support if equilibrium fails. Could serve as a long-term buying opportunity.

🌀 Expected Price Path (Yellow Projection)

Short-term downside continuation into 5,560–5,440.

Likely to form a double-bottom or mitigation structure at equilibrium.

Reversal potential targeting 6,200–6,300 (1.236–1.382 extension) before next macro correction.

📈 Probability Framework

Scenario Description Probability Rationale

📉 Pullback to Equilibrium Price revisits 5,443.75 75% Confluence of Smart Money FVGs + Fib levels + BOS indicates liquidity resting below

🔁 Reaccumulation at EQ Reversal from 5,440–5,500 65% Price often reacts to equilibrium in a bullish uptrend continuation

📈 Rally to 6,200+ Price takes out weak highs and extends 50% Depends on macro sentiment improving + liquidity expansion

🧨 Break below EQ into Discount Price collapses toward 5,300 30% Only if macro deterioration accelerates (Fed surprise, global contagion)

🧠 Macro Risk & Fundamental Context (as of May 31, 2025)

🏦 Federal Reserve

Market is pricing in no rate cut in June, but increased odds (65–70%) of a cut in July.

Sticky inflation + slowing job growth creates an uncertain macro narrative.

💵 Liquidity & Risk Sentiment

Bond market volatility (MOVE Index) remains elevated → signaling stress in interest rate pricing.

VIX is stable near 12–14 range → complacency risk if volatility spikes.

Global liquidity has tightened in EMs due to dollar strength, though US equities remain buoyed by AI & tech.

📉 Earnings + Breadth

Earnings season was mixed; top-heavy performance (few stocks driving index).

Weak market breadth suggests a correction is healthy or overdue.

⚠️ Risk Factors to Monitor

Surprise Fed policy pivot (hawkish).

Geopolitical escalations (Middle East, Taiwan).

Sudden rise in VIX or credit spreads.

Bearish divergence between index and market breadth indicators.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.