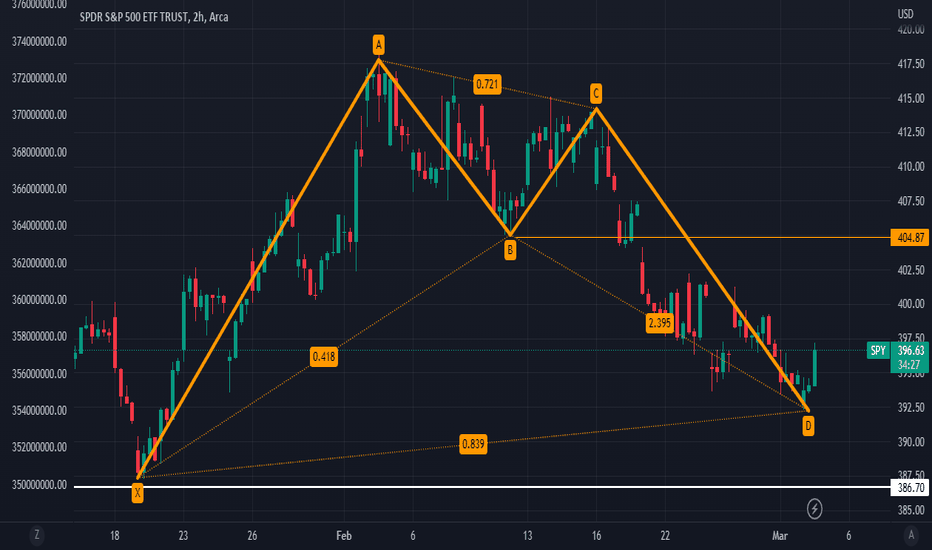

took my profits above 403 on  SPY call options printed good money... I see a retrace now from C wave to $370. Due to the AD + Stoc RSI at same height which is bearish based on money flow principles and strategies .. notice how SP500 rose when both the AD & Stoch RSI were bottom together.

SPY call options printed good money... I see a retrace now from C wave to $370. Due to the AD + Stoc RSI at same height which is bearish based on money flow principles and strategies .. notice how SP500 rose when both the AD & Stoch RSI were bottom together.

Note

added Note

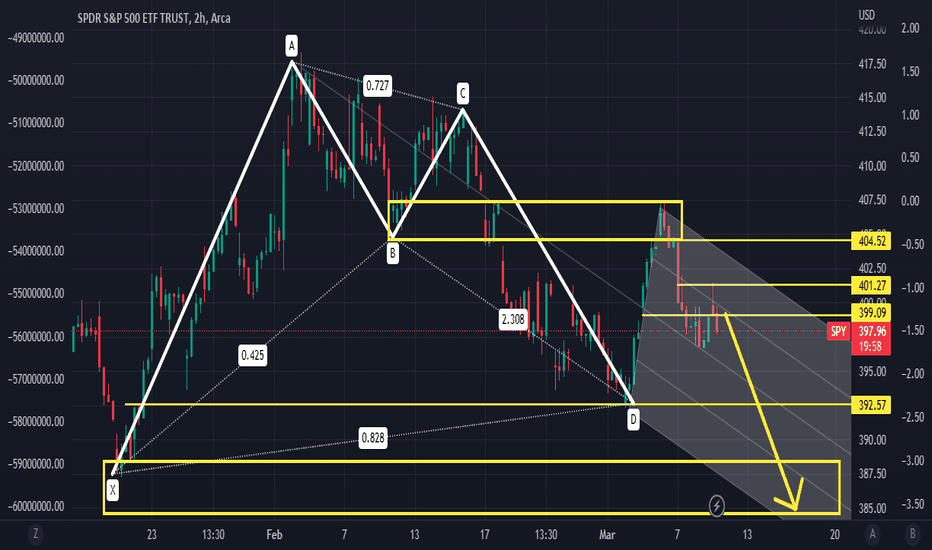

now we know 4080 is a key level. we've actually shorted this level before. its just a scalp position we're not holding it til NY openNote

