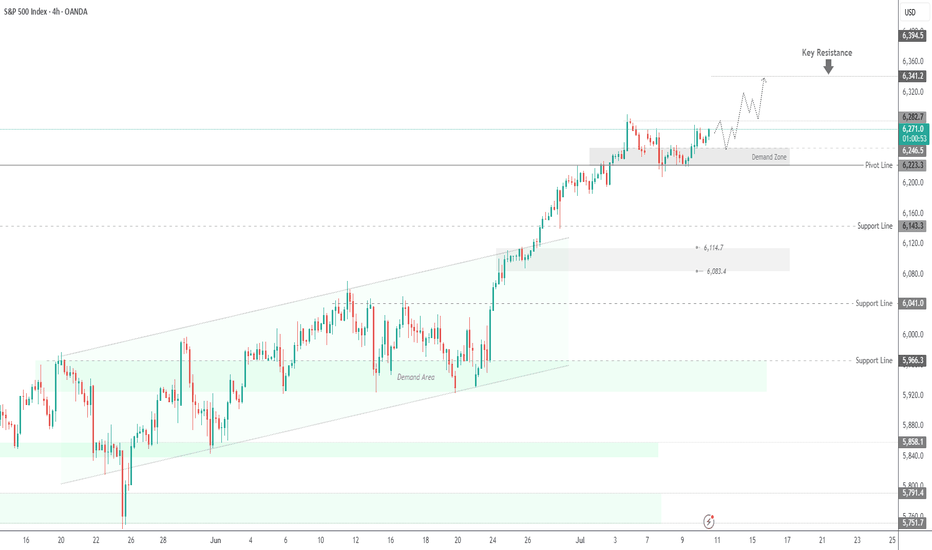

SPX500 – Market Outlook

U.S. futures are climbing as Nvidia plans to resume chip sales to China, fueling positive momentum across tech and growth sectors.

However, investor caution remains ahead of key events:

Major banks ( JPM ,

JPM ,  WFC Wells Fargo,

WFC Wells Fargo,  C Citigroup) will report earnings, offering insights into the financial sector.

C Citigroup) will report earnings, offering insights into the financial sector.

All eyes are on the June CPI report, expected at 2.6%. A higher reading could reinforce bearish pressure, while a softer print would support continued bullish momentum.

Technical Outlook:

SPX500 has bounced from the demand zone and is now trading above the pivot at 6282, which keeps the bullish trend in play.

As long as the price holds above this level, we expect continuation toward 6341, and if broken, extended upside toward 6394.

To shift bearish, price must break and close below 6223, which would open the path toward 6142.

Pivot: 6282

Resistance: 6341 – 6394

Support: 6225 – 6191 – 6142

Event Watch: CPI data release today – anything above 2.6% may trigger downside; below 2.6% could support further upside.

Previous idea:

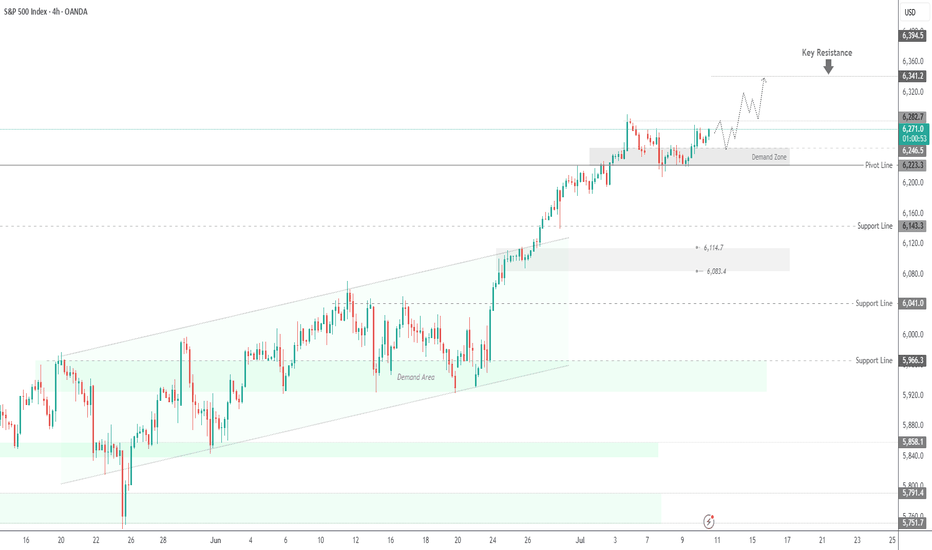

U.S. futures are climbing as Nvidia plans to resume chip sales to China, fueling positive momentum across tech and growth sectors.

However, investor caution remains ahead of key events:

Major banks (

All eyes are on the June CPI report, expected at 2.6%. A higher reading could reinforce bearish pressure, while a softer print would support continued bullish momentum.

Technical Outlook:

SPX500 has bounced from the demand zone and is now trading above the pivot at 6282, which keeps the bullish trend in play.

As long as the price holds above this level, we expect continuation toward 6341, and if broken, extended upside toward 6394.

To shift bearish, price must break and close below 6223, which would open the path toward 6142.

Pivot: 6282

Resistance: 6341 – 6394

Support: 6225 – 6191 – 6142

Event Watch: CPI data release today – anything above 2.6% may trigger downside; below 2.6% could support further upside.

Previous idea:

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.