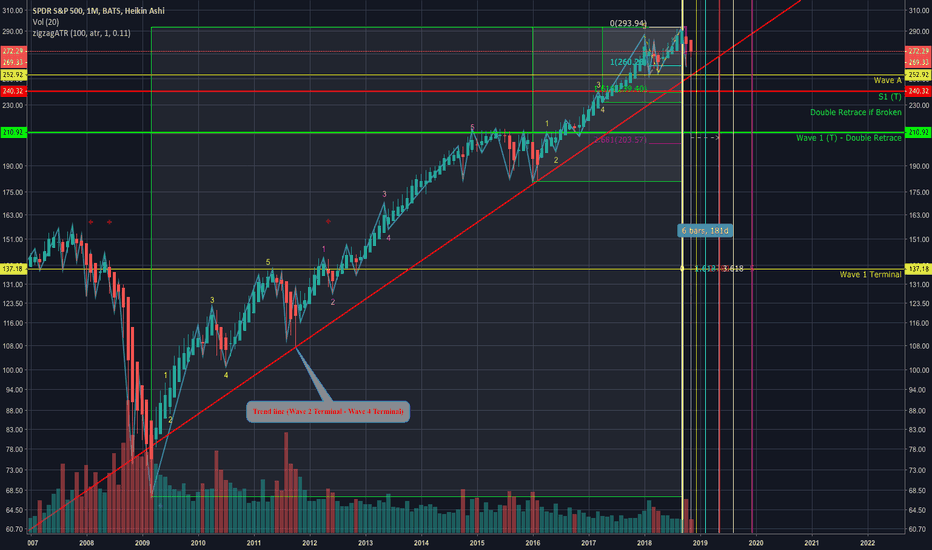

SPY has completed a 5 wave sequence.

-Wave 1 & Wave 5 Extended

-Correction Wave B went above the terminal point of Wave 5.

-Elliot calls this an irregular correction and can be subject to "Double Retracement". Double Retracement corrects Wave 5 and then the whole wave sequence.

I don't think we could see a double retracement due to economic conditions.

Chart:

Catalyst:

1. White House

2. Geo-politics

Will update.

-AB

Note

Potential Headline Catalyst Down:1. Kavanaugh

2. Mueller

3. Midterms

4. Big Tech - Breaking News about Data Collection methods by FB, TWTR, and Google.

Note

Irregular corrections usually appear after wave 5 of a cycle, and would correct the entire five waves according to Elliott’s approach to this phenomenon. The first move after the end of wave 5 would be a three wave affair and is labeled as Wave A. The Wave B that follows will also be in three sub waves but the price will exceed the top of Wave 5. Thereafter, we will get a normal Wave C made up of five sub waves.Note

Wave 5 extension= 16.47%Note

A bad storm is brewing.Note

Prior Super Cycle Correction was a Flat.Note

We are in the beginning of a new Super Cycle.Note

Other headline catalyst: -FISA Declassifiation

Note

Implemented an Put option strategy to protect portfolio.Note

Looking ready to drop...Note

New Headline about to drop?Note

Narratives matter...Note

These Sub-Waves will provide the bigger picture.Extending S-3?

Note

Wave C needs 5 Sub-Waves to be completed.Note

Wave Analysis and Fibonacci are used the same when going down.Note

Extending Sub-Wave 3Note

Reminder: Extending Waves = Impossible to know what level they stop.Note

4.618 is a key level for me.Note

If we break 4.618, support starts around $250.Note

So far, not good sub-wave 3 traveled over 320% of S1 & S2.Note

Double Retrace:1. Retrace Extension

2. 5th Wave Sequence

Note

No signs of finding support...Note

Reminder: Wave A & Wave B Sub-Wave were both shown in the WEEKLY chart!Note

We are clearly at an inflection point in history. Do we continue with an old Fiat money system?

Do we continue to let a privately held bank govern monetary policy?

