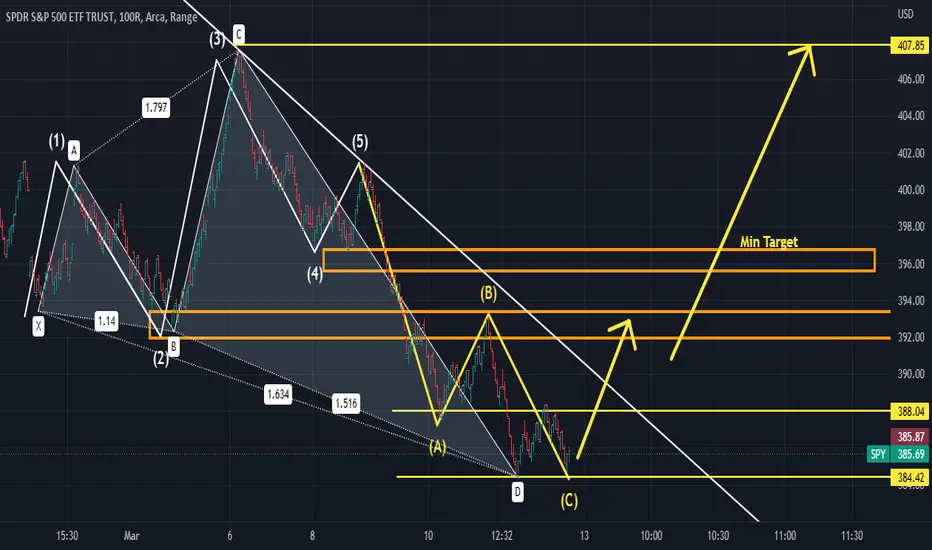

Previous resistances could then act as support to launch to $408.00. From Wave 1- Leg A, is a bullish Cypher pattern. B Leg was the rejection as it retrace back up to Wave 2. Double bottom occurred on the intraday Friday. A leg acted as resistances before the double bottom occurred. This information combined w/ my Technical Analysis on Tech, and Financial Sector I see the SP500 rally early next week and cause a short squeeze.

