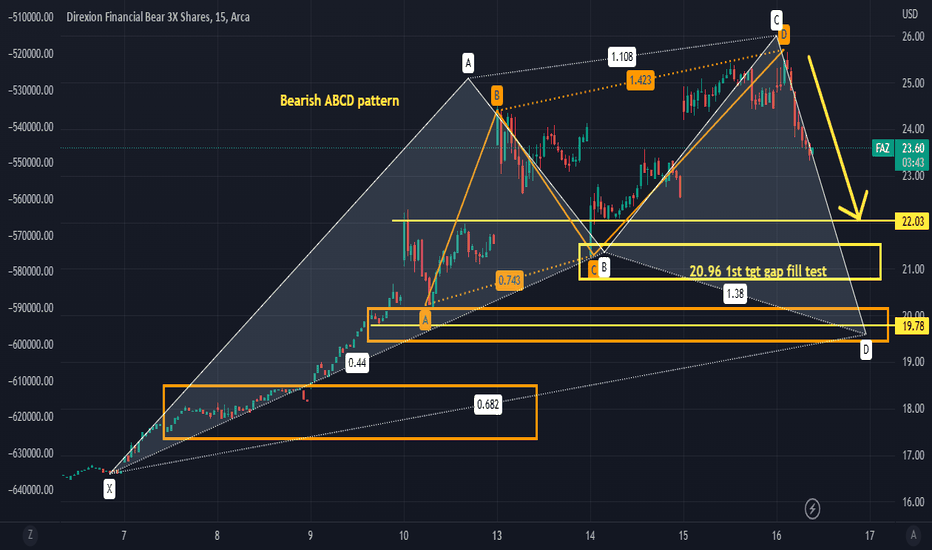

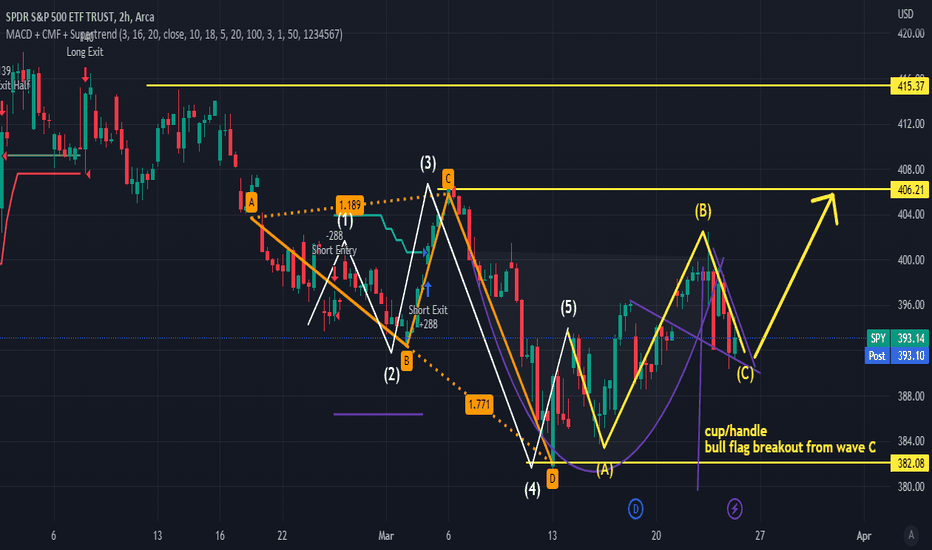

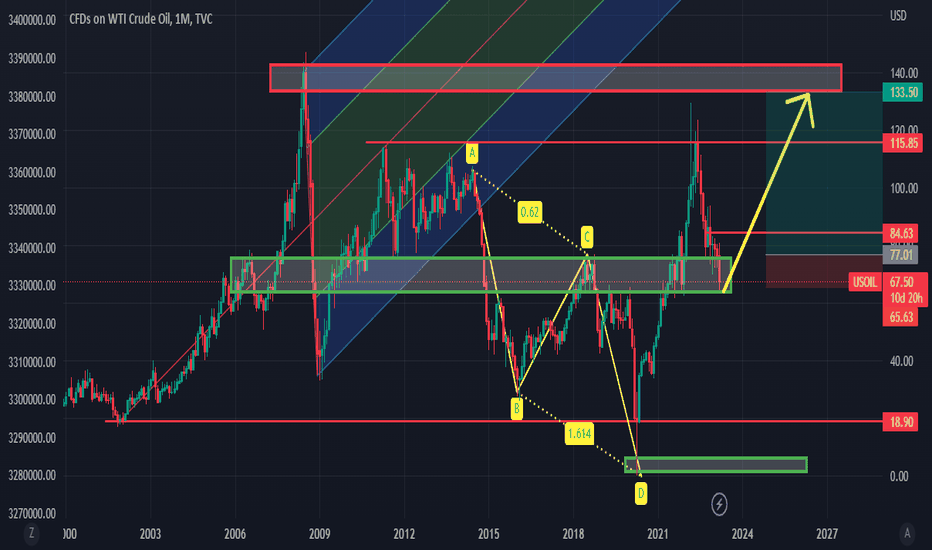

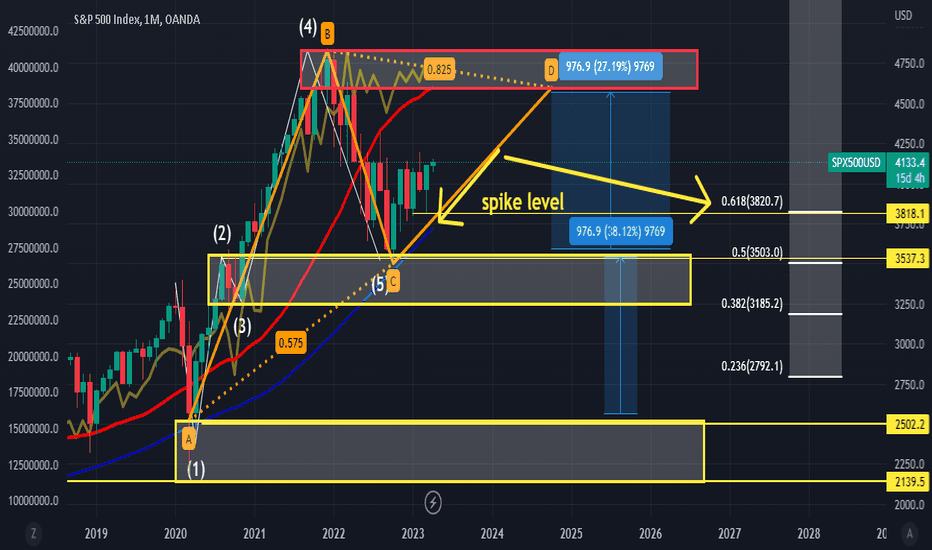

1st and foremost, i'm only doing this because I hate to see good people loose money. PRICE ACTION MEANS NOTHING, Nothing moves but the money. Please understand this... The AD and Money flow are Ascending... There is a bullish abcd pattern which correlates to the ABCD pattern on the  SPX go against this at your own will

SPX go against this at your own will

Notice the AD is in an ascending triangle pattern targeting 475 which is a retest of previous highs..

475 which is a retest of previous highs..

dont ask for updates, No I DONT HAVE A DISCORD, NO I DONT WANT YOUR MONEY, I DONT HAVE A WEBSITE... CHEERS.

Notice the AD is in an ascending triangle pattern targeting

dont ask for updates, No I DONT HAVE A DISCORD, NO I DONT WANT YOUR MONEY, I DONT HAVE A WEBSITE... CHEERS.

