Greetings again, fellow travelers.

Once more, I am not here to offer a crystal ball, but simply to share the patterns I observe and the story they seem to be telling. This is one perspective, a single lens through which to view the market's vast landscape. Take what serves you on your own path.

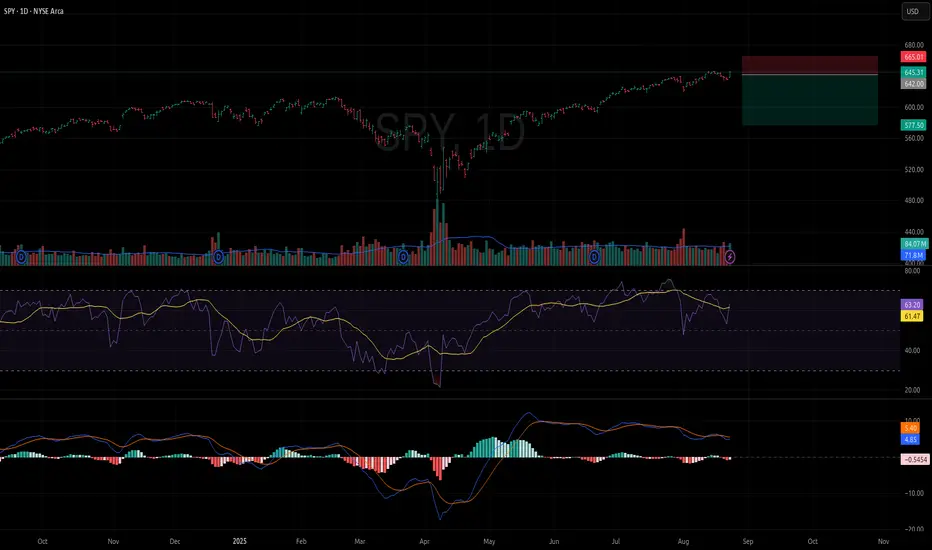

SPY: Are the Bears Preparing for Winter?

The narrative for SPY feels similar to the broader market: a moment of pause and potential reversal after a strong run. However, the winds here feel a bit colder. Recent commentary from Jerome Powell suggesting the economy may be more fragile than it appears, coupled with the ongoing tariff situation, provides a fundamental backdrop that warrants extra caution.

It feels like the seasons are changing. The bear claws seem sharp, and as we approach the colder months, they may need to fatten up before hibernation. This is a time when they can be voracious, so we must navigate with awareness and respect for their power.

The Technical Story on the Daily Chart

The chart itself reflects this cautious sentiment:

An Illustrative Short Setup

For those whose plan aligns with this cautious view, the current price offers a quality risk/reward setup based on the updated parameters.

Navigating the River

This potential downturn is not something to fear, but something to understand. It is a cycle. For those who are patient, it could present a fantastic "buy the dip" opportunity later on. The key is not to fight the current.

Don't be a salmon. A salmon fights with all its might to swim upstream, and while noble, it often ends in exhaustion and peril. Right now, the river's current feels bearish. It is wiser to be a leaf, flowing with it, observing from the bank, and waiting for the stream to calm before entering again.

This is my piece of the puzzle. I hope it helps.

Just shine.

Once more, I am not here to offer a crystal ball, but simply to share the patterns I observe and the story they seem to be telling. This is one perspective, a single lens through which to view the market's vast landscape. Take what serves you on your own path.

SPY: Are the Bears Preparing for Winter?

The narrative for SPY feels similar to the broader market: a moment of pause and potential reversal after a strong run. However, the winds here feel a bit colder. Recent commentary from Jerome Powell suggesting the economy may be more fragile than it appears, coupled with the ongoing tariff situation, provides a fundamental backdrop that warrants extra caution.

It feels like the seasons are changing. The bear claws seem sharp, and as we approach the colder months, they may need to fatten up before hibernation. This is a time when they can be voracious, so we must navigate with awareness and respect for their power.

The Technical Story on the Daily Chart

The chart itself reflects this cautious sentiment:

- Fading Momentum: Just as we saw elsewhere, the momentum indicators in the lower panel are showing signs of exhaustion. The energy that propelled this last move up is beginning to wane, suggesting the path of least resistance may soon be shifting downwards.

- Market Structure: Price is hovering at a level where it has previously met resistance. A failure to push decisively higher here could invite sellers to step in with more confidence.

[]Potential Pullback Zones: If sellers do take control, I see two primary areas of interest below:- []The first key support level is around the $577.50 mark, which represents a previous market structure break (MSB).

- Below that, a larger demand zone sits between $510-$530, where longer-term buyers might be waiting.

- []The first key support level is around the $577.50 mark, which represents a previous market structure break (MSB).

An Illustrative Short Setup

For those whose plan aligns with this cautious view, the current price offers a quality risk/reward setup based on the updated parameters.

- []Bias: Short-Term Bearish

[]Entry: Around $642.00[]Stop Loss: A clearly defined stop above the recent price action at ~$665.01 protects against a change in the narrative.

[]Take Profit: Targeting the support level at ~$577.50. The Risk/Reward for this specific idea is approximately 1:2.8.

Navigating the River

This potential downturn is not something to fear, but something to understand. It is a cycle. For those who are patient, it could present a fantastic "buy the dip" opportunity later on. The key is not to fight the current.

Don't be a salmon. A salmon fights with all its might to swim upstream, and while noble, it often ends in exhaustion and peril. Right now, the river's current feels bearish. It is wiser to be a leaf, flowing with it, observing from the bank, and waiting for the stream to calm before entering again.

This is my piece of the puzzle. I hope it helps.

Just shine.

Disclaimer: This is not financial advice. It is for educational and informational purposes only. Please conduct your own research and manage your risk accordingly.

Trade closed manually

Hello everyone, a mid-day update on the SPY short idea. This is an important one, as it's about managing a trade when the market immediately challenges your thesis.As we can see, the market had other plans this morning. The strong bullish rally pushed the price right through our potential entry zone. While this move doesn't invalidate the stop loss, it does give us new information, and we must act on what the market is telling us now.

Is the Bearish Thesis Still Valid?

In my view, yes. The broader picture still appears to be a tired bull run at its last gasp before a needed exhalation. The market feels indecisive—almost like a "kangaroo market" with sharp moves in both directions. This choppiness, ironically, can often precede a more significant directional move, which I still believe is to the downside.

However, a valid thesis and a valid entry are two different things. An entry this morning would have been sub-optimal.

My Philosophy: "Lose Fast"

From a trade management perspective, there are two valid paths: hold and respect the stop, or cut the trade and re-evaluate. My personal philosophy is to "lose fast."

I am closing this trade idea for now for a small, manageable loss. Why? Because the current price action is telling me the setup is not working as intended right now. Holding on would be trading on "hope" that the market will do what I want. A disciplined trader acts on the reality in front of them, not on hope.

Failing Fast Can Be a Success

The goal is for every loss to feel like a paper cut—small, quick, and insignificant to your overall health. "Failing fast" like this is actually a successful execution of a risk management plan. It prevents a paper cut from turning into a deep wound by "failing slow." As a #limitlessTrader, I know all possibilities are on the table, and that includes taking small, disciplined losses to protect capital for higher-probability setups tomorrow.

I will now stand aside and wait for the market to give a clearer signal.

Just shine.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.