A bearish to bullish parallel downtrend break is a technical analysis pattern that occurs when a security breaks out of a downtrend channel to the upside. This pattern is considered to be a bullish reversal signal, as it indicates that buyers are gaining control of the market and that the downtrend is likely to come to an end.

To identify a bearish to bullish parallel downtrend break, traders look for the following characteristics:

A downtrend channel is formed by connecting the lower highs and lower lows of a security's price action.

The security breaks out of the downtrend channel to the upside.

The breakout is accompanied by an increase in volume, which indicates that there is strong buying pressure behind the move.

Once a bearish to bullish parallel downtrend break has occurred, traders may enter long positions in anticipation of further upside momentum. Traders should also place stop-loss orders below the breakout point to limit their losses in case the security falls back into the downtrend channel.

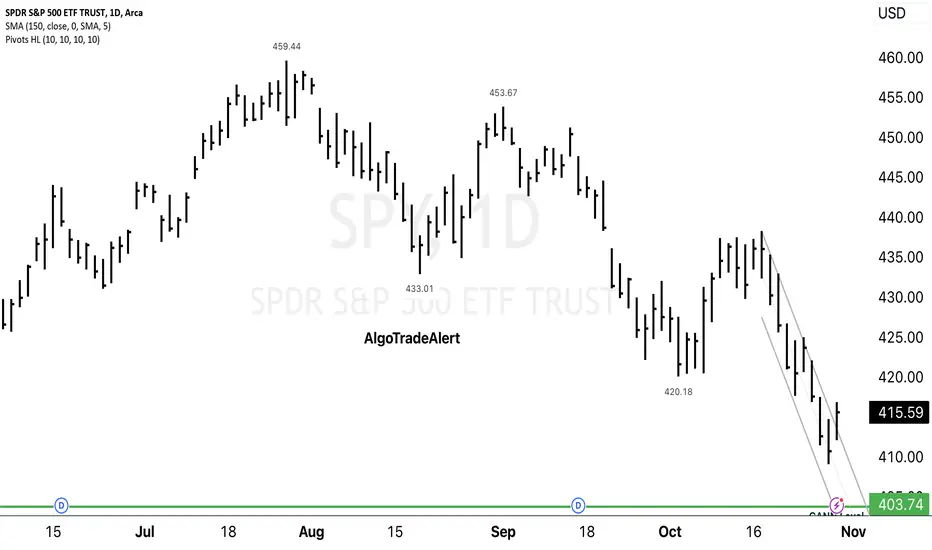

Here is an example of a bearish to bullish parallel downtrend break:

[Chart of a bearish to bullish parallel downtrend break]

As you can see in the chart, the security is in a downtrend channel when it breaks out to the upside. The breakout is accompanied by an increase in volume, which confirms that the breakout is legitimate.

After the breakout, the security continues to move higher, confirming that the downtrend has been reversed. Traders who entered long positions at the breakout would have been able to profit from the subsequent rally.

Conclusion

A bearish to bullish parallel downtrend break is a bullish reversal signal that can indicate that a downtrend is coming to an end. Traders can look for this pattern to identify potential trading opportunities. However, it is important to remember that no technical analysis pattern is foolproof, and traders should always use risk management measures to protect their capital.

To identify a bearish to bullish parallel downtrend break, traders look for the following characteristics:

A downtrend channel is formed by connecting the lower highs and lower lows of a security's price action.

The security breaks out of the downtrend channel to the upside.

The breakout is accompanied by an increase in volume, which indicates that there is strong buying pressure behind the move.

Once a bearish to bullish parallel downtrend break has occurred, traders may enter long positions in anticipation of further upside momentum. Traders should also place stop-loss orders below the breakout point to limit their losses in case the security falls back into the downtrend channel.

Here is an example of a bearish to bullish parallel downtrend break:

[Chart of a bearish to bullish parallel downtrend break]

As you can see in the chart, the security is in a downtrend channel when it breaks out to the upside. The breakout is accompanied by an increase in volume, which confirms that the breakout is legitimate.

After the breakout, the security continues to move higher, confirming that the downtrend has been reversed. Traders who entered long positions at the breakout would have been able to profit from the subsequent rally.

Conclusion

A bearish to bullish parallel downtrend break is a bullish reversal signal that can indicate that a downtrend is coming to an end. Traders can look for this pattern to identify potential trading opportunities. However, it is important to remember that no technical analysis pattern is foolproof, and traders should always use risk management measures to protect their capital.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.