Note

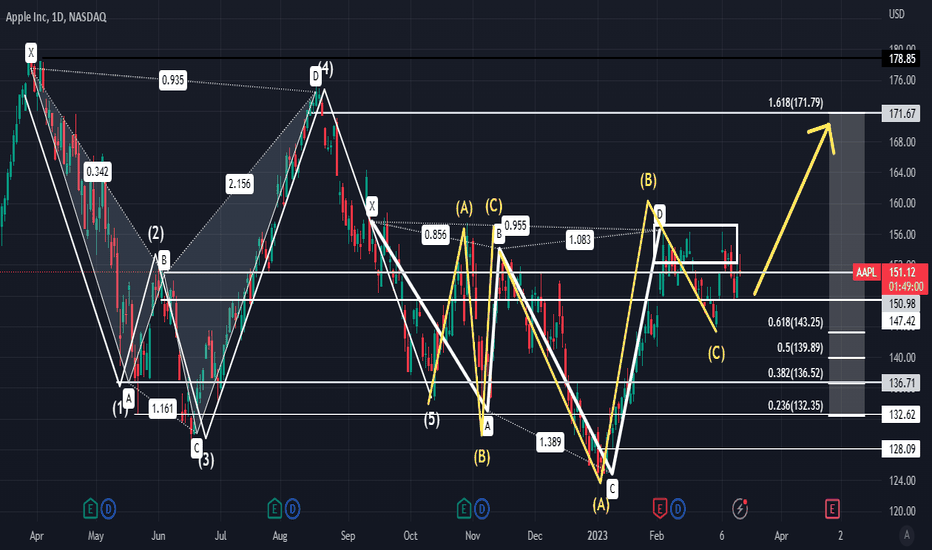

I'm going to revisit this potential bullish cypher pattern after Note

AD is set to cross over a spike level on the monthly chart on the sp500 futures... If this occurs, then you can't rule out the SP500 futures & I stay in my own lane, I rarely look at other chartist. I only look at the Money Flow and the AD...

