🔮 Nightly  SPY /

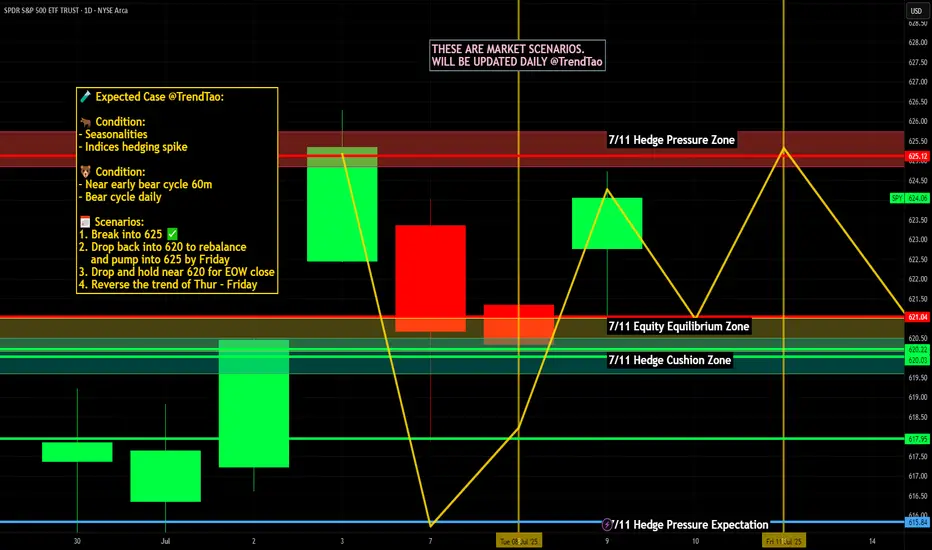

SPY /  SPX Scenarios for July 10, 2025 🔮

SPX Scenarios for July 10, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Global Banks Profit from Tariff Volatility

Major banks like JPMorgan, BofA, and Citigroup are expected to see ~10% growth in trading revenue in Q2, fueled by volatility from President Trump’s tariff policy shifts. Treasury trading volumes hit record highs as markets priced in policy swings

📈 S&P 500 Nears Lull Amid Bull Market Strains

Despite record highs in 2025, investors are warning that the rally may be reaching its limit. Bullish sentiment is strong, but analysts caution that sluggish consumer spending, rising inflation from tariffs, and few rate-cut signals from the Fed could cap downside momentum

🐻 Bear Case Gains Ground

Stifel’s Barry Bannister projected a potential ~12% correction in the second half of 2025. Key risks include slowing consumer spending, weak capital investment under tariff uncertainty, and persistent core inflation above 3%, negatively impacting earnings and growth outlooks

⚖️ “One Big Beautiful Bill” Could Add Trillions in Debt

The new fiscal package signed July 4 will add $3–4 trillion to national debt over the next decade while extending tax cuts and revising EV incentives. Bond market and Fed policy implications may become more pronounced if growth fails to keep pace

📊 Stocks vs Bonds: Diverging Signals

While equities climb and megacaps extend gains, Treasury yields have risen five days straight—signaling growing caution over real growth prospects. The yield curve steepening hints at mixed signals: growth optimism in stocks, but bond market signaling economic risk ahead

📊 Key Data & Events

📅 Thursday, July 10:

No major scheduled economic releases. Markets remain driven by tariff headlines, bank earnings reactions, and evolving Fed signals.

⚠️ Disclaimer:

This is for informational and educational purposes only—not financial advice. Consult a licensed advisor before making investment decisions.

📌 #trading #marketvolatility #tariffs #banks #Fed #debt #technicalanalysis

🌍 Market-Moving News 🌍

🏦 Global Banks Profit from Tariff Volatility

Major banks like JPMorgan, BofA, and Citigroup are expected to see ~10% growth in trading revenue in Q2, fueled by volatility from President Trump’s tariff policy shifts. Treasury trading volumes hit record highs as markets priced in policy swings

📈 S&P 500 Nears Lull Amid Bull Market Strains

Despite record highs in 2025, investors are warning that the rally may be reaching its limit. Bullish sentiment is strong, but analysts caution that sluggish consumer spending, rising inflation from tariffs, and few rate-cut signals from the Fed could cap downside momentum

🐻 Bear Case Gains Ground

Stifel’s Barry Bannister projected a potential ~12% correction in the second half of 2025. Key risks include slowing consumer spending, weak capital investment under tariff uncertainty, and persistent core inflation above 3%, negatively impacting earnings and growth outlooks

⚖️ “One Big Beautiful Bill” Could Add Trillions in Debt

The new fiscal package signed July 4 will add $3–4 trillion to national debt over the next decade while extending tax cuts and revising EV incentives. Bond market and Fed policy implications may become more pronounced if growth fails to keep pace

📊 Stocks vs Bonds: Diverging Signals

While equities climb and megacaps extend gains, Treasury yields have risen five days straight—signaling growing caution over real growth prospects. The yield curve steepening hints at mixed signals: growth optimism in stocks, but bond market signaling economic risk ahead

📊 Key Data & Events

📅 Thursday, July 10:

No major scheduled economic releases. Markets remain driven by tariff headlines, bank earnings reactions, and evolving Fed signals.

⚠️ Disclaimer:

This is for informational and educational purposes only—not financial advice. Consult a licensed advisor before making investment decisions.

📌 #trading #marketvolatility #tariffs #banks #Fed #debt #technicalanalysis

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.