S&P 500 Set to Extend Record Highs

U.S. stock futures climbed on Friday, continuing this week’s strong momentum on hopes of eased trade tensions and growing confidence in multiple Fed rate cuts later this year.

Futures tied to the S&P 500 and Nasdaq 100 pointed to fresh record-high openings, while the Dow Jones was set to rise by 150 points.

Adding to the bullish tone, Commerce Secretary Lutnick announced a trade agreement with China, reducing tariff risks and easing concerns over rare earth shortages.

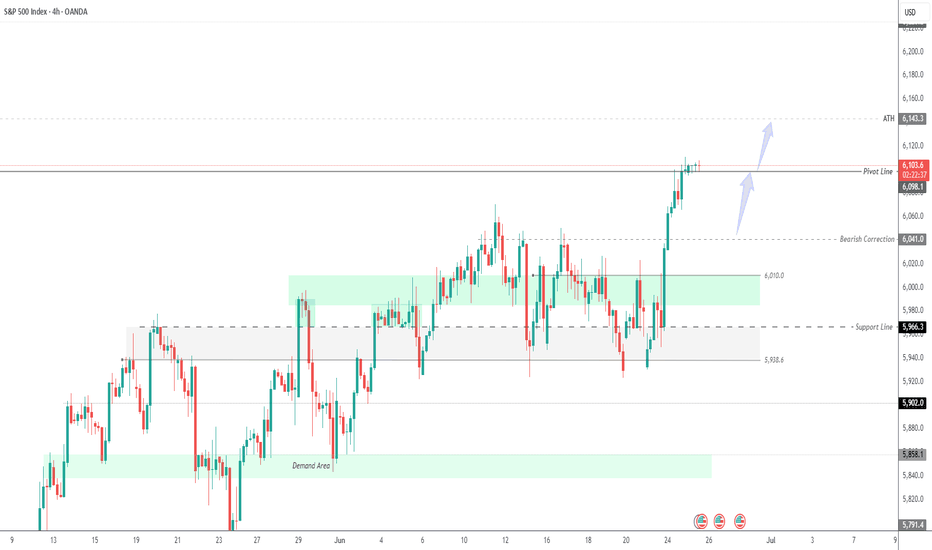

TECHNICAL OUTLOOK – SPX500

The index has broken into new all-time highs (ATH) and stabilized above the 6,143 resistance level, confirming bullish strength.

As long as the price trades above 6,143, the uptrend is likely to continue toward 6,225, with potential short-term pullbacks to 6,143.

A 1H candle close below 6,143 could trigger a deeper correction toward the pivot zone at 6,098.

Key Levels

Resistance: 6,175 → 6,225

Support: 6,098 → 6,041

previous idea:

U.S. stock futures climbed on Friday, continuing this week’s strong momentum on hopes of eased trade tensions and growing confidence in multiple Fed rate cuts later this year.

Futures tied to the S&P 500 and Nasdaq 100 pointed to fresh record-high openings, while the Dow Jones was set to rise by 150 points.

Adding to the bullish tone, Commerce Secretary Lutnick announced a trade agreement with China, reducing tariff risks and easing concerns over rare earth shortages.

TECHNICAL OUTLOOK – SPX500

The index has broken into new all-time highs (ATH) and stabilized above the 6,143 resistance level, confirming bullish strength.

As long as the price trades above 6,143, the uptrend is likely to continue toward 6,225, with potential short-term pullbacks to 6,143.

A 1H candle close below 6,143 could trigger a deeper correction toward the pivot zone at 6,098.

Key Levels

Resistance: 6,175 → 6,225

Support: 6,098 → 6,041

previous idea:

Trade active

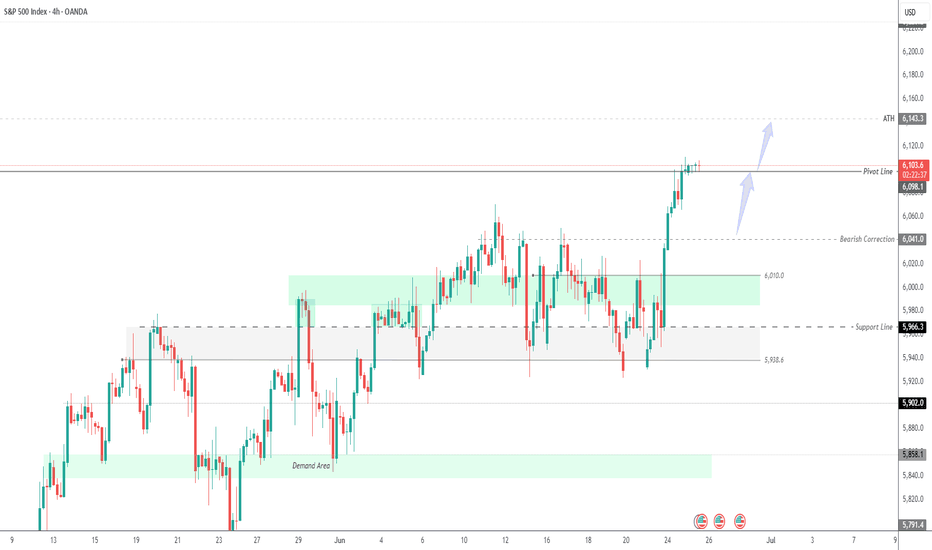

SPX500 UpdateThe price has surged approximately 300 points, as we anticipated above, and successfully retested the previous all-time high, continuing its bullish momentum. It is now approaching the key resistance level at 6225.

A rejection from 6225 may trigger a bearish correction toward 6170 and 6143, as long as the price trades below this level.

However, if the price closes above 6225 on the 1H timeframe, it would confirm bullish continuation toward the next resistance at 6287.

Pivot Level: 6225

Support Levels: 6170, 6143

Resistance Level: 6287

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.