Note

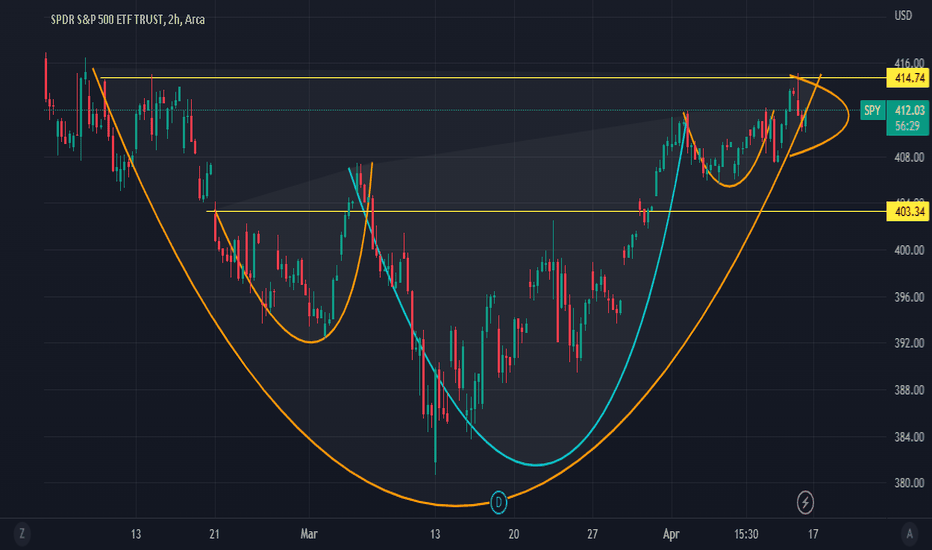

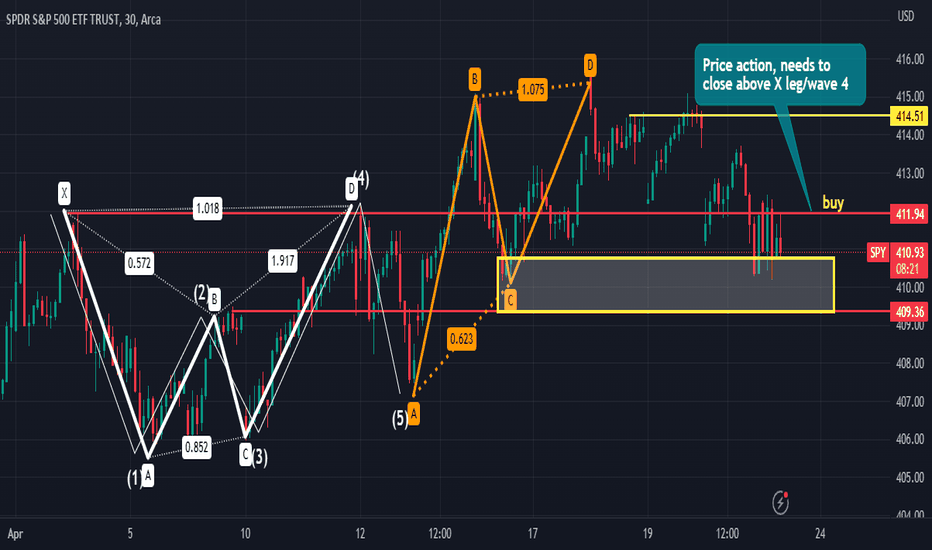

Price Action + Chikou Spann Double bottom= Buy signal.. seen yesterday..handle needs depth. Monitoring two handles. previous resistances needs to hold as support cup/handle set up... Likely short squeeze to get price action over $415... looking for this to carry over the new few trading sessions

Note

you have inverse head and shoulders set up... this is a bullish continuation pattern. Which means, said trend will continue to higher time frames. so If it occurs on the 2hr, then its likely to occur on the 3hr/4hr/daily/weekly/monthly until said trend is invalidated. this is why you have to trade between multiple time frames..Note

above chart is the 3hr ... I will continue to monitor til there is an invalidation... 415 must be taken out firstNote

on the sp500 futures... cup/handle breakout is key... that is all for nowNote

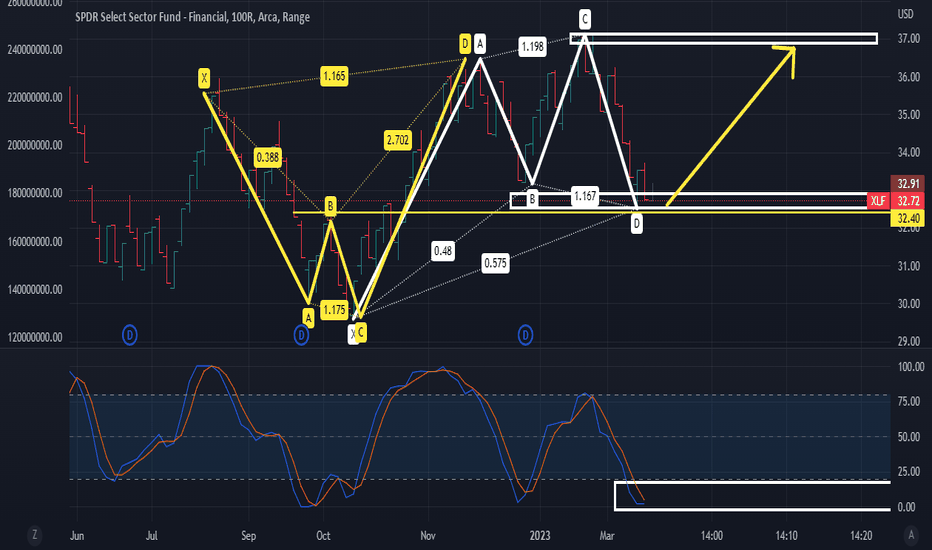

xlf- Target

Note

3hr box consolidation/bull flag on the sp500 futures broke out.. look for 4250 on the spx futuresNote

