🔮 Nightly  SPY /

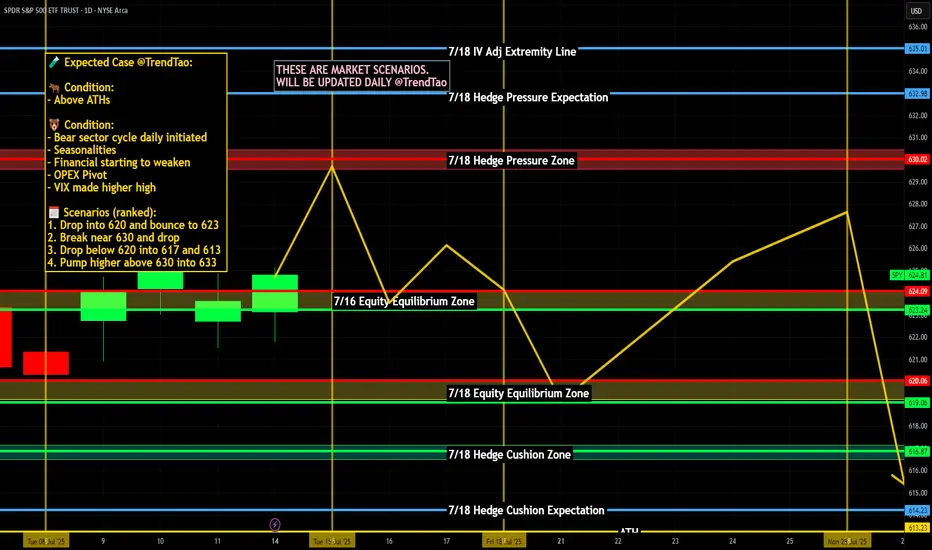

SPY /  SPX Scenarios for July 15, 2025 🔮

SPX Scenarios for July 15, 2025 🔮

🌍 Market-Moving News 🌍

📦 Dow Futures Dip on New Tariff Announcements

President Trump announced new 30% tariffs on EU and Mexico, with additional duties on Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar starting August 1. Dow, S&P, and Nasdaq futures each slipped ~0.3% as markets assess inflation risk ahead of key CPI data this week

📈 Tech & AI Stocks Lead Despite Tariffs

Stocks like Circle (+9.3%), CoreWeave (+5.2%), Palantir (+5%), Roblox (+5.8%), and Shopify (+4.1%) surged, showcasing sector resilience amid broader tariff fears

⚠️ Deutsche Bank Warns of Summer Volatility

With thin market liquidity and rising geopolitical tension (tariff deadline Aug 1), Deutsche Bank flags summer as a period prone to sudden corrections

📊 Key Data Releases & Events 📊

📅 Tuesday, July 15:

8:30 AM ET – CPI (June)

Core CPI is projected at +0.3% MoM (2.7% YoY) and headline CPI +0.3% MoM—signs tariff effects may be feeding into prices

8:30 AM ET – Core CPI (June)

Expected to come in around 3.0% YoY.

8:30 AM ET – Empire State Manufacturing Survey (July)

Forecast: –7.8 (less negative than June’s –16.0) — a modest sign of stabilizing factory conditions

Fed Speakers Throughout the Day

Watch for commentary from Fed officials (Michael Barr, Barkin, Collins, Logan) for fresh insights on inflation and monetary policy

⚠️ Market Interpretation:

Inflation Watch: A hotter-than-expected CPI could delay anticipated rate cuts and lift yields. A pick-up in core CPI above 3% would be a red flag.

Growth Signals: A less-negative Empire State reading may suggest improving industrial momentum but still signals contraction.

Political Risk: Tariff escalation could shift investor appetite, even if markets right now are focusing on broader macro narratives.

Volatility Setup: The combination of thin liquidity, tariff uncertainty, and critical data makes for a potentially choppy week.

📌 #trading #stockmarket #economy #inflation #tariffs #Fed #CPI #manufacturing #technicalanalysis

🌍 Market-Moving News 🌍

📦 Dow Futures Dip on New Tariff Announcements

President Trump announced new 30% tariffs on EU and Mexico, with additional duties on Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar starting August 1. Dow, S&P, and Nasdaq futures each slipped ~0.3% as markets assess inflation risk ahead of key CPI data this week

📈 Tech & AI Stocks Lead Despite Tariffs

Stocks like Circle (+9.3%), CoreWeave (+5.2%), Palantir (+5%), Roblox (+5.8%), and Shopify (+4.1%) surged, showcasing sector resilience amid broader tariff fears

⚠️ Deutsche Bank Warns of Summer Volatility

With thin market liquidity and rising geopolitical tension (tariff deadline Aug 1), Deutsche Bank flags summer as a period prone to sudden corrections

📊 Key Data Releases & Events 📊

📅 Tuesday, July 15:

8:30 AM ET – CPI (June)

Core CPI is projected at +0.3% MoM (2.7% YoY) and headline CPI +0.3% MoM—signs tariff effects may be feeding into prices

8:30 AM ET – Core CPI (June)

Expected to come in around 3.0% YoY.

8:30 AM ET – Empire State Manufacturing Survey (July)

Forecast: –7.8 (less negative than June’s –16.0) — a modest sign of stabilizing factory conditions

Fed Speakers Throughout the Day

Watch for commentary from Fed officials (Michael Barr, Barkin, Collins, Logan) for fresh insights on inflation and monetary policy

⚠️ Market Interpretation:

Inflation Watch: A hotter-than-expected CPI could delay anticipated rate cuts and lift yields. A pick-up in core CPI above 3% would be a red flag.

Growth Signals: A less-negative Empire State reading may suggest improving industrial momentum but still signals contraction.

Political Risk: Tariff escalation could shift investor appetite, even if markets right now are focusing on broader macro narratives.

Volatility Setup: The combination of thin liquidity, tariff uncertainty, and critical data makes for a potentially choppy week.

📌 #trading #stockmarket #economy #inflation #tariffs #Fed #CPI #manufacturing #technicalanalysis

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.