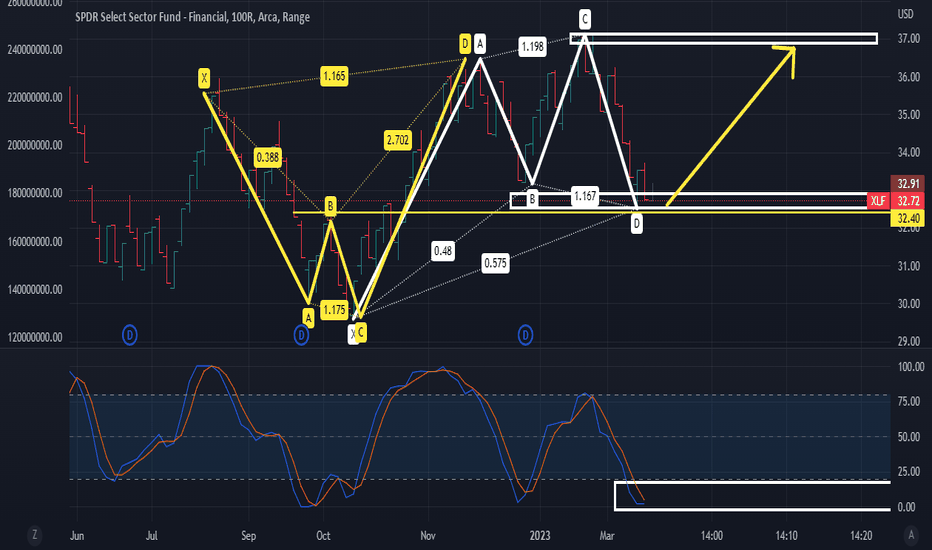

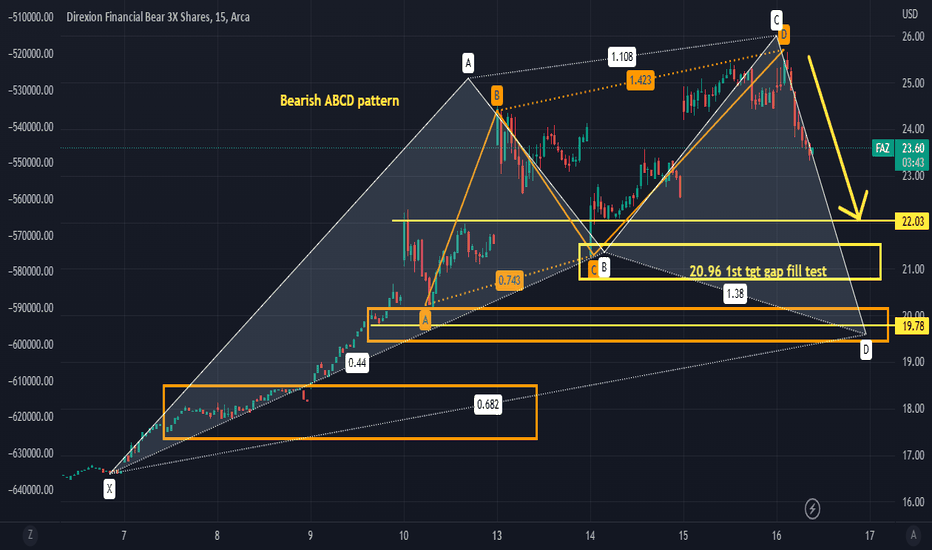

Looking to long Financials early next week, any negative news in the market is a buy opportunity. I also like Tech, and will likely short the inverse 3x bear etf

Looking to long Financials early next week, any negative news in the market is a buy opportunity. I also like Tech, and will likely short the inverse 3x bear etf

Note

im also anticipating financials to rally next week.Note

to retest short zone 398 next weekNote

shorting into the opening on futuresNote

then decision at 3876Note

bear trap this morning. I'm out of my shorts. Currently seeing a rounding top, the C leg hasn't been invalidated. Everything is going to plan so far. I will be buying puts and shorting inverse Bear ETFS like Note

bought Faz $22 puts, puts SPXS $20.5, puts SPXS $19Note

Looking for AD to breach this level, and price action respond to a move to $392.5 for Note

Note

All Things consider, I see today as a win for the bulls. Low of the Day held, on good volume. Big numbers tomorrow. here is a brief update before futures start trading tonight. Here is

Note

I ran an inside pitch fork from ( B leg t to C leg) of the Yellow ABC pattern. After reviewing this pattern, there is an ABCD pattern inside of this on the right side of the bullish cypher (In Gold). The intent wasn't to get the math sequence correct, but to illustrate what im seeing. A bullish Move from the D leg of the bullish cypher, would set up a retest to B leg or wave 2 of the Eliott wave. The ABCD pattern also confirms this set up. Price action could stay rising according to the pitch form and then we get directional point as we get closer to 395-398Note

1min (bearish into close)

Note

I will be monitoring the AD and the Money flow at the opening bell, the 1st 30min to determine if the AD will breach the 30min spike levelNote

All Systems appear to be a go. Lets get this money today. Puts will print, and Note

You dont need to see price action to trade. Here is the AD going through Key fib levels. Notice on the 15min chart we're approaching the .236 fib level by the AD. All I did was measure the height of the highest sell off $407.00 to the bottom of this range. As the AD approaches these key fib levels, you'll see more spikes in price actionNote

I don't have a website, or discord. I'm getting a lot of questions about this. If you have a specific question about a stock/etf/commodity and wish for me to chart it. Drop me a message. I'll do it for a fee which you can send via paypal. I'm keep charting If you're having success using the charts and want to support feel free to drop a tip, also if you want me to chart a certain stock for you. Send a tip with a message and your TV username and i'll do it for you. (DM me before so I know)

paypal.me/FlippingnStacking?country.x=US&locale.x=en_US

If there is enough interest in a discord, i'll consider starting one. Thanks again for the likes and comments

