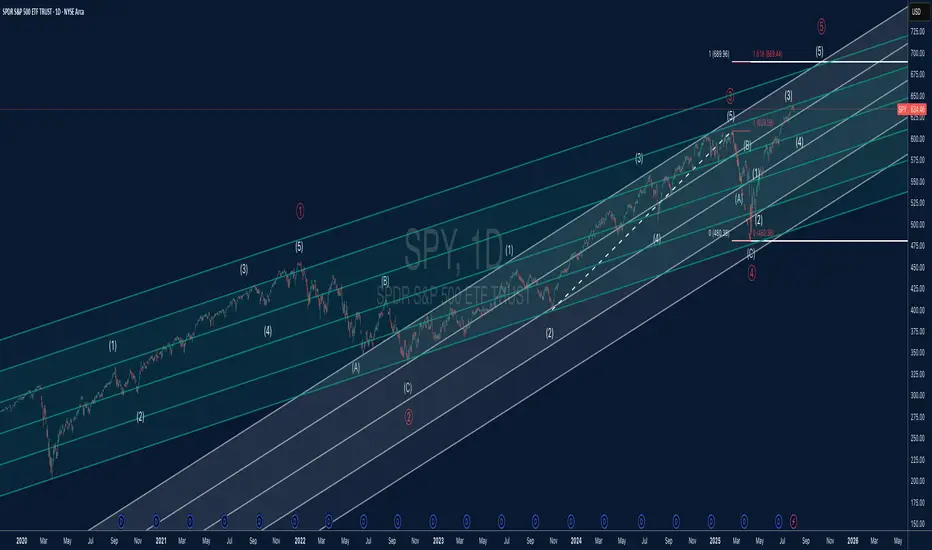

This chart offers a detailed Elliott Wave count for SPY (S&P 500 ETF) on the daily timeframe, combined with a structured parallel channel system to highlight key trend dynamics.

🔍 Elliott Wave Structure:

The price is currently advancing in what appears to be Wave (5) of Primary Wave ⑤, suggesting we may be in the late stages of a major impulsive cycle.

Each impulsive and corrective wave is clearly labeled, with the internal structure confirming classic Elliott Wave symmetry.

The 1.618 Fibonacci extension around $689 marks a critical upside target and potential completion zone for Wave (5).

Wave (4) held well at the lower channel boundary and completed near $480, establishing a solid base for the current advance.

📊 Channel Insights:

A system of parallel channels is applied to capture the overall trend and momentum structure.

Price is climbing toward the upper boundary of the long-term ascending channel, which has acted as dynamic resistance in previous waves.

The median lines have provided reliable support and resistance throughout the trend, making them important reference levels moving forward.

⚠️ Key Technical Levels:

Resistance: $689.44 (Wave ⑤ target at 1.618 Fib extension)

Support Zones: $609 (prior Wave (3) high), $575 (mid-channel support), and $480 (major cycle low)

A confirmed break above $690 could suggest a parabolic move, but risk of reversal grows as the upper channel is tested.

📈 Market Outlook:

SPY remains in a strong uptrend but is nearing a major confluence of wave and channel resistance.

A completed five-wave sequence would suggest the potential for a higher-degree correction, possibly leading into a Wave A/B/C scenario.

Short-term bullish bias remains valid while above $609, but watch for divergence or exhaustion signs near $689–$700.

🔍 Elliott Wave Structure:

The price is currently advancing in what appears to be Wave (5) of Primary Wave ⑤, suggesting we may be in the late stages of a major impulsive cycle.

Each impulsive and corrective wave is clearly labeled, with the internal structure confirming classic Elliott Wave symmetry.

The 1.618 Fibonacci extension around $689 marks a critical upside target and potential completion zone for Wave (5).

Wave (4) held well at the lower channel boundary and completed near $480, establishing a solid base for the current advance.

📊 Channel Insights:

A system of parallel channels is applied to capture the overall trend and momentum structure.

Price is climbing toward the upper boundary of the long-term ascending channel, which has acted as dynamic resistance in previous waves.

The median lines have provided reliable support and resistance throughout the trend, making them important reference levels moving forward.

⚠️ Key Technical Levels:

Resistance: $689.44 (Wave ⑤ target at 1.618 Fib extension)

Support Zones: $609 (prior Wave (3) high), $575 (mid-channel support), and $480 (major cycle low)

A confirmed break above $690 could suggest a parabolic move, but risk of reversal grows as the upper channel is tested.

📈 Market Outlook:

SPY remains in a strong uptrend but is nearing a major confluence of wave and channel resistance.

A completed five-wave sequence would suggest the potential for a higher-degree correction, possibly leading into a Wave A/B/C scenario.

Short-term bullish bias remains valid while above $609, but watch for divergence or exhaustion signs near $689–$700.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.