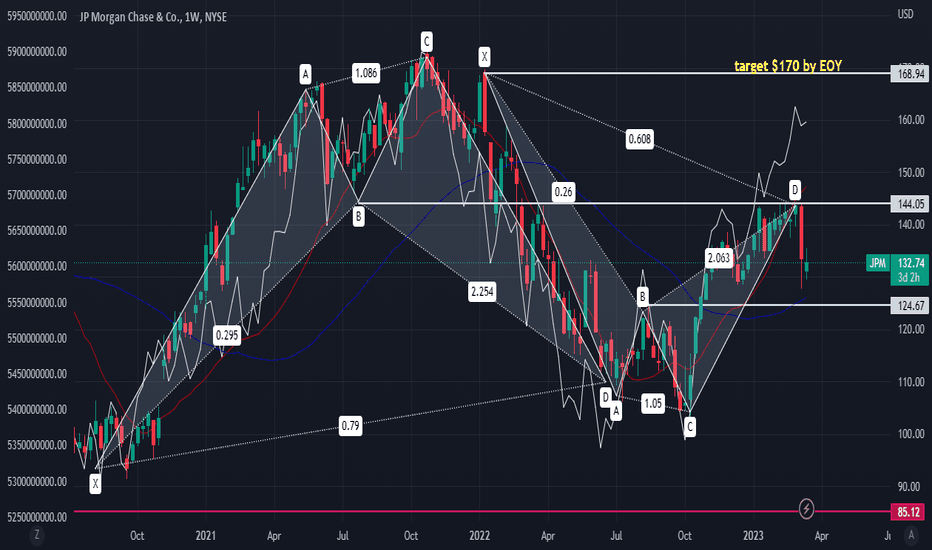

I have not updated the chart. JPM heading to

Note

buy signals flashing on Note

The AD is showing me the set up. Money Flow show buy signals before price action is determined. Chikou Spann + Price Action = buy signal on

Note

and if you look closer you can see an inverse head and shoulders pattern formingNote

