Here it is ladies & gentlemen.

The second biggest short play of the year is about to commence.

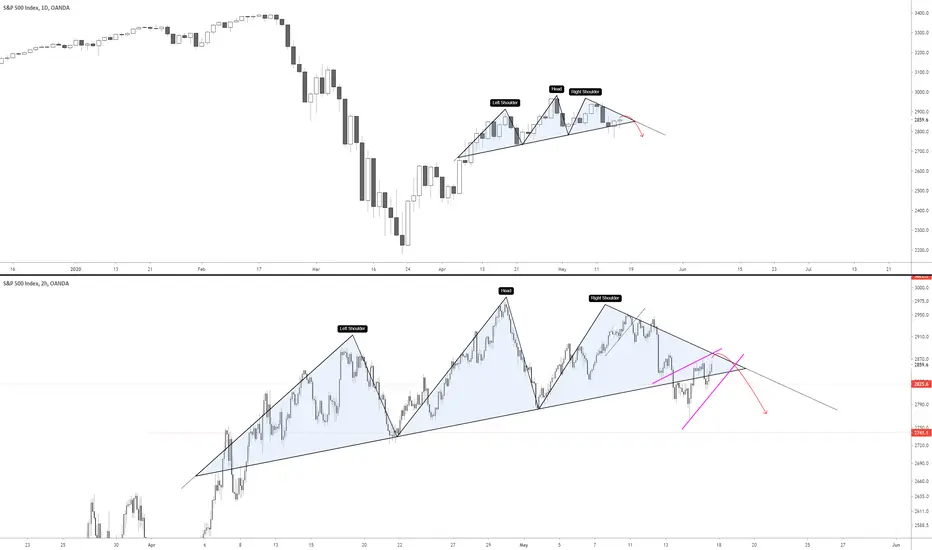

We have a H&S on the daily with price action neatly contained within a bearish rising wedge (pink) since MAY 13 overnight session (the bottom 2HR chart).

The bearish rising wedge termination appears to coincide with the right shoulder of the H&S pattern. This puts ES price around 2870 to 2880 area.

2880 was a very important price level two weeks ago.

We have Fed Chair Jerome Powell's interview with 60 Minutes on CBS airing on 7 pm MAY 17, or this Sunday night.

The smart money has finished unloading their stocks onto the public as proven by the explosion in new accounts with TD Ameritrade and Robinhood since the corona virus depression began. The average joe has been suckered into the market and unloaded on.

Check out this tweet - twitter.com/MidwestHedgie/status/1260914149565005827 - this is proof of the huge increase in DART (Daily Average Revenue Trades) by retail folk.

Smart money will now commence the next leg down and all the blame will be laid at the feet of Jerome Powell and the Federal Reserve for this interview airing Sunday night.

A daily view of the SPY paints the same bearish picture.

The second biggest short play of the year is about to commence.

We have a H&S on the daily with price action neatly contained within a bearish rising wedge (pink) since MAY 13 overnight session (the bottom 2HR chart).

The bearish rising wedge termination appears to coincide with the right shoulder of the H&S pattern. This puts ES price around 2870 to 2880 area.

2880 was a very important price level two weeks ago.

We have Fed Chair Jerome Powell's interview with 60 Minutes on CBS airing on 7 pm MAY 17, or this Sunday night.

The smart money has finished unloading their stocks onto the public as proven by the explosion in new accounts with TD Ameritrade and Robinhood since the corona virus depression began. The average joe has been suckered into the market and unloaded on.

Check out this tweet - twitter.com/MidwestHedgie/status/1260914149565005827 - this is proof of the huge increase in DART (Daily Average Revenue Trades) by retail folk.

Smart money will now commence the next leg down and all the blame will be laid at the feet of Jerome Powell and the Federal Reserve for this interview airing Sunday night.

A daily view of the SPY paints the same bearish picture.

Trade active

2 MES at 2860, taking heat. Still confident but I should have been more patient.Trade closed manually

Well, I tilted to 30 MES short to 2881, tapered off to 20, had a chance to get out for a profit, didn't.Then covered for a $200 loss right before the dump started cause I couldn't take any more heat. The plan was to double down all night to get a good price, then taper some off to build a profit cushion and then sit on the remaining position rest of the week. I didn't expect so many vertical green pumps - that's evidence right there that they are taking this market lower.

Best of luck to anyone short positioned, I still think the TA is right but I just ruined my mental capital.

Note

Well, TA is dead to me now.Do you think its unusual that the biggest overnight pump on some BS vaccine working news happens right about as a huge sell opportunity shows up?

I think TA doesn't work now that the Fed has a stake in the markets - they will use bears TA setups to do the exact opposite.

All we have is this pennant resistance, then its back to the bear flag resistance.

Trade active

SHORT 4 MES 2945.50Trade closed manually

I added more shorts on that 66 push, it was a clear intraday bearflag retest & rejection.Cleared +$300 - in the worlds of Elon Musk, "Don't doubt your vibe"

Note

Just saw this blue resistance line. Some sort of combo of bear flag pullback again lining up with blue resistance line and 3000 psychological number before Fed FOMC on Wednesday is probably a great short to take in terms of risk to reward. To refine the entry, look for any hourly upper bollinger band pierces on both the 2 and 3 sigma. Use the free [JR]MBHB_EBO technical indicator so that it automatically identifies these 2 and 3 sigma upper bollinger band breaches for you.

Trade active

I opened up 2 x SPY JUN 290/280 BEAR PUT Debit Spread for $2.50. Pays out 3:1 and breaks even at 287.48.I opened up 20 × QQQ 29MAY 200 PUT.

I have existing 2 × VIX JUN16 50 CALL that have been paid for by the market by 3 I sold last week.

Planning to leg in some more tomorrow prior to FOMC, see how that goes.

Trade closed manually

That was wild - I wanted 2960 short on the rising wedge resistance but market top ticked at 58.75. Then it dumped hard on the vaccine news, I shorted the pop at 61.8 retracement, it overthrew a bit but I maneuvered into a 54 short position and rode it down 161.8% retracement before I got out.i.imgur.com/u5DwzHQ.png

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.