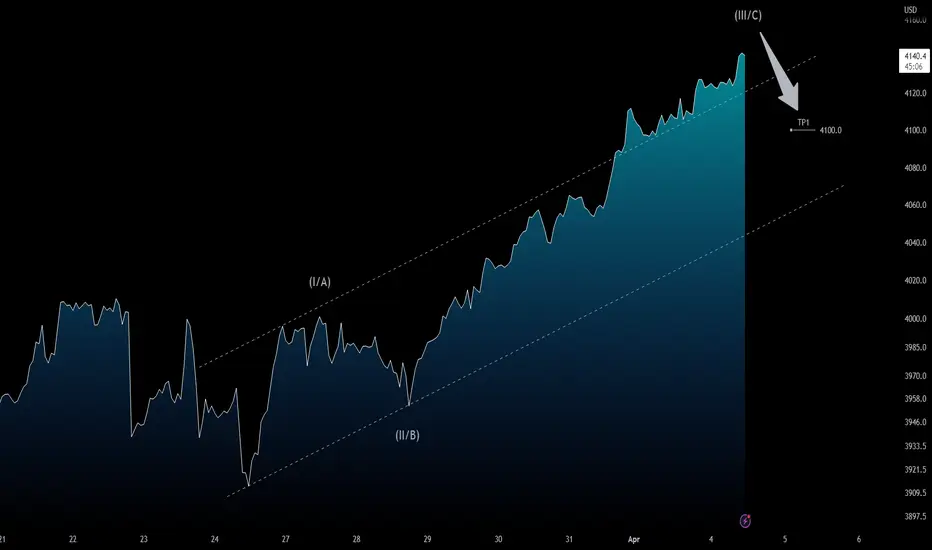

On 1H chart the trend is bullish, but even if it wanted to develop a bullish impulsive structure (i-ii-iii-iv-v), in short term, it would have to trigger a corrective structure (ABC Pattern, for example) with a Target around $4,100.

Trade with care! 👍 ...and if you think that my analysis is useful, please..."Like, Share and Comment" ...thank you! 💖

Cheers!

N.B.: Updates will follow below

Trade with care! 👍 ...and if you think that my analysis is useful, please..."Like, Share and Comment" ...thank you! 💖

Cheers!

N.B.: Updates will follow below

Note

Although the expected pullback was corrected, it did not reach 4.089 and thus did not form the "Right Shoulder".Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.