🔮 Weekly  SPY /

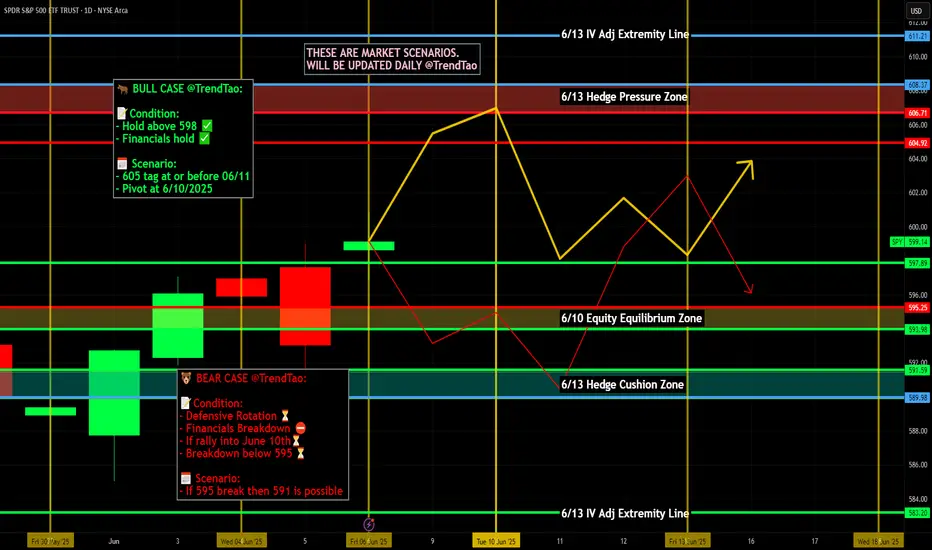

SPY /  SPX Scenarios for June 9–13, 2025 🔮

SPX Scenarios for June 9–13, 2025 🔮

🌍 Market-Moving News 🌍

📱 Apple WWDC & Tech Momentum

Apple’s annual Worldwide Developers Conference kicks off Monday with CEO Tim Cook set to discuss new products, services, and likely AI initiatives—tracks should watch include impacts on AAPL and AI-related stocks

AAPL and AI-related stocks

🧨 GameStop Eyed for Crypto Pivot

GameStop (a meme-stock darling) reports earnings Tuesday. Markets are watching for updates on its $500M bitcoin investment and potential pivot toward crypto-driven revenue streams

🇨🇳 U.S.–China Trade Talks in London

High-level trade dialogue begins Monday between U.S. and Chinese representatives in London, offering possible relief to trade tensions and providing a lift to risk assets

📉 Key Inflation Data Midweek

Wednesday brings the May CPI release—crucial for assessing tariff-driven inflation trends and likely to influence Fed policy outlook ahead of next month’s meeting

💹 Oil Markets React to Trade Uncertainty

Oil prices are stable to slightly up ahead of trade talks, as Brent holds around $66/barrel—reflecting balanced supply concerns and hopes for easing global tensions

🌐 G7 Summit and Global Policy Risks

G7 finance ministers convene in Canada (50th anniversary), tackling trade strains, Russia–Ukraine, and inflation. Global macrospoilers could trigger renewed volatility

📊 Key Data Releases & Events 📊

📅 Monday, June 9

Apple WWDC begins (CEO keynote)

U.S.–China trade talks start in London

📅 Tuesday, June 10

GameStop Q2 earnings (+ bitcoin update)

NFIB Small Business Index (6:00 AM ET)

📅 Wednesday, June 11

8:30 AM ET – Consumer Price Index (May)

Watch for inflation signal from tariffs.

8:30 AM ET – Core CPI (May)

Core inflation trend under scrutiny.

📅 Thursday, June 12

8:30 AM ET – Producer Price Index (May)

Early check on wholesale inflation

8:30 AM ET – Initial & Continuing Jobless Claims

📅 Friday, June 13

10:00 AM ET – University of Michigan Consumer Sentiment (June, preliminary)

Consumer mood and tariff impact insights

⚠️ Disclaimer:

This is for informational/educational purposes only. Not financial advice. See a licensed advisor before making investing decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

🌍 Market-Moving News 🌍

📱 Apple WWDC & Tech Momentum

Apple’s annual Worldwide Developers Conference kicks off Monday with CEO Tim Cook set to discuss new products, services, and likely AI initiatives—tracks should watch include impacts on

🧨 GameStop Eyed for Crypto Pivot

GameStop (a meme-stock darling) reports earnings Tuesday. Markets are watching for updates on its $500M bitcoin investment and potential pivot toward crypto-driven revenue streams

🇨🇳 U.S.–China Trade Talks in London

High-level trade dialogue begins Monday between U.S. and Chinese representatives in London, offering possible relief to trade tensions and providing a lift to risk assets

📉 Key Inflation Data Midweek

Wednesday brings the May CPI release—crucial for assessing tariff-driven inflation trends and likely to influence Fed policy outlook ahead of next month’s meeting

💹 Oil Markets React to Trade Uncertainty

Oil prices are stable to slightly up ahead of trade talks, as Brent holds around $66/barrel—reflecting balanced supply concerns and hopes for easing global tensions

🌐 G7 Summit and Global Policy Risks

G7 finance ministers convene in Canada (50th anniversary), tackling trade strains, Russia–Ukraine, and inflation. Global macrospoilers could trigger renewed volatility

📊 Key Data Releases & Events 📊

📅 Monday, June 9

Apple WWDC begins (CEO keynote)

U.S.–China trade talks start in London

📅 Tuesday, June 10

GameStop Q2 earnings (+ bitcoin update)

NFIB Small Business Index (6:00 AM ET)

📅 Wednesday, June 11

8:30 AM ET – Consumer Price Index (May)

Watch for inflation signal from tariffs.

8:30 AM ET – Core CPI (May)

Core inflation trend under scrutiny.

📅 Thursday, June 12

8:30 AM ET – Producer Price Index (May)

Early check on wholesale inflation

8:30 AM ET – Initial & Continuing Jobless Claims

📅 Friday, June 13

10:00 AM ET – University of Michigan Consumer Sentiment (June, preliminary)

Consumer mood and tariff impact insights

⚠️ Disclaimer:

This is for informational/educational purposes only. Not financial advice. See a licensed advisor before making investing decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.