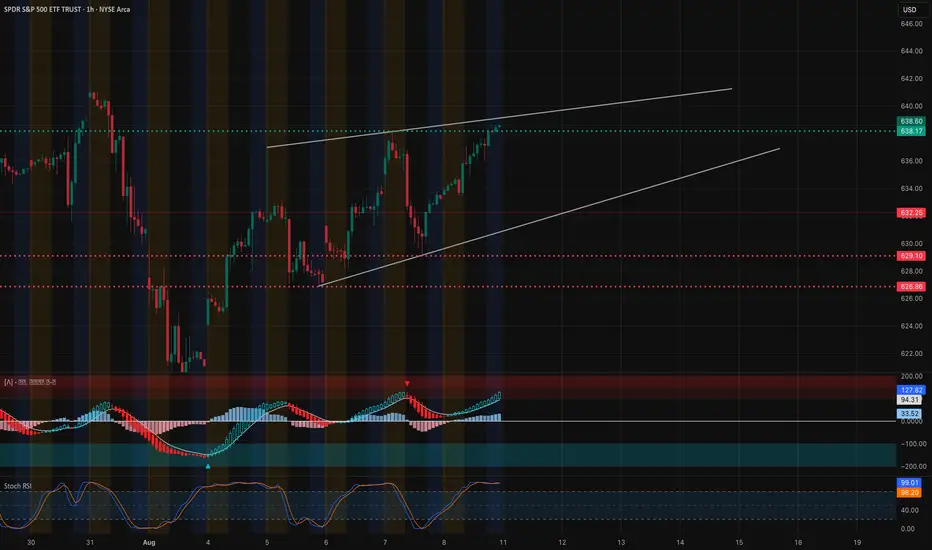

Technical Analysis (1H Chart)

SPY is currently pressing into the upper boundary of a rising wedge pattern, approaching the 638–642 resistance zone. Price action has been in a controlled uptrend since the bounce from the 625 demand level, supported by higher lows. However, MACD shows strong momentum but is nearing extended territory, while Stoch RSI is overbought at ~99, signaling potential exhaustion. If price rejects at this wedge top, a pullback toward 632.25 (trendline & prior support) becomes likely. A clean breakout above 642 would invalidate the immediate bearish wedge bias and open a path to higher highs.

Key Support Levels:

* 632.25 – First support / trendline confluence

* 629.10 – Major shelf support

* 626.86 – Last strong demand zone before breakdown

Key Resistance Levels:

* 638.17 – First upside target

* 642.35 – Rising wedge breakout level & gamma wall

GEX & Options Sentiment Options data shows the highest positive NET GEX at 638.60 (CALL resistance / gamma wall), with additional resistance stacking at 642. These levels act as dealer short gamma zones, meaning moves into them could slow unless there’s significant buying pressure. On the downside, large PUT support sits at 631 and heavier protection at 625 — losing this level could accelerate downside momentum.

Options Flow Snapshot:

* IVR: 12.4 (low vol environment; cheaper premiums)

* Call positioning concentrated at 638 & 642

* Put positioning heavier below 631, especially at 625

* GEX: Mildly bullish bias as long as SPY stays above 631

Trade Thoughts:

* Bullish Scenario: Break and hold above 642 → Target 646–648; favor short-dated calls or debit spreads while IV is low.

* Bearish Scenario: Rejection at 638–642 → Short with puts targeting 632, then 629.

* In both cases, watch for momentum shift as Stoch RSI resets.

Disclaimer: This analysis is for educational purposes only and is not financial advice. Always manage risk and trade according to your plan.

Key Support Levels:

* 632.25 – First support / trendline confluence

* 629.10 – Major shelf support

* 626.86 – Last strong demand zone before breakdown

Key Resistance Levels:

* 638.17 – First upside target

* 642.35 – Rising wedge breakout level & gamma wall

GEX & Options Sentiment Options data shows the highest positive NET GEX at 638.60 (CALL resistance / gamma wall), with additional resistance stacking at 642. These levels act as dealer short gamma zones, meaning moves into them could slow unless there’s significant buying pressure. On the downside, large PUT support sits at 631 and heavier protection at 625 — losing this level could accelerate downside momentum.

Options Flow Snapshot:

* IVR: 12.4 (low vol environment; cheaper premiums)

* Call positioning concentrated at 638 & 642

* Put positioning heavier below 631, especially at 625

* GEX: Mildly bullish bias as long as SPY stays above 631

Trade Thoughts:

* Bullish Scenario: Break and hold above 642 → Target 646–648; favor short-dated calls or debit spreads while IV is low.

* Bearish Scenario: Rejection at 638–642 → Short with puts targeting 632, then 629.

* In both cases, watch for momentum shift as Stoch RSI resets.

Disclaimer: This analysis is for educational purposes only and is not financial advice. Always manage risk and trade according to your plan.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.