Note

What caused the last ‘recession’?Note

“The real cause of the Great Recession lay not in the housing market but in the misguided monetary policy of the Federal Reserve” - “The Fed can control NGDP through its monetary policy, and as NGDP fell in 2008, the Fed should have lowered interest rates rapidly. If that proved insufficient, it should have increased the money supply through quantitative easing. Instead, the Fed, terrified of inflation, kept interest rates too high for too long—causing NGDP to fall even further.” -

Source: ForeignAffairs.com

Note

Bogey Man - InflationNote

If 270 is broken, next stop is 250.Note

Still got more to go...Note

S3 Extended Wave A was 3

Note

Friday: Correction SequenceMonday: S5

Note

66 Days to form Wave ANote

170 days to form Wave BNote

$240 looks to be the Terminal Point of the correction.Note

Correction will not be completed until AFTER 2019.Note

Best SHORT: wait till S2 completes and short higher degree Wave 3Note

Clarification: Correction will not be completed until Jan. 2019.Note

Wave 2 Terminal projection: $288Note

S1Terminal Projection: $273Note

S5 Complete: Oct. 18Note

Yellow = Lower Degree Teal = Higher Degree

Note

We need to watch higher degree Wave 5 very carefully and be on watch for "Double Retracement."Note

Don’t fall for the head-fakeNote

S5 still needs to be completedNote

S=sub-wavesNote

Here comes the reversal...Note

Not sure what the headline will be or maybe it’s an earnings report but this will fade in After-HoursNote

Netflix? Pop and Drop?Note

Will Netflix pop hold?Note

Netflix is still in a Correction...Note

Here comes wave 2 back upNote

Sub-Wave 5 hit target exactlyNote

I would use this rally to exit any positions you don't want to hold before Wave 3 down begins...Note

Wait till $282 then Short.Note

Looks like we WILL see Double RetracementNote

Wave 1:Sub-Wave 3 Extended

Sub-Wave 5 Extended

Note

Wave 5 Extension Target is between $259 & $255Note

Double Retrace is in PlayNote

Don't Sell here! Wait for Wave 2 to get out of any position you don't want to hold.Note

Pretty Confident Wave 1 is complete...Note

Indicators look goodNote

.618 is the Key HurdleNote

Election Day?Note

5th Wave will be a big test...Note

Complex Correction implies a strong move higher.Note

$284 is a key level.Note

Starting to fail...Note

Watch for the reversalNote

Wave 2 hit target almost exactly...Note

Target was $282.Note

Above: The Turn.Note

SPX Chart is a little scary!We have clearly completed Waves 1, 2, 3, and 4.

We are in the 5th Wave...

The question is are we more towards the beginning of Wave 5 or more towards the end?

Note

Above in Pink shows the most recent Wave Sequence.Note

260-250 are Critical LevelsIf Broken look to 210 for support...

Note

Doesn’t look good...Note

Note Wave A. Wave C needs 5 sub-waves.

Note

Very inclined to double retrace...Probably nothing will be safe...

Note

Sub-Wave 5 is a tell to double retrace...Note

If Sub-Wave 5 breaks S1 & S2 in meaningful way we will likely see new lows.Note

Wave C Time Est. = 210 days...Note

Shaping up to be a real blood bath...Note

What brand new market is forming? Where is the money going?

Note

$218 Target for Double RetraceNote

Russell MAY be ok...HOLDMJ Stocks MAY be ok...HOLD

TSLA looks ok..BUY

Inverse short ETF...

Inverse Correlation SPY equities:

1. Micro Cap Equities

2. Some Biotech

3. Blockchain/Digital

Note

Zombie/Corrupt Companies must either fail or clean houseNote

Fed?Note

On life support?Note

Fed engineered economic collapses instead of expansions...FACTNote

If I’m right about SPX (All-Time Chart) we can go a lot lower than 218.Note

$1,338...Note

Wish I could make this more digestible but...it is looking pretty bad!Note

Sub-Wave 2 only retraced .382 of Sub-Wave 1, could this imply the higher degree wave will extend as well? Possible.Note

Think I solved it....382 = $2,056.93

Note

Yea, very high degree of confidence $2,056.93 will be the bottom.Note

If .382 Fails we will see $1,338.The World is Changing...

FAST!

Note

Strongly encourage portfolio protection or move to the side lines...Note

Volume Disappearing? Makes you wonder...

Trade closed manually

Trade closed: target reached

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.