📊 SPY Macro Risk Map | Positioning for Global Capital Flows

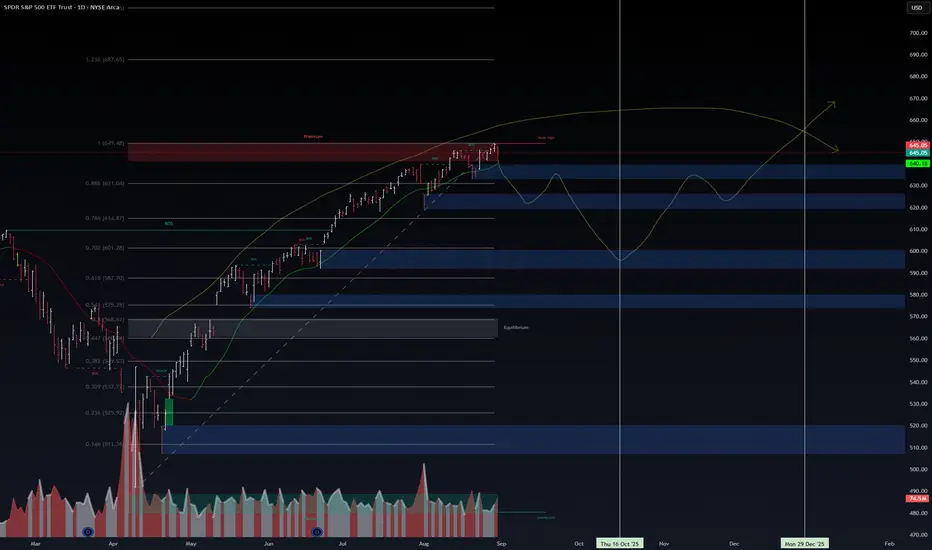

The S&P 500 ( SPY) is testing premium levels near the 1.0 Fibonacci extension (649). My risk model highlights a potential liquidity sweep before deeper retracements toward the 0.786–0.702 zones (631–601). These levels represent equilibrium realignments where high-probability institutional accumulation often re-emerges.

SPY) is testing premium levels near the 1.0 Fibonacci extension (649). My risk model highlights a potential liquidity sweep before deeper retracements toward the 0.786–0.702 zones (631–601). These levels represent equilibrium realignments where high-probability institutional accumulation often re-emerges.

🌍 Global Macro Alignment

US Macro: Sticky inflation, Fed policy uncertainty, and fiscal imbalances may cap upside in the near term. Liquidity stress will likely fuel tactical drawdowns.

UAE Positioning: Sovereign wealth capital (ADIA, Mubadala, ICD) is actively rotating into AI-driven infrastructure, global equity overlays, and commodity hedges. Their deep liquidity seeks asymmetric risk-adjusted returns while maintaining exposure to dollar assets.

Capital Intelligence Play: By framing SPY drawdowns as structured entry opportunities, we align with UAE’s appetite for risk-managed US exposure—bridging tactical market volatility with long-term sovereign allocation needs.

⚖️ Risk Pathway

Short-term rejection at premium zones → corrective wave toward 600–620 liquidity pockets.

Potential macro catalyst alignment around October (IMF/WB meetings, Fed forward guidance).

Re-accumulation phase into year-end, targeting 670+ if global liquidity stabilizes.

📌 Financial Intelligence Insight

This is less about chasing trend tops and more about positioning in volatility as an entry vehicle. For UAE-based allocators, the current SPY setup is a live case study in tactical liquidity provision—risk is not avoided but engineered.

💡 Key takeaway: SPY is not just a chart—it’s a capital flow model. Anticipating global sovereign rotation allows us to build strategies that resonate with investors sitting on deep pools of capital.

The S&P 500 (

🌍 Global Macro Alignment

US Macro: Sticky inflation, Fed policy uncertainty, and fiscal imbalances may cap upside in the near term. Liquidity stress will likely fuel tactical drawdowns.

UAE Positioning: Sovereign wealth capital (ADIA, Mubadala, ICD) is actively rotating into AI-driven infrastructure, global equity overlays, and commodity hedges. Their deep liquidity seeks asymmetric risk-adjusted returns while maintaining exposure to dollar assets.

Capital Intelligence Play: By framing SPY drawdowns as structured entry opportunities, we align with UAE’s appetite for risk-managed US exposure—bridging tactical market volatility with long-term sovereign allocation needs.

⚖️ Risk Pathway

Short-term rejection at premium zones → corrective wave toward 600–620 liquidity pockets.

Potential macro catalyst alignment around October (IMF/WB meetings, Fed forward guidance).

Re-accumulation phase into year-end, targeting 670+ if global liquidity stabilizes.

📌 Financial Intelligence Insight

This is less about chasing trend tops and more about positioning in volatility as an entry vehicle. For UAE-based allocators, the current SPY setup is a live case study in tactical liquidity provision—risk is not avoided but engineered.

💡 Key takeaway: SPY is not just a chart—it’s a capital flow model. Anticipating global sovereign rotation allows us to build strategies that resonate with investors sitting on deep pools of capital.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.