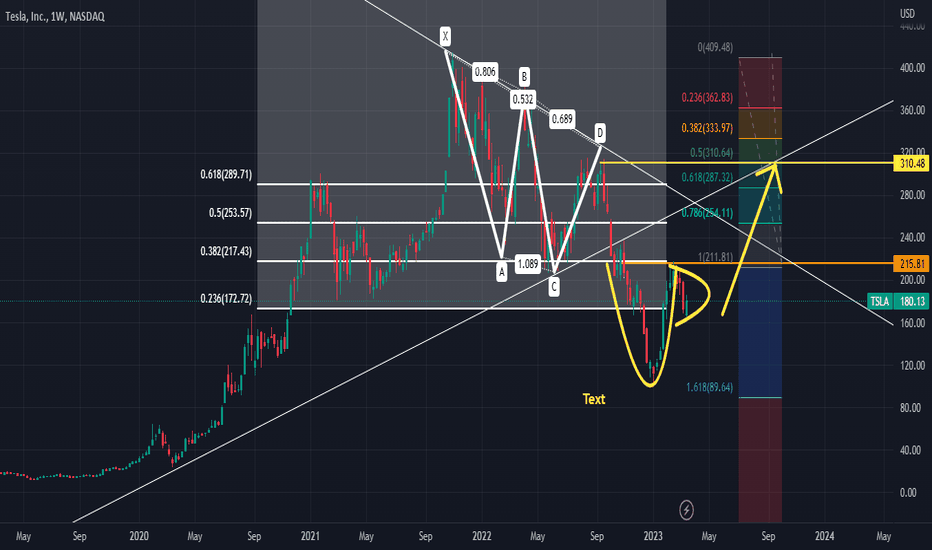

buy the B leg of the ABCD pattern on Note

click on the chart above, takes you directly to the linkNote

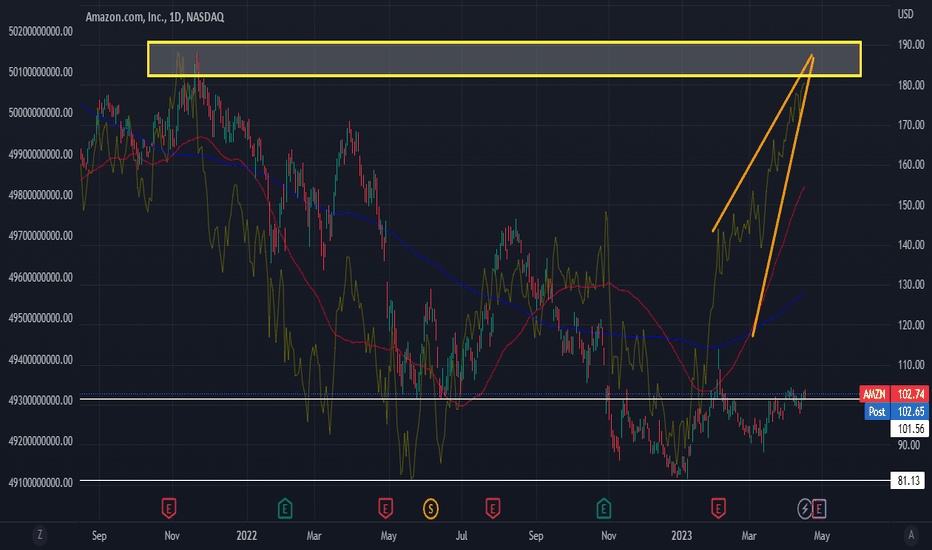

Chart was Created March 14th, 2023.. There needs to be another Catalyst to get us above Wave 4/D Leg... Now remember what I said about bullish continuation patterns, they will proceed to the higher time frames until there's an invalidation of said trend. This cup/handle pattern, should carry over to the next higher time frame which is the Daily chartNote

you have to train your eyes... find the Supply zone (the last sold off zone)look at the stoch rsi on the Daily chart, and you'll see we're not in overbought territory

Note

Monster Day in LABU (3x biotech etf) I hope some of yall got in the LABU Trade I posted it last week near market close. I haven't updated the chart... I mentioned the 41% gains as its headed to 7.15.. This chart is the higher time frame... I haven't updated it all ... This is how I know the markets aren't tanking.. dont be mislead by some of these Chartist on Trading View. I honestly question some of their motives. I Just follow the Money and stay in my own lane... Note

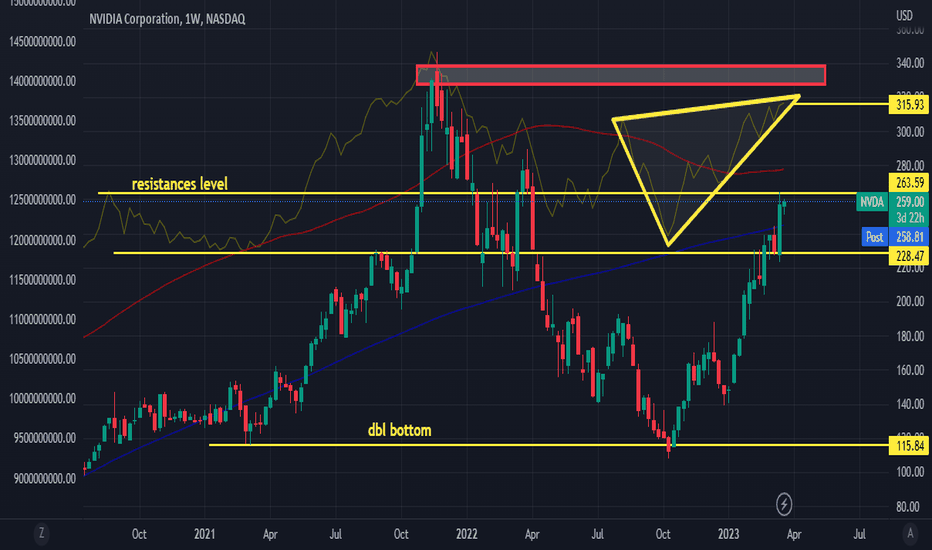

The NVDA Chart is live, click the chart aboveNote

a breach of 29600 invalidates the bullish momentum for the 1hr trade set up..Note

B leg resistances of the sp500 futures is now support. This becomes invalidated below 4087, it would have to close below this to invalidate the move. In fact, I would say we've broken out above trendline resistances but have not closed above D leg resistances.. Im looking for this to happen this week Note

Take a look at the AD here. This is a bearish Cypher pattern, Bears have attempted to take it below the 50 day moving avg. However, look at how B leg previous resistances is now acting as support, which is holding up near the 50 day moving avg. for the sp500 futures.. The money flow is strong here... Bears would have to dump Billions to invalidate this move and push price action back to Note

looking for a retest of x legNote

higher time frames lead to higher spikesNote

at 4300, could be a short level... could catch a lot of folks off guard (im forecasting this for now, not a specific trade set up... but something that has to be respected at 4300 when we get there)Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.