Note

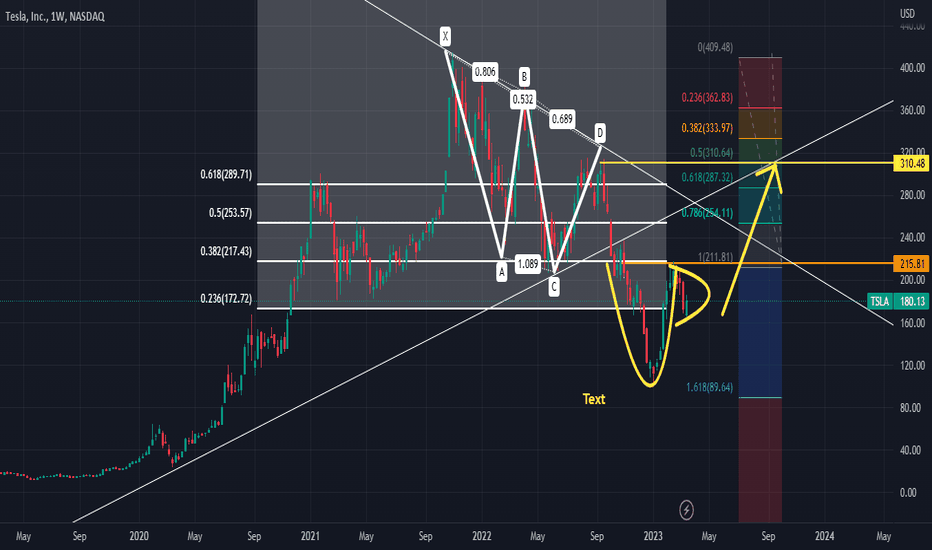

jpm and apple wont let this market crash. see my Note

Price action spiked towards the end of the day as the AD crossed up through these levels on the fib. Now im keep these same fib levels, and jump to the 1hr time frame to show what im seeing.Note

We have to get over $401.5 to invalidate that head and shoulders. I'm stating price action is going to run above $407.. I'm sticking to the 398.50, you dont have to keep asking me that.. and this is the reason whyNote

Note

and once this level is breached, then im consider taking a short. AD + price action would then be at the same height. It would likely form a double top. But first let the price action catch up. Cheers..Note

1hr update for Note

sp500 3x bear etf Note

Note

aight might be the last chart for this trade.. im looking to take profits when Note

weakness on short the C leg of the bullish cypher on

Note

notice how when the Stoch RSI is under the cloud, those have been buys. with previous resistances acting as support now, stoch rsi may not dip below the cloud. Keep that in mindNote

spx closed above previous resistances level during NY session, I actually want to see it retested during futures and hold. And gradually rise going into NY open. But if there is no retest from D leg of the abcd pattern (in white) to A leg (top of the bullish cypher) than that's extremely aggressive bullish behaviorNote

i'll take 3945 even..Note

all the answers you need and looking for are right here in Note

spy will eventually move back up due to the heavy short of the 3x bear sp500 etf...Note

here it is Note

Note

Note

apex on 3min futures Note

keep an eye out for for Note

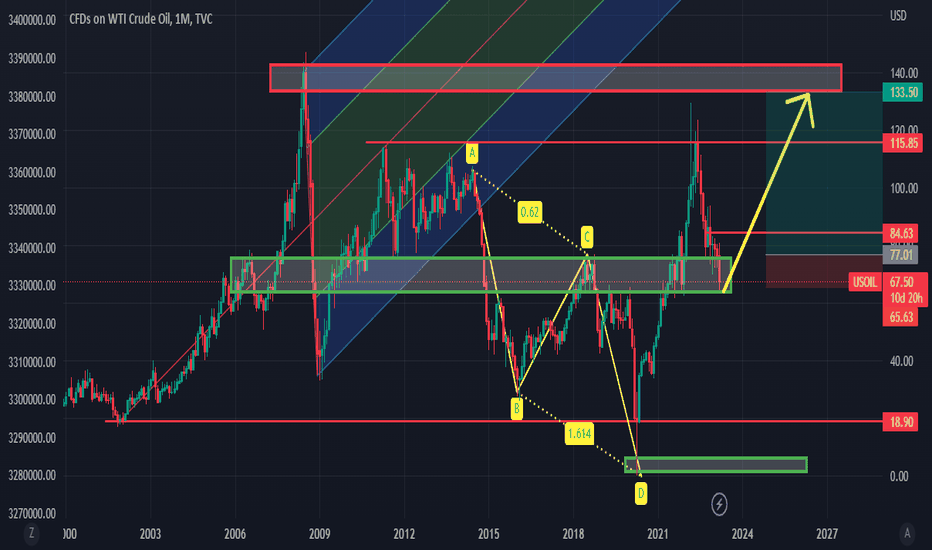

Volatility coming back into the markets even stronger... looking for a flush on Note

Bull flag on Note

Trade closed: target reached

Target reached at the open this morning. We saw $398, market looks bullish.. as of now im closing the trading idea. CheersTrade closed manually

No more updates will be provided...Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.