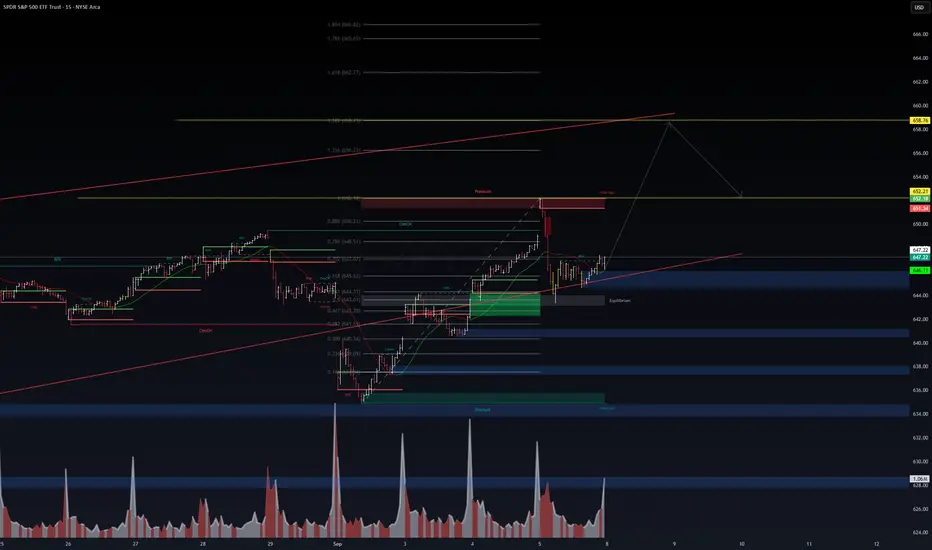

🛰️ WaverVanir Market Intelligence – SPY Outlook

Catalyst:

September rotation into risk assets ahead of CPI/Fed cycle.

Strong liquidity injections in last sessions visible in volume profile.

Market seeking liquidity above prior highs (651–653) before establishing next trend leg.

Analysis (15m–1h Structure):

Current price: 647.2 (holding above equilibrium ~646).

Liquidity Pool Above: 651–653 (void high, premium zone).

Liquidity Pool Below: 644 → 636 (discount demand zones).

Fibonacci Map:

Retracements: 648.5 (0.786) → 650.2 (0.886).

Extensions: 658 (1.272) → 662 (1.618).

Market Mechanics:

Break of structure (BOS) confirmed, retest at equilibrium.

Volume spikes indicate institutional positioning.

Thin liquidity at 646–648 → easy to sweep higher.

Probabilities (WaverVanir DSS Projection):

📈 Bullish Path (60%): Price targets 651–653 liquidity sweep, extension to 658–662 if absorption holds.

📉 Bearish Path (30%): Failure to hold 646 → drawdown into 644 equilibrium → deeper sweep at 636–632.

⚖️ Neutral Chop (10%): Sideways between 646–650 before CPI/Fed clarity.

Strategic Note:

While SPY remains above 646 equilibrium, probability favors a liquidity grab to 653 and possible extension to 658+. A breakdown below 646 flips bias into deeper demand hunts.

🔮 WaverVanir Protocol View:

Capital flow remains tilted bullish into liquidity, but with strong volatility clusters — risk-managed entries around equilibrium (646–647) give best R:R.

Catalyst:

September rotation into risk assets ahead of CPI/Fed cycle.

Strong liquidity injections in last sessions visible in volume profile.

Market seeking liquidity above prior highs (651–653) before establishing next trend leg.

Analysis (15m–1h Structure):

Current price: 647.2 (holding above equilibrium ~646).

Liquidity Pool Above: 651–653 (void high, premium zone).

Liquidity Pool Below: 644 → 636 (discount demand zones).

Fibonacci Map:

Retracements: 648.5 (0.786) → 650.2 (0.886).

Extensions: 658 (1.272) → 662 (1.618).

Market Mechanics:

Break of structure (BOS) confirmed, retest at equilibrium.

Volume spikes indicate institutional positioning.

Thin liquidity at 646–648 → easy to sweep higher.

Probabilities (WaverVanir DSS Projection):

📈 Bullish Path (60%): Price targets 651–653 liquidity sweep, extension to 658–662 if absorption holds.

📉 Bearish Path (30%): Failure to hold 646 → drawdown into 644 equilibrium → deeper sweep at 636–632.

⚖️ Neutral Chop (10%): Sideways between 646–650 before CPI/Fed clarity.

Strategic Note:

While SPY remains above 646 equilibrium, probability favors a liquidity grab to 653 and possible extension to 658+. A breakdown below 646 flips bias into deeper demand hunts.

🔮 WaverVanir Protocol View:

Capital flow remains tilted bullish into liquidity, but with strong volatility clusters — risk-managed entries around equilibrium (646–647) give best R:R.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.