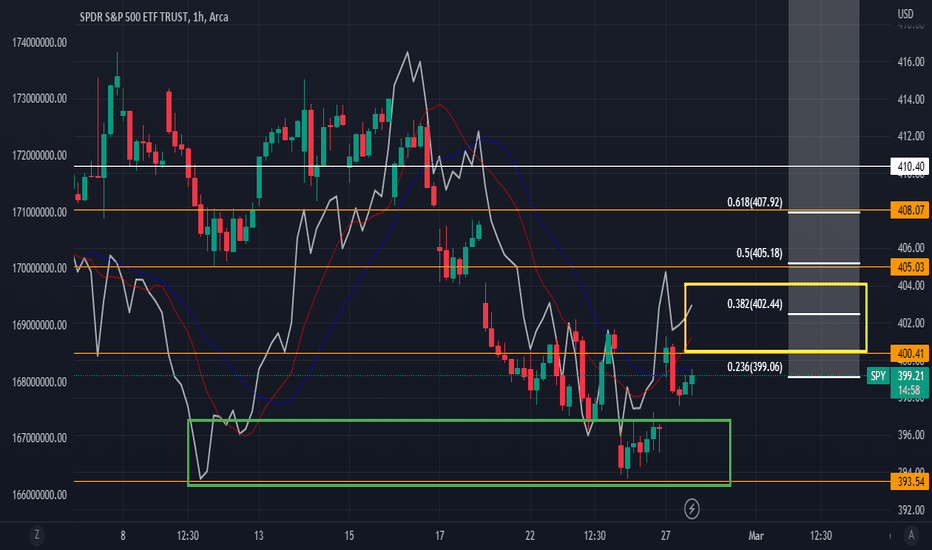

hit play on the above chart and you'll see the .618 rejection. Can Jerome Powell talk this up? Possibly, but there are way too many gaps present. and would likely have to gap up above $406-407, to retrace upward to 410-415 level. I dont see that happeningNote

We came, We saw, We conquered.. Hope everyone is in profits, thanks for the likes and comments even if was negative. Letting the profits ride. cheersNote

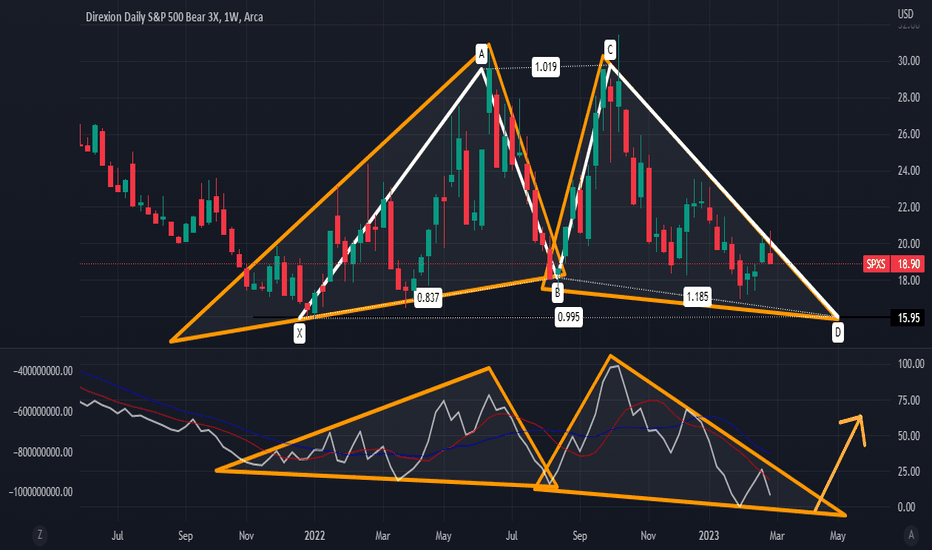

I established a position here in spxs 3x bear etf.. bought calls this morning a month outNote

lets see what she will do from here tradingview.com/chart/rByb49Ih/Note

now at the .236 fib levelNote

above chart is the 2hr, and study is the Daily. see how they both correlate. You're just seeing a bigger short on a higher time frame oppose to the 2hr time frameNote

If the AD breaches trend Line, I really can see Note

$385.90 just flashed on the ticker for Note

maybe it bounces on Monday or Tuesday next week at the .236 fib level ..Trade closed manually

im closing shorts early, locking my profits in, have a good weekend folsRelated publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.