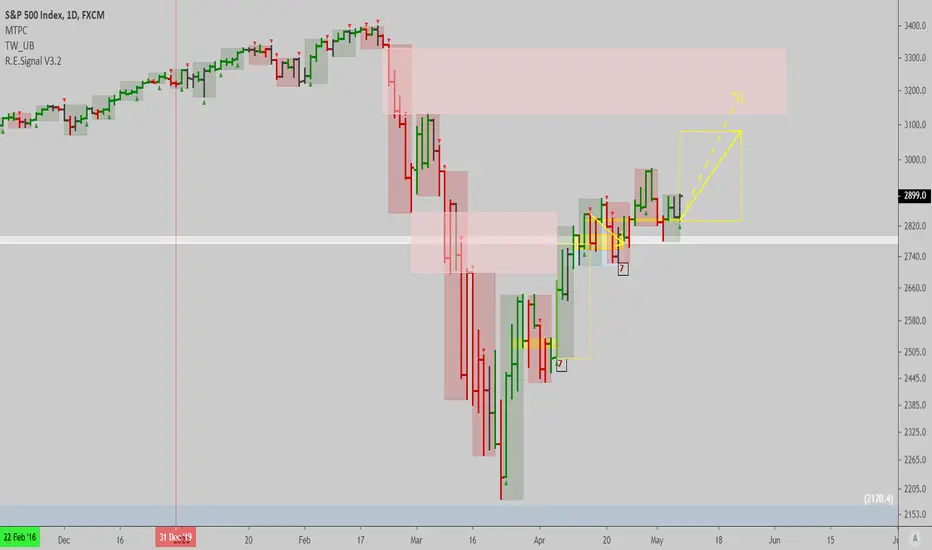

With everyone so damn bearish since the bottom, it has been clear to me we have been climbing a huge 'wall of worry'. The daily chart shows #SPX can rally for two weeks+ here, peaking for some time when retesting potential supply near the top (see the bright red boxes).

We should see the economy starting to open up gradually, overall we had a intense rally in many tech stocks but not so much in other 'real economy' names, which are likely to catch up soon. I'm positioned with overweight value, but also own some growth names that can still rally higher. Overall, the logical thing to do is to be long assets, given the Fed's actions. Cash is indeed trash now (Dalio had it a bit too early).

Cheers,

Ivan Labrie.

We should see the economy starting to open up gradually, overall we had a intense rally in many tech stocks but not so much in other 'real economy' names, which are likely to catch up soon. I'm positioned with overweight value, but also own some growth names that can still rally higher. Overall, the logical thing to do is to be long assets, given the Fed's actions. Cash is indeed trash now (Dalio had it a bit too early).

Cheers,

Ivan Labrie.

Note

Was working for a while but Fauci slammed everything today. If things don't hold up we could see either another drop or a lenghty sideways range in the index until things improve.Some stocks are faring well, so it is probably better to look into names showing strength, rather than trading the index.

Trade closed manually

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.