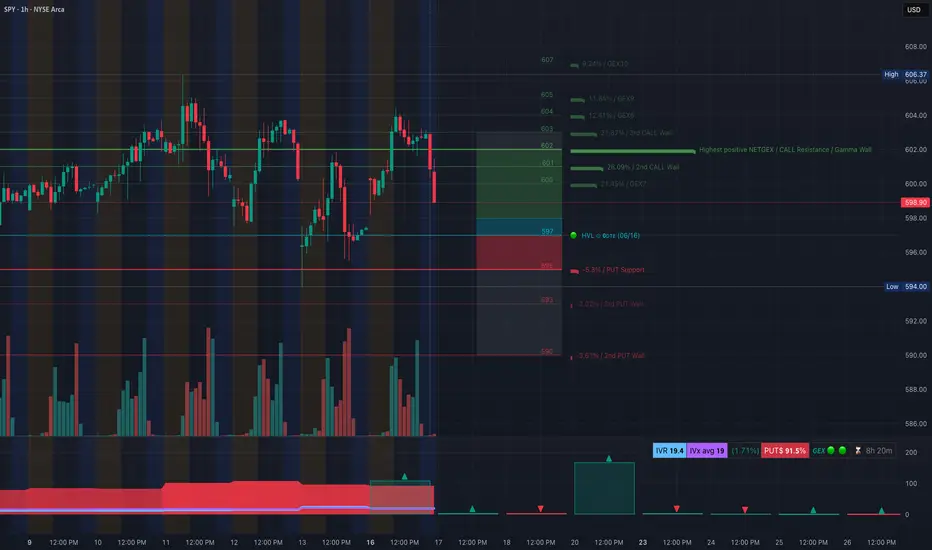

SPY Breaks Rising Wedge! Gamma Wall Rejected — Bearish Momentum Building Into OPEX 🔻

🔬 GEX (Gamma Exposure) Sentiment Breakdown:

* Gamma Resistance Above:

* Gamma Wall / Call Resistance: $602

* $603–$604.50 = additional CALL walls (2nd & 3rd tier resistance)

* $606.37 = Local high; unlikely to reclaim without macro tailwind

* PUT Walls / Downside Zones:

* $597 = HVL + Key Flip Level

* $595 = 1st Major PUT Support (Highest negative NET GEX)

* $593 / $590 = deeper GEX-supported flush zones

* Options Flow Metrics:

* IVR: 19.4 (slightly below avg)

* IVx avg: 19

* PUT Flow: 91.5% 🟥

* GEX Sentiment: 🔴🔴🔴 (Bearish dealer positioning + skewed delta exposure)

* Interpretation:

* Heavy call rejection at $602 combined with high PUT flow suggests dealers are short gamma.

* If SPY closes below $597, gamma exposure flips net negative — potential acceleration into $595/$593.

🧠 15-Minute SMC Breakdown:

* Current Price: $598.00

* Structure Overview:

* Clean rising wedge break

* Two CHoCHs confirmed at top → shift from bullish to bearish control

* Price broke into demand box (~$597–$598), testing support

* Volume spiked on breakdown = institutional participation confirmed

* Trend View:

* Uptrend is broken.

* Now entering potential distribution-to-downtrend transition phase

🧭 Trade Scenarios:

🟥 Bearish Breakdown Setup (High Probability):

* Trigger: Clean breakdown below $597

* Target 1: $595 (GEX Put wall)

* Target 2: $593 / $590

* Stop-loss: Above $600.50

Gamma flip + SMC structure shift supports downside. Dealer flows likely exacerbate drop under $597.

🟩 Bullish Reclaim Setup (Low Probability):

* Trigger: Reclaim of $602 with volume

* Target 1: $604.50

* Target 2: $606.50 (high)

* Stop-loss: Below $597.50

Only possible with major market strength, such as dovish Fed cues or macro catalysts.

📌 My Thoughts:

* SPY is showing signs of weakness across the board — structure, options flow, and volume confirm sellers stepping in.

* Put flows are extreme (>90%), so bounces may be brief and used to reload shorts.

* This is not a dip to buy blindly — best play is momentum PUTs under $597, tight risk control.

* Ideal setup for zero-day or 1DTE options trades with defined exits.

📉 Conclusion:

SPY failed to hold $602 Gamma Wall, rejected hard, and now tests $597 support. With options sentiment flipping negative and SMC structure breaking down, a drop to $595 or lower is increasingly likely.

Disclaimer: This analysis is for educational purposes only. Always manage risk and trade based on your plan.

🔬 GEX (Gamma Exposure) Sentiment Breakdown:

* Gamma Resistance Above:

* Gamma Wall / Call Resistance: $602

* $603–$604.50 = additional CALL walls (2nd & 3rd tier resistance)

* $606.37 = Local high; unlikely to reclaim without macro tailwind

* PUT Walls / Downside Zones:

* $597 = HVL + Key Flip Level

* $595 = 1st Major PUT Support (Highest negative NET GEX)

* $593 / $590 = deeper GEX-supported flush zones

* Options Flow Metrics:

* IVR: 19.4 (slightly below avg)

* IVx avg: 19

* PUT Flow: 91.5% 🟥

* GEX Sentiment: 🔴🔴🔴 (Bearish dealer positioning + skewed delta exposure)

* Interpretation:

* Heavy call rejection at $602 combined with high PUT flow suggests dealers are short gamma.

* If SPY closes below $597, gamma exposure flips net negative — potential acceleration into $595/$593.

🧠 15-Minute SMC Breakdown:

* Current Price: $598.00

* Structure Overview:

* Clean rising wedge break

* Two CHoCHs confirmed at top → shift from bullish to bearish control

* Price broke into demand box (~$597–$598), testing support

* Volume spiked on breakdown = institutional participation confirmed

* Trend View:

* Uptrend is broken.

* Now entering potential distribution-to-downtrend transition phase

🧭 Trade Scenarios:

🟥 Bearish Breakdown Setup (High Probability):

* Trigger: Clean breakdown below $597

* Target 1: $595 (GEX Put wall)

* Target 2: $593 / $590

* Stop-loss: Above $600.50

Gamma flip + SMC structure shift supports downside. Dealer flows likely exacerbate drop under $597.

🟩 Bullish Reclaim Setup (Low Probability):

* Trigger: Reclaim of $602 with volume

* Target 1: $604.50

* Target 2: $606.50 (high)

* Stop-loss: Below $597.50

Only possible with major market strength, such as dovish Fed cues or macro catalysts.

📌 My Thoughts:

* SPY is showing signs of weakness across the board — structure, options flow, and volume confirm sellers stepping in.

* Put flows are extreme (>90%), so bounces may be brief and used to reload shorts.

* This is not a dip to buy blindly — best play is momentum PUTs under $597, tight risk control.

* Ideal setup for zero-day or 1DTE options trades with defined exits.

📉 Conclusion:

SPY failed to hold $602 Gamma Wall, rejected hard, and now tests $597 support. With options sentiment flipping negative and SMC structure breaking down, a drop to $595 or lower is increasingly likely.

Disclaimer: This analysis is for educational purposes only. Always manage risk and trade based on your plan.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.